Wanna know what my inbox looks like?

“Hey GovWorker – How does a federal employee access money from the TSP without penalty in early retirement? Asking for a friend…”

Judging from the conversations in my inbox, a lot of us have similar questions.

Is there a way to avoid penalties on TSP withdrawals? In this article I’m going to break down one method to access your TSP money in early retirement with no penalties.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- Understanding the TSP

- How to withdraw money from the TSP

- How can early retirees access money from their TSP without penalty

- What is 72(t) “Substantially Equal Periodic Payments” Rule?

- How can I use SEPP to get money from my TSP Early?

- TSP SEPP Method 1: Minimum Distribution Method

- TSP SEPP Method 2: Amortization Method

- TSP SEPP Method 3: Annuity Method

- Can I set up a SEPP plan through the TSP or do I need to roll money into an IRA?

- Comparing a TSP SEPP to a Roth conversion ladder

- What happens if I mess up my TSP SEPP calculations?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

Understanding the TSP

If you’ve been following my blog for any length of time, you know about the Thrift Savings Plan – it’s one leg of a federal government employee’s retirement plan, with pre- or post-tax investment options, employer match, and 5 main investment funds. It’s worth taking the time to understand the TSP as an important tool if you are on the hunt for financial independence.

How to withdraw money from the TSP

If you want to know the basics of accessing money from your TSP, you’ve come to the right place. The TSP offers multiple options for separated or retired federal employees to withdraw money from their retirement accounts: installment payments, single withdrawals, and annuity purchases. However – it’s important to know what tax implications or penalties might be associated with accessing these TSP funds.

How can early retirees access money from their TSP without penalty

Please remember that this is just a blog and is not financial or tax advice. Before making an irreversible money move, like a 72(t) SEPP in your TSP, talk with a trusted financial advisor or CPA about potential implications.

According to the IRS, most early retirement plan distributions are subject to income tax and may be subject to an additional 10% tax. Not what we want to hear! Thankfully, there are at least 2 options that might be helpful in minimizing or eliminating the penalties:

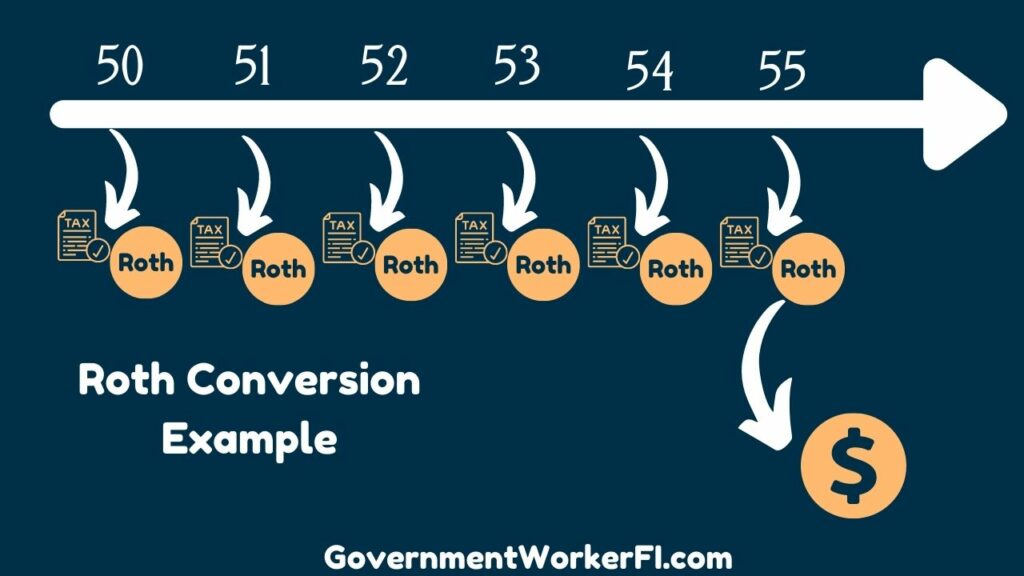

- Roth IRA conversion ladder – allows you to move pre-tax money from an IRA or other pre-tax retirement plan (i.e. the TSP) into a Roth IRA, let it mature for a period of time, then withdraw it later. It is a taxable event in the year of the conversion, and you will need to do some homework to make an informed decision if this is the option that’s best for you. Stay tuned for more info on this in a future post!

- 72(t) SEPP rule – This is what I’m focusing on today. The name of the rule comes from Internal Revenue Code, Section 72(t), which describes exceptions to the 10% additional tax (“penalty”) for early distributions. SEPP is an acronym for “Substantially Equal Periodic Payments.”

Recognize the tax implications of making early withdrawals, and the long-term commitment you are making in order to avoid withdrawal penalty tax, before electing to access TSP funds to finance early retirement.

What is 72(t) “Substantially Equal Periodic Payments” Rule?

Hang on to your hats, everyone – this section of the Internal Revenue Service tax code allows you to avoid the 10% early withdrawal penalty. That’s music to your ears! But – as it says right there in the name – there are rules. You must use one of three methods to determine your substantially equal periodic payments.

Be aware that while you may be able to use the TSP SEPP rule to avoid extra penalties, you will still be required to pay applicable federal and state income tax. If you have questions about the basics, the IRS has an entire FAQ page about SEPPs.

How can I use SEPP to get money from my TSP Early?

First let’s cover the basics: the TSP is an eligible retirement plan according to 72(t) SEPP rules.

There are 3 calculation methods to choose from to determine your 72(t)-compliant distribution installments.

You’ll want to play with the numbers work with a CPA before making a decision to see which formula best meets your financial goals. The SEPP isn’t right for everyone – You might find that this isn’t the best financial decision for you. Don’t just listen to some guy on the internet (i.e. me)- work with a financial advisor or financial planner before making your decision!

Alright – let’s get down to the nitty-gritty of SEPP Methods.

TSP SEPP Method 1: Minimum Distribution Method

This is the only method that recalculates the annual payments each year. It applies a formula to your TSP account balance (or other qualified account) using a life expectancy factor from the applicable life expectancy table.

TSP SEPP Method 2: Amortization Method

This is a fixed payment method. Once the installment amount has been calculated, the annual distributions cannot change without potential tax penalties.

If you have a fixed mortgage, this method might feel familiar. Your retirement funds are amortized over a specific number of years (again determined from the appropriate life expectancy table), using an interest rate that is not more than either 5% or 120% of the federal mid-term interest rate, whichever is greater. The 5% interest rate option is a recent change from early 2022.

TSP SEPP Method 3: Annuity Method

Finally, this is another fixed distribution amount. You apply an annuity factor to your account balance to determine the payment values. The annuity factor is calculated using an IRS mortality table and, as in the amortization method above, an interest rate that is not more than either 5% or 120% of the federal mid-term interest rate, whichever is greater.

Can I set up a SEPP plan through the TSP or do I need to roll money into an IRA?

As long as you are separated from federal service, you can keep money invested in the TSP and set up SEPP installment payments through the withdrawal tool at TSP.gov.

Alternatively, you can make a partial withdrawal to roll a portion of your TSP balance into an IRA and use that for the SEPP. You will have to determine which option is best for you – and it might be neither!

Downsides of a TSP 72(t) SEPP

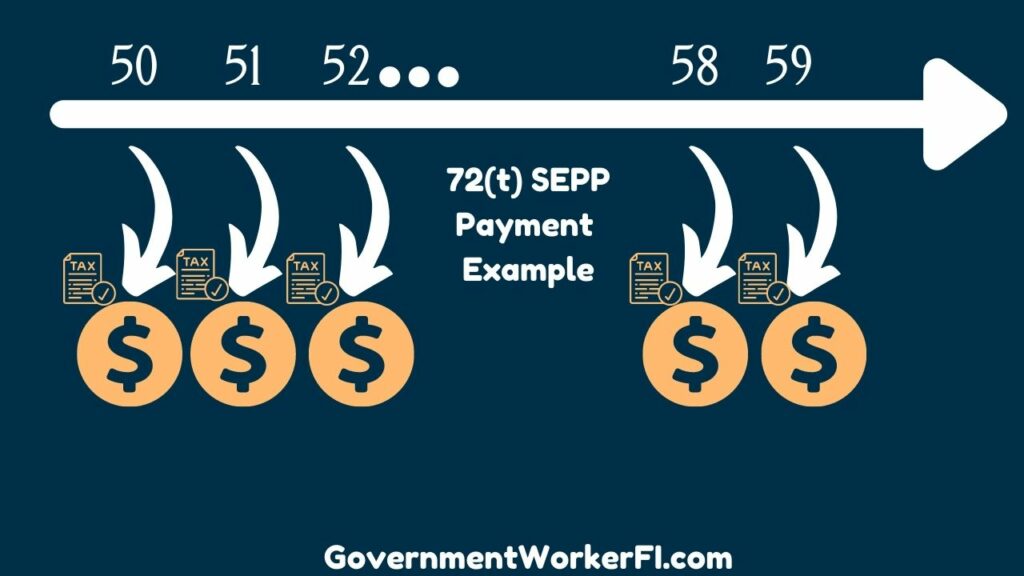

Be very cognizant that the decision to apply the 72(t) SEPP rules for early withdrawal has long-term repercussions. You must continue taking the series of substantially equal payments for a minimum of 5 years, or until age 59.5, whichever comes later. Otherwise you will be on the hook for the tax penalties you are trying to avoid.

Here’s an example – Let’s say a fictional GovWorker decides to retire early at age 45. He funds his early retirement using his chosen 72(t) SEPP distribution calculations and sets up installment payments to be made monthly from his qualified retirement plan. Those payments must continue until he reaches age 59.5, or the fictional Govworker will be paying the 10% penalties.

In another example, he starts the SEPPs at age 57 – the payments must continue for 5 years until he reaches age 62, or he will face penalties.

Comparing a TSP SEPP to a Roth conversion ladder

Since you can withdraw the principal from your Roth IRA at any time penalty free, this is another way to access funds in early retirement. Let’s compare the TSP SEPP to a Roth conversion ladder:

Disadvantages of a TSP SEPP

- You are locked into receiving a certain amount of (taxable) income each year. You have no opportunities for changing your tax bracket until at least age 59.5.

- If you return to work or get a side job in early retirement, you cannot stop these payments.

Advantages of a TSP SEPP

- Unlike a Roth conversion, there is no waiting period to receive money from a TSP SEPP. If you need money now in early retirement, and almost all of your money is tied up in the TSP, then a TSP SEPP can help you access your funds early.

What happens if I mess up my TSP SEPP calculations?

Readers – Don’t mess up the calculations, okay?

The IRS lets you make one change to the method used to calculate your payments – you can change from the amortization or annuitization method to required minimum distributions during either the first 5 years of payments or until you reach age 59.5, whichever comes later – and that’s it. For any other modifications – you might have to pay the early-withdrawal penalties you’re hoping to avoid.

Get Gov Worker’s top 4 tips for federal employees!