Most financial experts agree that saving money for retirement is a smart move.

But what happens if you need to access money in your TSP account before retirement?

In this article I break down the TSP early withdrawal penalty so you can make the most of your savings.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What’s the TSP?

- When can I withdraw money without a TSP early withdrawal penalty?

- Can I withdraw from my TSP early?

- How does the TSP early withdrawal penalty work?

- How can I avoid the TSP early withdrawal penalty?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What’s the TSP?

The Thrift Savings Plan (TSP) is a defined contribution plan for federal government employees and members of the uniformed services.

Access to the TSP is a major benefit of federal government service. In short, it’s one of the best retirement plans available!

The TSP provides low-cost investment options through the core TSP funds by minimizing administrative expenses. While the rolled out a mutual fund window in 2022, it is loaded with fees; most people are better off constructing a portfolio from the low cost options: C Fund/S Fund/I Fund/F Fund/G Fund.

There’s no right answer to constructing the best TSP portfolio. In fact, there are several strategies for determining the best TSP allocation.

When can I withdraw money without a TSP early withdrawal penalty?

The IRS typically imposes a 10% penalty on distributions from a qualified employer-sponsored retirement plan. However, luckily for federal employees, if you separate from federal service after age 55, you can make a penalty-free TSP withdrawal.

In other words, federal employees who reach their minimum retirement age before age 59 ½ are eligible to begin TSP withdrawals immediately without the 10 percent IRS enforced TSP early withdrawal penalty.

Note that this does not apply if you separate from federal service before age 55 (such as taking a deferred retirement). In that case, you would not be eligible to make a TSP withdrawal until age 59 ½ if you wanted to avoid the 10% TSP early withdrawal penalty.

You qualify for age-based withdrawals without penalty at age 50 if your job description meets the IRS definition of a public safety employee. This includes:

- federal law enforcement officers

- customs and border protection agents

- federal firefighters

- air traffic controllers

- nuclear materials couriers

- United States Capitol Police and Supreme Court Police officers

- State Department diplomatic security special agents

In particular, be sure to consult IRS Section 72(t)(10)(B)(ii), Distributions to qualified public safety employees in governmental plans, to determine whether you are eligible for a penalty-free withdrawal.

Can I withdraw from my TSP early?

You have several options if you need to access money in your TSP account early, but it’s important to understand the how the TSP early withdrawal penalty applies to different types of withdrawals. In short- it’s your money, you can always get it out. But it might be very expensive for you to do so.

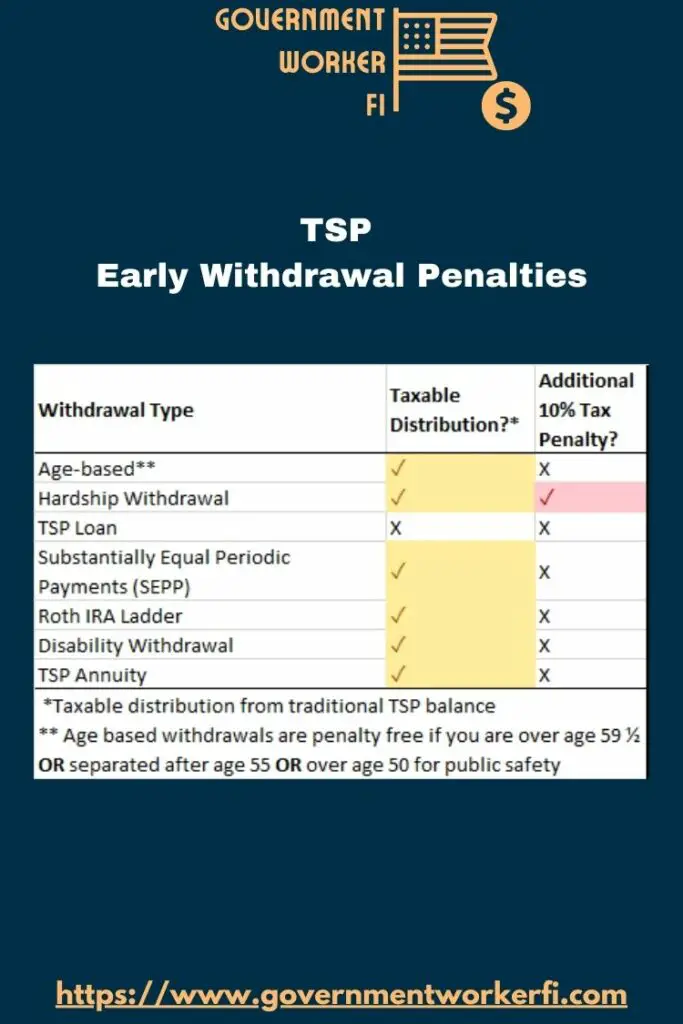

Here is a chart of the methods available to withdraw from your TSP:

TSP Hardship Withdrawal

If you are experiencing a genuine financial hardship, you may qualify for an in-service financial hardship withdrawal. Examples of qualifying financial needs include ongoing negative monthly cashflow, medical expenses not covered by insurance that exceed 10% of your adjusted gross income, uninsured personal losses, or legal expenses related to separation or divorce.

These withdrawals are subject to federal and state income taxes and may incur an additional 10% tax penalty. The TSP pamphlet titled “Tax Rules about TSP Payments” has additional information that may be relevant for your tax situation.

TSP Loan

The TSP loan option allows you to borrow up to $50,000 from your TSP with repayment plan options over 5 to 15 years. The interest rate is determined by the rate of the G Fund at the time of loan disbursement.

In addition, TSP loans do not incur an income tax penalty, but you miss out on earnings while the borrowed money is not invested in TSP funds in your account. The negative effect of these lost earnings on your net worth grows over time due to the principles of compound interest.

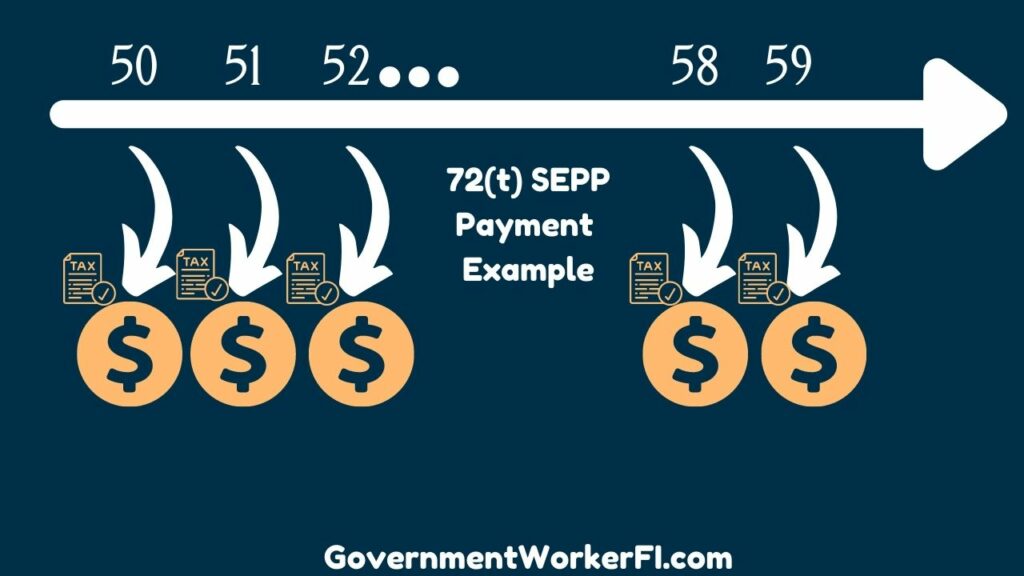

Substantially Equal Periodic Payments (SEPP)

If you separate from federal service, multiple SEPP methods allow you to withdraw periodic payments from your TSP without incurring the additional tax penalty.

But once you’ve begun SEPP withdrawals, you can only make limited changes to withdrawal amounts, otherwise you may face additional penalties.

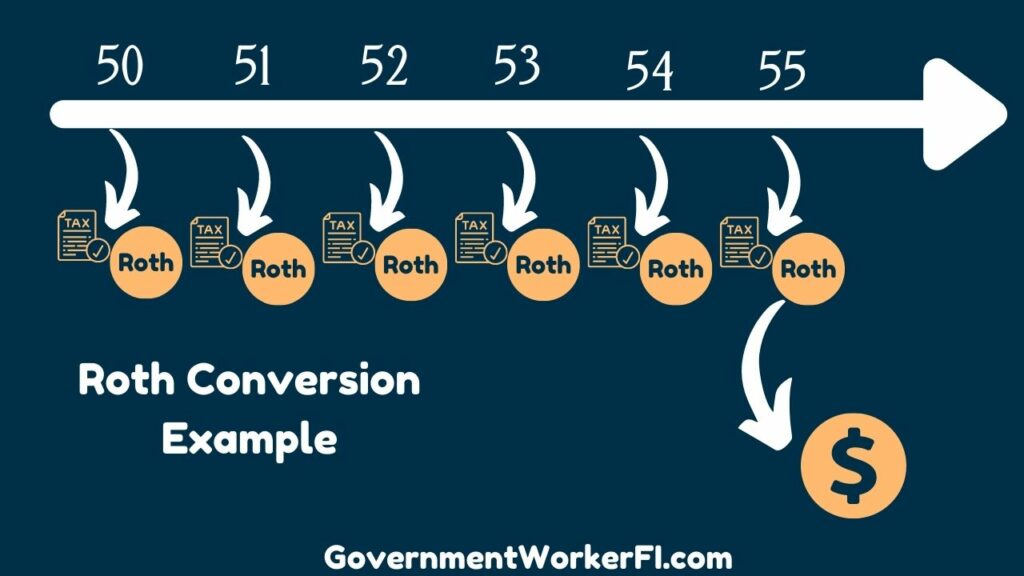

Roth IRA Ladder

A Roth IRA conversion ladder is a technique used to withdraw money from your TSP by performing a rollover into a Roth IRA, allowing the money to “season” for five years, and then making penalty-free withdrawals.

This is a powerful strategy but it has major tax consequences in the year you make the taxable conversion. You should discuss your financial situation with a qualified professional to make an informed decision.

TSP Early Withdrawal for Disability

If you have a total and permanent disability, you can make TSP withdrawals without paying the 10% penalty.

The IRS definition of “total and permanent disability” at Section 72(m)(7) of 26 U.S.C is that an individual is “unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or to be of long-continued and indefinite duration.”

Note that claiming the permanent disability exception for TSP withdrawal purposes is a separate process from qualifying for FERS disability payments.

TSP Annuity

You can purchase a TSP annuity after separating as a federal employee. Annuity payments are not subject to early withdrawal penalties at any age.

Court-Ordered Withdrawals

Due to legal implications, you should consult a lawyer to understand the tax implications if a judge directs you to make TSP withdrawals to satisfy the conditions of a divorce, separation, or bankruptcy agreement.

How does the TSP early withdrawal penalty work?

TSP early withdrawals are subject to federal and state income taxes at ordinary income rates.

If you request a TSP withdrawal, 10% of the distribution will be withheld automatically for federal income tax. You can elect to increase or decrease the automatic withholding amount.

You will owe an additional 10% penalty when you file your federal income tax return, unless you qualify for one of the exemptions discussed in this article. Therefore, it’s important to understand the tax consequences before you request the distribution!

How can I avoid the TSP early withdrawal penalty?

There are several options for withdrawals that avoid the 10 percent early-withdrawal tax penalty.

First, you can wait until you qualify for age-based TSP withdrawals at age 59 ½. If you separate from the federal government, you can take age-based withdrawals at age 55 (or age 50 for public safety employees).

Next, you can take a TSP loan to avoid a taxable distribution. In this case, you must repay the loan before you separate from federal service!

In addition, you can set up SEPP payments or a Roth IRA conversion ladder to avoid penalties on TSP early withdrawals.

On the other hand, you can also purchase a TSP annuity to avoid early withdrawal penalties.

Finally, you can withdraw from your TSP without penalty if you have a total and permanent disability.

Get Gov Worker’s top 4 tips for federal employees!

![TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2022/01/TSP-2050.jpg)