“Why does the TSP S Fund stink so much this year”

A reader recently Tweeted this @ me.*

I immediately checked the TSP returns. So far, the TSP S Fund is up 11.80% year to date.

Um….

Average stock market returns are roughly 10%. 11.80% seems like a very solid return. Unless you compared it to 2020 when the TSP S Fund returned ~32% or 2019 when it returned ~28%.

In this post I explain

- what the TSP S Fund is,

- whether the TSP S Fund actually invests in small-cap stocks

- how the TSP S Fund can fit into your portfolio.

*(To be fair, it may have been a Russian troll-bot. It has hard to tell on that app who is real sometimes).

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- How does the TSP Work

- What is the historical rate of return for the S Fund?

- What does the TSP S Fund invest in?

- Why would someone want to invest in the S Fund?

- Does the TSP S Fund really invest in “Small Cap” stocks?

- Summary- Is the TSP S Fund a good fit for your TSP?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

How does the TSP Work

The Thrift Savings Plan, or TSP, is open to federal employees, including members of the armed forces.

For all practical purposes, the TSP operates similarly to a 401(k). Employees can automatically make TSP contributions through their paycheck. The federal government provides matching contributions (up to the first 5% of your salary if you are a civilian employee under FERS).

Employees can make tax-deferred contributions in a traditional TSP or after-tax contributions to a Roth TSP. (Are you having a hard time deciding between the two? I wrote this article comparing the traditional and Roth TSPs.) Regardless of the type of TSP you use, you can contribute a maximum of $20,500 a year in 2022.

Investment options within the TSP

Unlike some 401(k)’s that are loaded with mutual funds with high fees, the TSP only has 5 different investment funds for participants. (Note, funds within the TSP are trust funds operated by the Office of the Comptroller of the Currency. Therefore, they are not traded like stocks and you cannot find a ticker symbol for them)

The plan has 2 bond funds:

- The F Fund gives participants exposure to the bond market through a bond index fund made up of high quality government and corporate bonds.

- The G Fund invests in short term government securities and is guaranteed to have positive returns.

The TSP also has 3 stock funds:

- The C Fund or “common stocks” fund, invests in the S&P 500 index

- The I Fund invests in international stock markets

- The S Fund invests in small- and mid-size businesses

In addition to these individual TSP Funds, TSP Participants can invest in Lifecycle Funds comprised of these 5 core funds.

What is the historical rate of return for the S Fund?

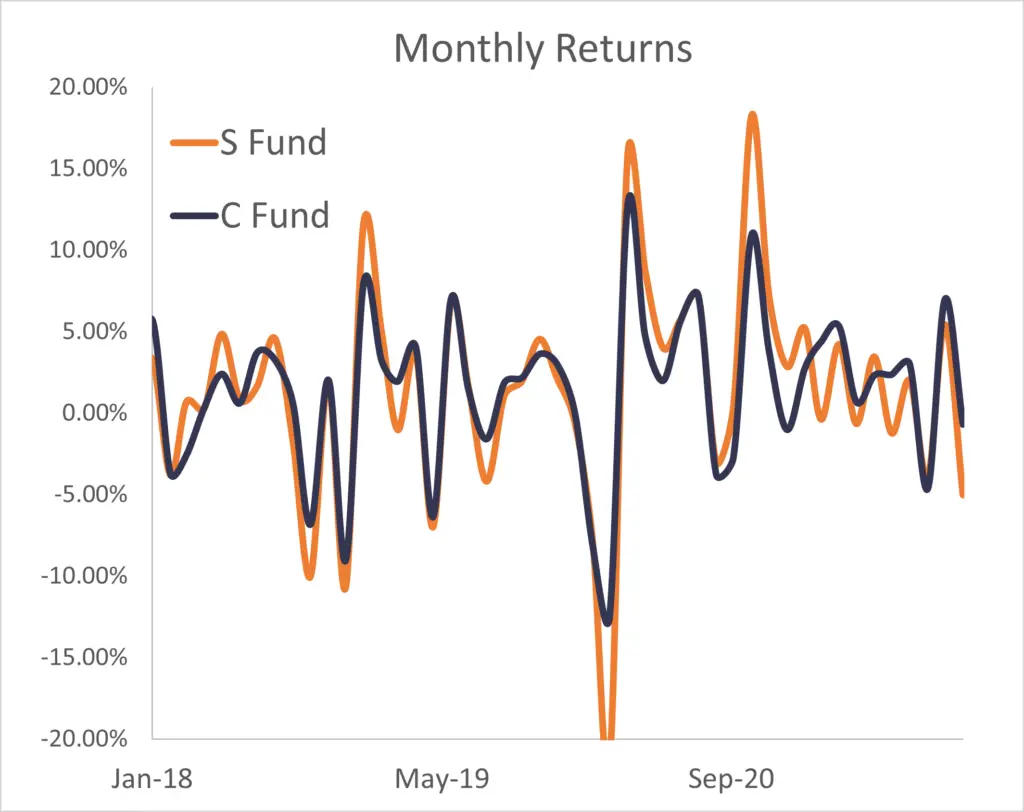

The S Fund has some of the largest 1-month and 1-year returns of any of the funds within the TSP. It has also had some of the most sharp declines.

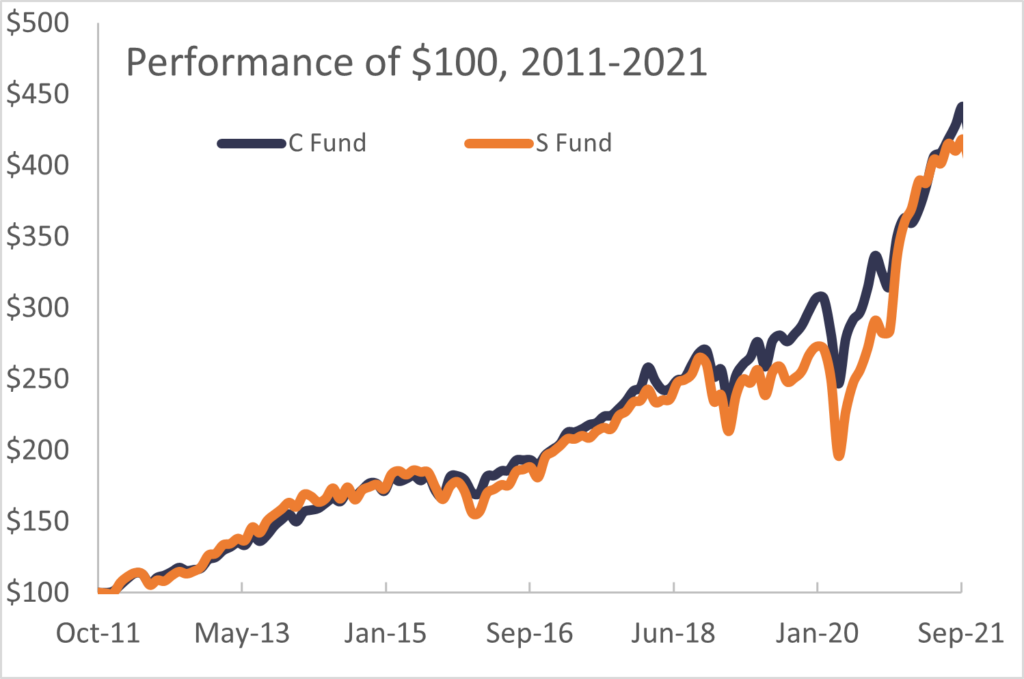

Over the last 10 year window, the TSP S Fund had a similar return to the C Fund.

In building my portfolio, I like to think about correlation.

(I think it goes back to all of my engineering classes on adding sine waves together)

If we look at the monthly returns, we can see that the C Fund and S Fund are highly correlated.

When the C Fund goes up, the TSP S Fund nearly always also goes up. However, the “amplitude” of the variations is larger in the S Fund.

If the C Fund is the core of your portfolio, adding in the S Fund won’t smooth out your returns. Instead it will increase the volatility in your portfolio.

This volatility can help you earn large returns and is great for federal employees in the wealth accumulation phase of their lives. However, federal retirees may want to limit their exposure to the S Fund.

Why did the S Fund do so well in 2020?

In the introduction of the article, I said that the TSP S Fund grew by over 30% in 2020. Most of the TSP S Fund returns in 2020 were from a single stock, Tesla. Tesla returned nearly 700% in 2020 and had the largest market cap of any stock not in the S&P 500. (It’s now the 5th largest stock within the S&P 500).

2020 was the year of the meme stock. It’s unreasonable to expect meme stock returns every single year within the TSP.

What does the TSP S Fund invest in?

The TSP S Fund matches the Dow Jones U.S. Completion TSM Index.

This index follows all stocks within the “total stock market” excluding stocks within the S&P 500 index. Therefore, while the “S” in the S Fund stands for “small-cap”, it also includes many medium-sized U.S. companies.

In fact, since the Dow Jones U.S. Completion TSM Index is weighted by market cap, S Fund investment returns are dominated by the biggest stocks in the index (i.e. Tesla in 2020).

Investment portfolios based off of the total stock market

By combining C Fund and S Fund holdings, TSP investors can achieve broad market exposure to the total stock market.

Many investors interested in financial independence like to invest in “VTSAX” which is Vanguard’s total stock market fund. There is also “VTI”, the Vanguard Total Stock Market ETF if you prefer exchange traded funds to mutual funds.

I became a big believer in VTSAX after reading JL Collin’s Simple Path to Wealth.

Since the stocks within the S&P 500 accounts for 78% of the holdings of the total stock market, you can recreate VTSAX within your TSP by having a portfolio of 70-80% C Fund and 20-30% S Fund.

Similar Stock Funds and ETFs

The S Fund follows an obscure index. Although there is a mutual fund analog (FSEMX), most small cap index funds follow other indices.

However, we can easily compare the S Fund against another small cap stock index fund (Russel 2000) to understand its performance.

As stated earlier, the TSP S Fund invests in the total stock market (defined by the Dow Jones total stock market) with the exception of the S&P 500 stocks.

There are several indices that attempt to track the total stock market, whether that’s the Dow Jones TSM, VTSAX, or the Russel 3000 index, which invests in the 3,000 largest stocks in the United States. The largest 3,000 stocks account for 98% of the total stock market, so performance differences between the Russel 3000 and VTSAX are negligible.

The smallest 2,000 stocks within the Russel 3000 comprise the Russel 2000 index. The Russel 2000 is the most common benchmark for small-cap stocks.

Comparison of the TSP S Fund and Russel 2000 index

So we can now compare the Russel 2000 to the TSP S Fund.

- The S Fund is the total stock market without the 500 biggest stocks

- The Russel 2000 is the total stock market without the 1000 largest stocks

In other words, the S Fund within the TSP has 500 more “medium” sized companies than the Russel 2000.

This isn’t necessarily a bad thing. In 2020, Tesla was the biggest stock *not* in the S&P 500 and had amazing returns. The S Fund grew by almost 40% that year.

Why would someone want to invest in the S Fund?

Note:I am not a financial advisor and certainly not *your* financial advisor. Please discuss your investment strategy with a certified professional rather than basing decisions off of an educational blog.

The TSP S fund gives an aggressive investor a chance to grow their portfolio through exposure to small and medium capitalization stock exposure.

Similar to the C and I Funds, the S fund has stock market risk and investors should be aware of the risk of loss inherent in stock market investing.

The S Fund has the largest price fluctuations of any individual investment funds within the TSP. While a large exposure to the S Fund may not be suitable for a retiree interested in capital preservation, it is great for younger employees looking to grow their retirement savings.

Personally, I think adding the TSP S Fund into your investment mix is useful if you want your portfolio to mirror a total stock market index.

Does the TSP S Fund really invest in “Small Cap” stocks?

I had a reader ask me whether the S Fund really invests in small cap stocks.

The S Fund clearly invests in some small cap funds. It invests in every stock outside of the 500 largest ones.

On the other hand, the S Fund also holds lots of medium stocks that aren’t quite big enough to make it in the S&P 500.

This doesn’t really bother me. These medium stocks have accounted for the lion’s share of the returns, and the S Fund has historically performed very well over the long term.

Top S Fund holdings

The S Fund holds a lot of stocks you have heard of before and probably use everyday.

The top 5 holdings as I write this in December 2021 are:

- Square (a digital payment company)

- Zoom (if you haven’t heard of Zoom, you haven’t lived the pandemic)

- Blackstone (an investment company)

- AirBnB (a peer-to-peer housing rental solution)

- Snap (Snapchat, a social media company)

Summary- Is the TSP S Fund a good fit for your TSP?

I believe there is a time and place for nearly all of the core TSP Funds.

Current employees primary objective should be growing capital for retirement. The S Fund, while susceptible to market risk, can help federal employees achieve this investment objective. The S Fund can be combined with the other core investment funds to build a portfolio that meets your investment objectives.

Retirees are primarily focused on capital preservation (i.e. not running out of money in retirement). Even still, U.S. Treasury securities may not provide returns sufficient to protect against inflation.

Having exposure to stock market indices like the C and S Fund can help retirees portfolio outpace inflation.

I like to think of the S Fund like salt. It makes almost everything (or every portfolio better), but if you put in too much it can ruin it.