If I had a dollar for every time I saw someone ask for the best TSP allocation in an internet forum, I’d be retired on a beach somewhere.

Instead, I’m typing this blog post in my very modest house as the temperatures plunge below zero degrees every night.

I am not surprised that peopled are looking for the best TSP allocation. We all want to optimize our retirement savings with the perfect investment plan.

But I am surprised that anyone thinks an internet stranger can tell them their best TSP allocation. Each individual has their own time horizon, life expectancy, and individual factors that affect their plan for retirement.

Your fund allocation should probably consider questions such as:

- Will you have to financially support your parents in their retirement? Are you a caretaker for a disabled relative?

- Do you have health concerns that will be costly in retirement?

- How big will your FERS annuity be? Do you own real estate? Expect a large inheritance?

While I can’t give you a personalized allocation percentage, I can talk about things you should consider when crafting your own personal best TSP allocation.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is the TSP?

- Why there is no “best TSP allocation”

- Market timing, TSP allocations, and interfund transfers

- Best types of TSP allocations for current employees

- Best TSP allocation for retirees

- Why your best TSP allocation may be “none of the above”

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is the TSP?

The Thrift Savings Plan (or TSP for short) is a defined contribution retirement plan, similar to a 401(k), for federal employees and members of the uniformed services. The contribution limits for the TSP are the same as for the 401(k) and the government provides matching contributions on the first 5% of your salary you contribute.

Federal employees under the FERS system have access to three sources of income in retirement: FERS annuity (pension), social security, and the TSP. Upon retirement, federal employees can withdraw their retirement savings from the TSP or purchase a TSP annuity.

Federal employees can have both a TSP and an IRA. The TSP offers a Roth TSP option (not to be confused with a Roth IRA). You can choose to contribute to the Roth TSP or Traditional TSP or both depending on your tax situation.

Understanding the different TSP Funds

If you are looking for the best TSP allocation, you need to understand how the 5 basic funds within the TSP work.

The TSP does not use publicly traded mutual funds. Instead the TSP has 5 core fund options.

There TSP contains 3 different types of stock funds:

- C Fund “Common Stock Index Fund” follows the S&P 500

- S Fund “Small Cap Stock Index Fund” follows the Dow Jones U.S. Completion Total Stock Market Index

- I Fund (International Index Fund) follows the MSCI EAFE index

While the C fund follows a well recognized index, the international fund and small cap index fund follow more obscure indices. Make sure your individual investment funds are matching your investment objectives.

In addition to the TSP equity funds, there are two bond fund options:

- G Fund “Government Security Fund” is guaranteed to not lose money yet provides the smallest potential return of any fund

- F Fund “Fixed Income Fund” follows the Bloomberg Barclays U.S. Aggregate Bond Index.

Federal employees can build their TSP allocation from these 5 different fund types

Why there is no “best TSP allocation”

Let’s say you wanted to get stronger. Would you go to the gym and ask 100 people how much you should bench press?

Hell no!

Depending on who you talked to, you might try to lift something that’s way to heavy for you and get injured. Or you might end up lifting weights that don’t make you stronger at all.

The same thing goes for your TSP allocation.

Depending on what your financial situation is, being too aggressive could leave you exposed in retirement. Or, if your FERS pension will cover most of your expenses, being too conservative could mean that you’re leaving money on the table.

Your TSP investment strategy depends upon both your current financial position (do you have lots of debt?) and your life situation (are you healthy? do you have kids?). While I can’t read your mind and describe your best TSP allocation, I can run through some common suggested allocations for a comfortable retirement.

Market timing, TSP allocations, and interfund transfers

Before talking about different asset allocation models, I want to be clear that these are strategies for long-term investors. Your TSP contributions can grow throughout your whole career.

I don’t recommend trying to time the market within your TSP by using interfund transfers. (In fact the TSP has limited the number of interfund transfers you can perform to discourage active trading within the TSP).

TSP investors have the advantage of letting their contributions grow over long time periods. Over 80% of day traders lose money and the average trader loses 100% of their money within a year.

While you might feel the need to “hit a home run” with your investments, sticking to a long term investment strategy over your federal government career is the easiest way to have a large retirement nest egg.

Best types of TSP allocations for current employees

If you are a current employee, you are probably in a “wealth accumulation phase”. That is, you are trying to grow your TSP balance so that you can one day live off your assets in retirement.

Current employees likely have a higher risk tolerance than retirees and can therefore seek a higher rate of return.

Here are some different models people have developed for asset allocation during the wealth accumulation stage. If you are closer to retirement or have other financial considerations, you may wish to be more conservative than these models.

Note: I am not a financial planner and am certainly not your financial planner. Please speak to a retirement expert before making a life-altering change to your retirement plans.

JL Collins “Simple Path” for TSP allocations

The Simple Path to Wealth changed my life. For a long time, I tried to manage my own stock portfolio. It was a lot of work, a lot of stress, and (although I’ve been too afraid to do a thorough look-back), I’m pretty sure I underperformed index funds.

JL Collin’s book (and blog) are amazing resources for anyone who wants to build long term wealth. He is a big proponent of just having one fund during your wealth accumulation stage. He argues that the total stock market index (VTSAX if you’re a fan of Vanguard) is all that you need.

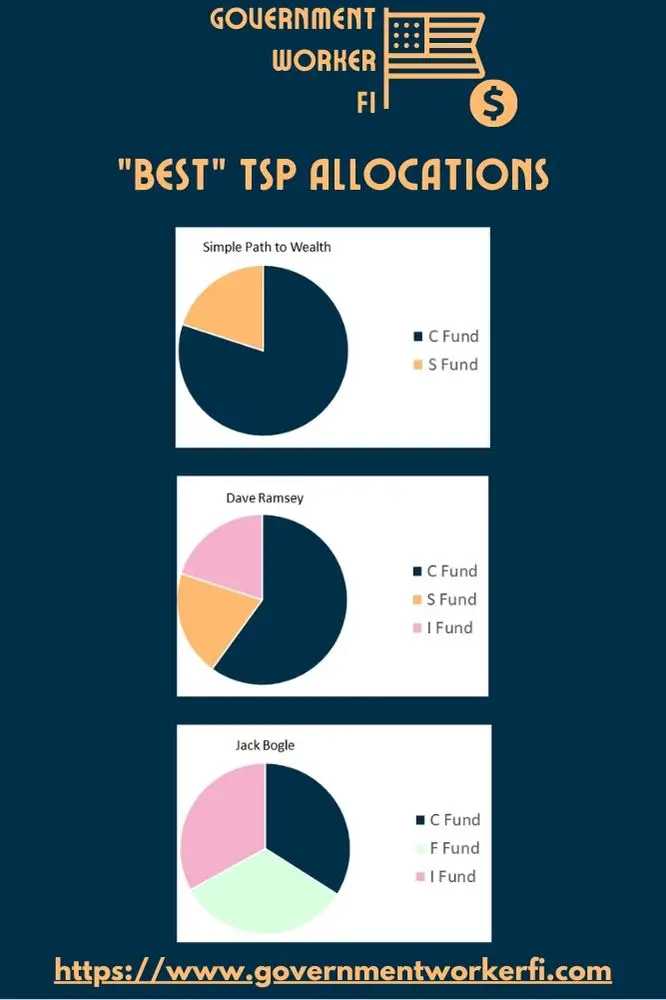

If you (like me) want to hold a VTSAX type portfolio in your TSP, you can do that with holding 70-80% of your TSP in the C Fund and 20-30% of the S Fund.

Dave Ramsey TSP allocation

Finance guru Dave Ramsey is one of the most recognizable voices in personal finance. While he is mostly known for helping people pay off debt, he also talks about wealth accumulation.

Like other voices, he recommends a portfolio with 100% equities but recommends a breakdown of 60% C Fund, 20% S Fund, and 20% I Fund.

If you want to research this portfolio further, you should know that the I Fund doesn’t invest in what you think it does and may not give you the international exposure you desire.

Jack Bogle three fund model for TSP allocations

Jack Bogle invented index funds and started Vanguard. The so called “Bogleheads” who follow Jack Bogle’s investment philosophy believe that you need just three funds in your retirement portfolio: a domestic total stock market fund, and international stock market fund, and a bond fund.

You could build your own 3 fund portfolio with a combination of the C, I, and F funds.

What about the TSP Lifecycle Funds?

We can’t talk about the TSP allocations without mentioning the TSP Lifecycle Funds. The TSP designed these funds to have the best TSP allocation at every age for a federal retiree.

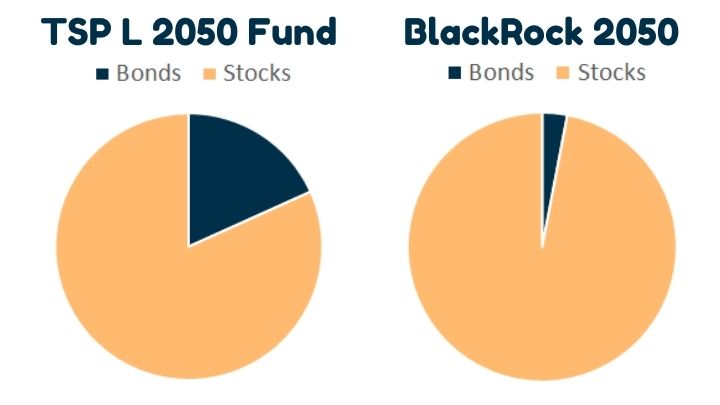

However, your idea of “best” might not match what the TSP wants for you. And in fact, the TSP’s asset allocation is quite a bit different than other target date funds.

For example the L2050 Fund has ~18% less exposure to equities than BlackRock’s fund.

Best TSP allocation for retirees

Bear markets don’t have serious consequences for young employees during their asset accumulation phase. If anything, downturns help these investors purchase stocks “on sale”.

However, once you reach retirement and begin drawing down your portfolio,you will want to have a more conservative portfolio. I’m not sure there’s anyone recommending that retirees have 100% equities in their portfolios.

The TSP L Income Fund is designed for current employees and is extremely conservative. If you have a small pension and need to live off of your TSP savings, then you may wish to be in a fund like the L Income Fund with lots of U.S. Treasury bonds and corporate bonds.

However, if your FERS pension covers most of your expenses, you can probably be a little bit more aggressive with your portfolio. Being more aggressive will help you to beat inflation and increase the odds that you will not outlive your portfolio.

Why your best TSP allocation may be “none of the above”

In this article I’ve tried to strike a balance between providing information on what the best TSP allocation may be and clearly stating that I have no idea what your finances are like.

Personal finance is personal. Asset allocations depend upon your age, but also your life situation. While the portfolios I presented in this article are well known, and work well for many people, they may not be appropriate for you.

As always, if you are unsure of what to do, meeting with a professional you trust can be well worth it for the peace of mind.

Get Gov Worker’s top 4 tips for federal employees!