I see quite a few of my fellow government workers lauding the TSP lifecycle funds (L Funds) for their simplicity.

Instead of needing to rebalance your investments yourself, the L funds do it for you! These funds can be a great tool for accumulating wealth during your years of federal service.

The L Funds adjust their target allocation until they merge with the TSP L Income Fund which has a heavy dose of the G Fund.

But is there such a thing as being too conservative? I’ve taken a hard look at the TSP L Income fund to answer this very question, and to see if there’s a more balanced approach.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- Overview of the Thrift Savings Plan (TSP)

- TSP Lifecycle Funds

- TSP L Income Fund Asset Allocation

- Is the TSP L Income Fund too conservative?

- Alternatives to the TSP L Income Fund in Retirement

- Where to learn more

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

Overview of the Thrift Savings Plan (TSP)

The government’s Thrift Savings Plan (TSP) is similar to other employer directed tax-advantaged accounts, like a 401(k). You can have both a TSP an IRA. Furthermore, you can also choose between a traditional TSP and a Roth TSP. (Note: a Roth TSP is different from a Roth IRA.)

One of the most significant differences between the TSP and a 401(k) are the investment choices. Unlike most other accounts, you are limited to index funds only. And not just any index funds, but five specific government-approved funds:

- The C Fund (Common Stock Index)

- The F Fund (Fixed Income Index)

- The G Fund (Government Securities Investment)

- The I fund (International Stock Index)

- The S Fund (Small Capitalization Stock)

You can also invest in TSP Lifecycle Funds that are comprised of a mix of funds automatically adjusted to employees’ anticipated retirement dates.

TSP Lifecycle Funds

If you’re a new government service worker and investing in your TSP (even maxing it!) you may have already you were automatically invested in an L fund. The fund you’re in automatically should correlate to whatever is your closest to your retirement date. Young and fresh-faced? You’re in L 2055 or farther. Been in the workforce for longer? Depending on your age, you could be in L 2040 or sooner.

If you have no clue what your TSP is invested in, it’s worth logging on and checking it out. (You don’t want to think you’re invested in a stock fund only to find all of your money is sitting the G Fund)

The TSP site has a nifty tool for comparing three different L funds at a time. Since several of the L funds were made official in July 2020, they don’t have data on the site for their returns. Instead, it’s useful for determining for yourself which fund choice best aligns with your retirement date.

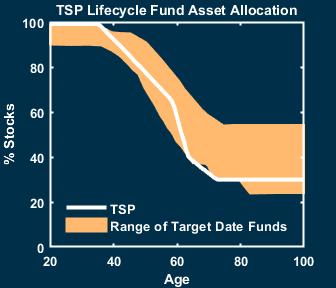

The closest counterparts for non-federal civilians are target-date funds, which are designed to optimize your risk and returns as you approach retirement. Choosing a closer time horizon, like 2025, will mean your contributions are in very conservative investments, in order to preserve your wealth for that time.

Choosing dates farther away, like 2065, will mean your contributions are much more aggressive, to take advantage of the decades you have to generate more wealth. This is exactly what the L funds do, with the L Income fund available if you’re withdrawing from your TSP right now.

TSP L Income Fund Asset Allocation

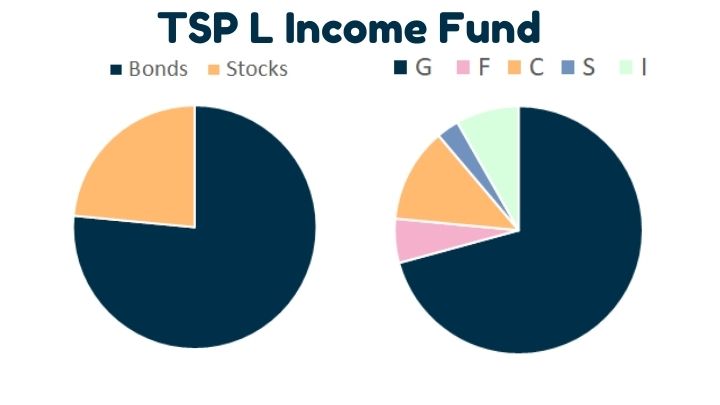

Here is where the TSP L Income Fund gets interesting. Since it’s intended for employees who have already retired, it’s the most conservative L fund of the bunch. Currently, its investment mix across the individual funds contain 75% bonds and 25% stocks.

In the TSP L Income fund, 70% of your money will be in the G fund.

The C and I combination of funds take up the next two biggest pieces of the pie, with the F and S funds making up the least.

Not only is the L Income Fund as conservative as it gets in the TSP, it is also more conservative than almost all target date funds in the private sector. It’s so conservative that its 10-year average returns sit at 4.49%. For reference, the inflation rate in that same time frame averages to just under 3%.

Your rate of return is still “winning” against inflation, but not by much at all. That’s the very definition of a conservative return.

Is the TSP L Income Fund too conservative?

Which begs the question on whether or not the L Income Fund is too conservative for a retiree who is withdrawing money from the TSP.

Obviously, you don’t want your TSP funds invested in something risky. No one wants to log in one day and see their livelihood in retirement took a nosedive while they were at the beach.

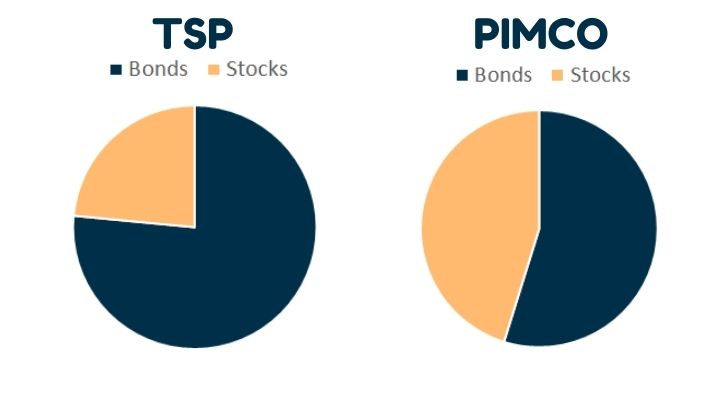

But I believe there’s a better middle ground between something aggressive (100% C Fund) and watching your investments tread water against inflation. Capital preservation doesn’t need to mean terrible returns, and being too conservative is just as dangerous as being too risky.

If you’ve read my post about the G Fund, you will know that while it gives you more returns than any other risk-free investment, G Fund returns still lag behind diversified bond funds. Furthermore, a portfolio with 25% stocks (like the TSP L Income Fund) has a less than 90% chance of supporting 30 years of withdrawals at a 4% per year withdrawal rate.

In other words, you need some risk in retirement.

Don’t forget about your pension!

Federal employees have a secret weapon that their private sector counterparts do not… a FERS pension! FERS employees will have two guaranteed streams of income in retirement: a pension and social security. (Not to mention subsidized health care for life!)

These guaranteed income streams mean that federal employees can be more aggressive in retirement than their private sector counterparts. Despite that, the TSP L Income Fund is the most conservative target date fund available for retirees.

While the TSP L Income Fund is a safe default choice, you need to carefully consider whether it meets your investment objective.

Alternatives to the TSP L Income Fund in Retirement

Retirement savings are no joke. If you are a retiree, please think carefully and consider consulting with a financial advisor before making a money move.

If you feel like the TSP L Income fund is not for you and you’ve ruled out a TSP annuity, you have two options both requiring more hands-on investment management:

- Rollover your TSP to an IRA with a better index fund allocation, or

- Build a better portfolio using the C/S/I/G/F Funds using an interfund transfer.

Where to learn more

Want to learn more about the TSP? Check out my TSP School series.

Do you have questions or comments? Drop a note in my Facebook community.