If you, like me, work for the federal government, you probably have a TSP (or Thrift Savings Plan) account.

While civilian federal employees and uniformed service members have TSPs, a surprising number of people are confused about what the TSP is and isn’t.

Let me set the record straight:

The TSP is not a 457 plan.

In fact, there are key differences between the Thrift Savings Plan and Deferred Compensation plans, also called 457 plans or 457(b) plans.

In the remainder of this article, I’ll walk you through the major differences between the TSP and 457 plans.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- Overview of the Thrift Savings Plan

- What is a 457 “Deferred Compensation” Plan?

- Is the TSP a 457 Plan?

- Can I contribute to both the TSP and a 457 Plan?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

Overview of the Thrift Savings Plan

As a FERS employee, the TSP is an important part of your retirement benefits. In addition to your FERS annuity and social security, you can contribute to the TSP throughout your career and withdrawal this money in retirement or purchase a TSP annuity.

There are two major benefits to contributing to the TSP instead of a savings account or brokerage account. The first is that the government matches your contributions up to 5% of your salary, and most of these matching funds have no vesting period.

The second major reason you may want to contribute to the TSP is that it is taxed favorably because the TSP is a qualified retirement plan. You can choose between a traditional and Roth TSP. Both of these options allow money to grow without capital gains taxes. And depending on your current tax situation, you can choose to either avoid paying taxes on the money you contribute today (with a traditional account), or withdraw the money tax-free in retirement (with the Roth).

A quick note on the TSP fund options

The TSP is comprised of 5 core funds and lifecycle funds built from these 5 core funds. Employees can build a complete portfolio by balancing their money across these funds:

- C Fund (S&P 500)

- S Fund (Small & medium cap stocks)

- I Fund (International stocks, focused in Europe, Japan, and Australasia)

- F Fund (Medium term government and corporate bonds)

- G Fund (Short term government bonds, guaranteed positive return)

Employees who don’t want to build their own portfolio can choose a lifecycle fund. These funds include the L Income Fund for current retirees, and funds in 5 year increments from 2025 to 2065. If you go this route, you just need to select the lifecycle fund closest to your estimated retirement date and keep contributing until you retire. (The TSP automatically balances risk and potential returns throughout your career).

In 2022, the TSP introduced a mutual fund window where employees can choose from one of 5,000 privately managed mutual funds. Unfortunately, these funds have high fees. Since federal employees can already build a wonderful portfolio with low fees from the 5 core funds, I don’t see any reason to participate in the mutual fund window.

What is a 457 “Deferred Compensation” Plan?

A 457 is an employer-sponsored “deferred compensation” plan for employees of some state and local governments. It is also designed for workers from any non-church tax-exempt organization. The 457 plan gets its name because it is defined in section 457 of the Internal Revenue Code.

The important words in the above definition was “state and local governments”. I’m sorry to say to my fellow feds that we are not able to participate in a 457(b) plan.

Two flavors of 457 plans: 457(b) vs. 457(f) plans

Technically, there are two types of 457 plans. When most people say “457” plan, they’re talking about a 457(b) plan. In these plans, employees can contribute money to a tax-deferred account and their employer can choose to match these funds.

There’s also a 457(f) plan, which operates completely differently. The 457(f) plan is a way for organizations to pay their executives more money when they leave the company (golden parachute). You cannot contribute to a 457(f) plan. Needless to say, most people don’t get an executive compensation plan, so really there’s no reason to talk more about 457(f) plans.

Is the TSP a 457 Plan?

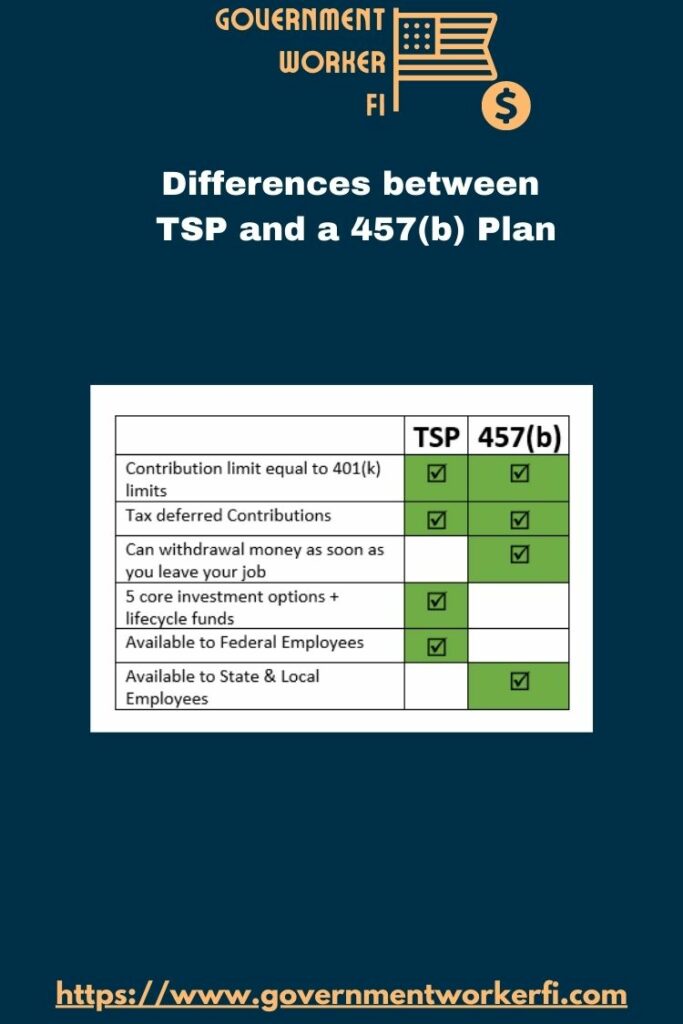

I said at the top of the article that the TSP is not a 457 plan. But there are a lot of similarities between the TSP and a 457(b) plan.

For instance, both the TSP and a 457 plan help government employees retire. They also have similar tax treatments.

Let’s walk through some of the similarities and differences together.

How a 457(b) is similar to the TSP

In many ways, a 457(b) plan is similar to a TSP.

Employees can make salary contributions via payroll deductions. It’s called a “deferred compensation plan” because you’re deferring this compensation (and paying taxes) to a later date. This tax treatment is the same as the traditional TSP. The 457(b) plan has the same maximum contribution limit as the TSP ($22,500 in 2022).

How the TSP is different from a 457(b) plan

The 457(b) plan has a very special feature that makes it the most attractive retirement account (in my opinion). You can withdraw your 457(b) contributions any time after you separate from your employer.

With IRA’s you need to be at least age 59.5, and with the TSP you need to be at least age 55 (50 if a public safety employee) to avoid an early withdrawal penalty.

However, with the 457(b) plan, you can start accessing the money without penalty as soon as you quit your job. That’s why it’s an amazing plan for people who want to retire early.

Beyond that major early retirement loophole, there are many differences due to the fact that the TSP is a single plan for federal employees and the 457(b) plan is a general type of retirement plan. Depending on your employer, you may or may not receive a match on your contributions. Furthermore, your investment options depend upon whom your employer chose to partner with to create your plan. Regardless, you won’t have access to the 5 core TSP funds.

What about the Roth 457(b) and the Roth TSP?

I feel obligated to note here that both the TSP and the 457(b) have Roth options. However, the Roth 457(b) plan is quite different from the 457(b) and much more like the Roth TSP. Roth 457(b) contributions cannot be accessed until age 59.5 or you will face an early withdrawal penalty.

Get Gov Worker’s top 4 tips for federal employees!Can I contribute to both the TSP and a 457 Plan?

Yes. Because the 457(b) and TSP plan come from different parts of the IRC you can contribute to both plans and they each have their own contribution limit. One amazing way to avoid paying taxes is to max out both your 457(b) plan and a TSP.

The only catch is that you need to have access to both the TSP and a 457(b) plan. This would require you to have two jobs. One as a federal employee and one as a state and local employee. While federal employees can have a second job, you may have problems finding a second job where you can qualify for a 457(b) plan.

For instance, as a government researcher, I have been offered several opportunities to teach classes at a nearby state university that offers a 457 plan. However, the ethics office has denied these requests as a conflict of interest.

While in theory it’s possible to contribute to both a 457(b) plan and a TSP, in actuality, you may find it difficult to thread the needle of your agency’s ethics department review of your outside employment to land a job that offers a 457(b).