They said what???

If you’ve gotten an email from the Thrift Savings Plan (TSP) lately, you might have experienced some serious cognitive dissonance.

The TSP board is trumpeting the fact that they have innovated and modernized by allowing TSP participants to invest in mutual funds outside of the five core TSP Funds.

But the reality is that the TSP mutual fund window is a throwback to earlier times when 401(k)’s had high fees and sucky funds managed by wealthy white dudes in New York City.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- How the TSP worked prior to the mutual fund window

- What is the TSP mutual fund window?

- How the TSP mutual fund window works

- How much does it cost to participate in the TSP mutual fund window

- Why is the TSP doing this?

- Why I’m never using the TSP mutual fund window

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

How the TSP worked prior to the mutual fund window

When the TSP started back in the 1980s it was revolutionary. The TSP only allowed investors to choose between 3 index funds they managed:

- The C Fund (which tracks the S&P 500)

- The F Fund (similar to VBIAX)

- The G Fund (which invests in government securities and is guaranteed not to decrease in value)

The government structured the TSP to have the lowest fees of any defined contribution retirement plan at the time. They furthermore restricted investments to broad indices that tracked major stock and bond markets. As an individual investor, you literally could not mess it up (unless you kept all of your money in the G Fund to avoid risk).

In the early 2000’s, the TSP added two more funds: a small cap fund and an international fund.

In its current form, the TSP is a Boglehead’s dream. You can build a completely balanced portfolio with negligible fees, a generous employee match, and the choice between traditional and Roth options.

What is the TSP mutual fund window?

The TSP announced that in 2022 they will now add a mutual fund window to the TSP. According to the Federal Register, this change was in response to a 2009 Congressional change to the TSP which allowed the addition of the mutual funds.

When the FTIRB voted in 2009 about adding mutual funds to the TSP investment options, the vote was split 50:50 among board members who were for and against the window. They then hired consultants to do research and presented information to the board over the next 5 years. In 2015, the FTIRB voted to add a mutual fund window, which is just now being implemented.

The FTIRB is justifying this change based on a survey that found that 39% of TSP participants wanted to invest in mutual funds outside of the 5 core funds. (In other words, not even a majority of participants wanted this change.)

How the TSP mutual fund window works

The good news: The TSP is committed to keeping the 5 core TSP Funds with the same low fees.

In other words, you don’t have to make any changes now that the TSP mutual fund window is open. (In fact, I’m not making any changes. And from a Facebook survey, most of my readers aren’t planning any changes either…)

The bad news: If you do want to invest your TSP funds in the mutual fund window, expect to pay a lot of money in fees and deal with a lot of restrictions and red tape. You’ll only be allowed to invest 25% of your total TSP balance in the mutual fund window and you need to invest a minimum of $10,000 in the window.

How much does it cost to participate in the TSP mutual fund window

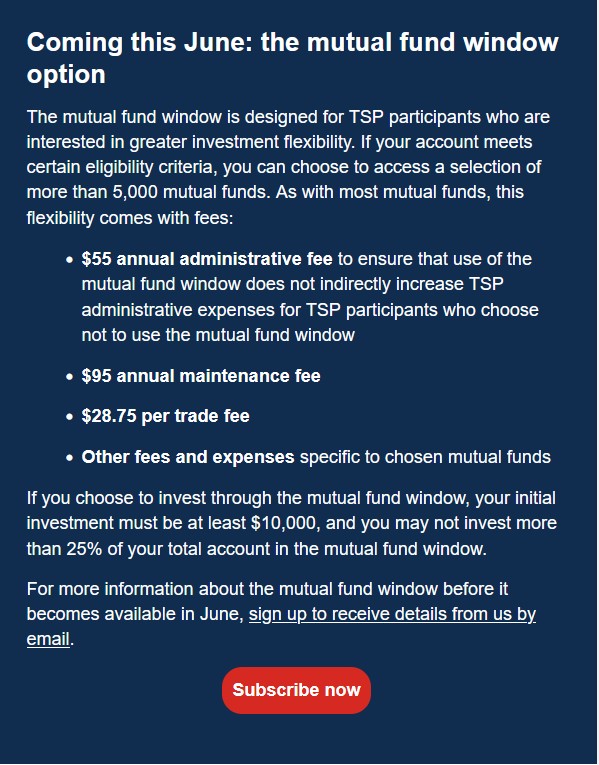

If you want to invest in mutual funds within the TSP, expect to shell out a nontrivial amount of money for that privilege.

According to the latest email the TSP sent out on the subject, federal employees and uniform service members will need to shell out $150 per year if they own any mutual funds. Any mutual fund trades will incur a $28.75 per trade fee.

Finally, these fees are in addition to any management fees within the fund. Since the TSP hasn’t discussed which mutual funds will be available yet, this could be another major source of fees for TSP participants.

Since the fees on the core TSP funds are very small, and differences between funds are negligible, participants never needed to shop around for a fund that met their objectives with low fees.

The mutual fund window is definitely adding complexity to the TSP… but is it providing any benefit?

Why is the TSP doing this?

Honestly, I have no idea why the TSP decided to add the mutual fund window over a decade after Congress approved it.

In 2009, the board was deadlocked on the issue. The cynical part of me thinks that the Wall Street consultants hired by the TSP to brief them on the issue have a serious conflict of interest. If you’re a professional money manager, you may see the TSP as a rather simple, backwards plan without access to exotic investments…

But in reality, the simplicity of the TSP was a feature, not a bug.

But what about ethical stuff?

If you read the TSP press releases, they are leaning heavily on the fact that employees can now invest in ESG (Environmental/Social Governance funds). While there are a lot of varieties of ESG funds, they’re marketed as a more ethical choice when compared to broad index funds. Whereas an index fund invests in all companies according to their market capitalization, ESG funds may avoid potentially objectionable companies like petrochemical companies or weapons manufacturers.

While ESG funds sound great on paper, I’m a little bit skeptical. Many ESG funds are concentrated heavily in tech companies like Facebook (Meta) or Google (Alphabet). And a lot could be written about whether big tech is more ethical (or energy intensive) than petrochemical companies but I’m not going to write it here.

Also… if you feel strongly that you must invest in ESG funds, I’m not sure what you’re supposed to do with the other 75% of your money in the TSP.

In short, I find the argument that the TSP needs the mutual fund window to appease ESG investors to be nonsensical.

Why I’m never using the TSP mutual fund window

I’ll be honest. The TSP mutual fund window sucks.

In the TSP mutual fund window

- You pay more money

- For worse investment options

- With higher fees

- For a small fraction of your TSP balance

Honestly, who benefits from this besides the investment partners that the TSP is working with?

I posted a note in my Facebook Community to see if anyone I knew was planning on using the window and found no takers but someone shared this entertaining thread on the Boglehead Forum.

Two Bogleheads wanted to use the window.

One person wanted to invest an in emerging market fund. The other one may wear a tinfoil hat… They are concerned the core TSP funds may not be investing the money because they couldn’t FOIA the proper financial paperwork from the TSP.

While I agree that emerging markets are sorely missing from the TSP I Fund, I believe there are better ways to fill that gap in your portfolio. For instance, you could invest in these funds for less fees within an IRA or a taxable brokerage account.

The TSP doesn’t need to be your entire financial portfolio. And for that reason, I see no reason for this mutual fund window.

Get Gov Worker’s top 4 tips for federal employees!