Is a TSP Withdrawal Considered Income? The short answer is that unless you are using the Roth TSP, your TSP withdrawals are considered income and are subject to tax.

However, this is a complicated topic with lots of nuance. So let’s dive into more details below.

Table of Contents

- What is the Thrift Savings Plan (TSP)?

- Understanding the differences between a Traditional TSP, Roth TSP, and Roth IRA

- Is a TSP withdrawal considered earned income?

- Do I need to report my TSP withdrawal on my taxes?

- How do I report TSP withdrawal on my taxes?

- Does TSP withdrawal count as income for Social Security?

- Can you withdraw all money from TSP?

- Are Required Minimum Distributions (RMDs) from the TSP considered income?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is the Thrift Savings Plan (TSP)?

The TSP is a qualified retirement plan for federal employees and members of the Uniformed Services who have taken the oath of office. Founded in 1986 through the Federal Employees’ Retirement System Act (FERS), the TSP operates in a similar manner to a 401(k) for government employees.

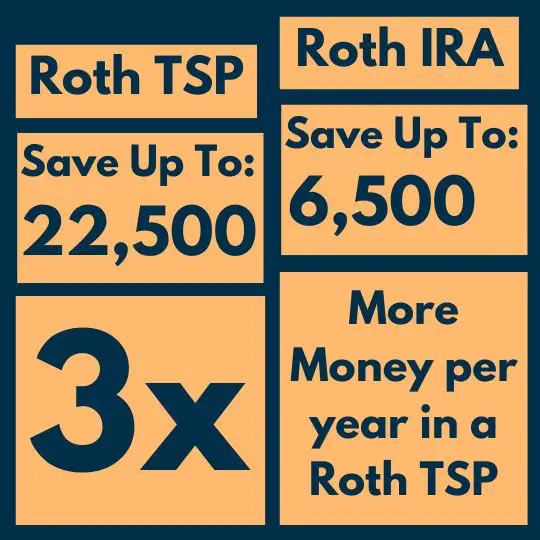

Federal employees can contribute up to the 401(k) maximum ($22,500 in 2023, not including catchup contributions). They even receive matching contributions up to 5% of their salary; most of it with no vesting period (free money).

Currently, employees can choose between one of 5 index funds with no added fees:

- G Fund– (short term government bonds, guaranteed to increase in value)

- F Fund– (medium term government and corporate bonds, similar to BND)

- C Fund– (“common stocks” i.e. S&P 500)

- S Fund– (small and medium cap stocks)

- I Fund– (international stocks, limited to certain countries that excludes emerging markets)

Understanding the differences between a Traditional TSP, Roth TSP, and Roth IRA

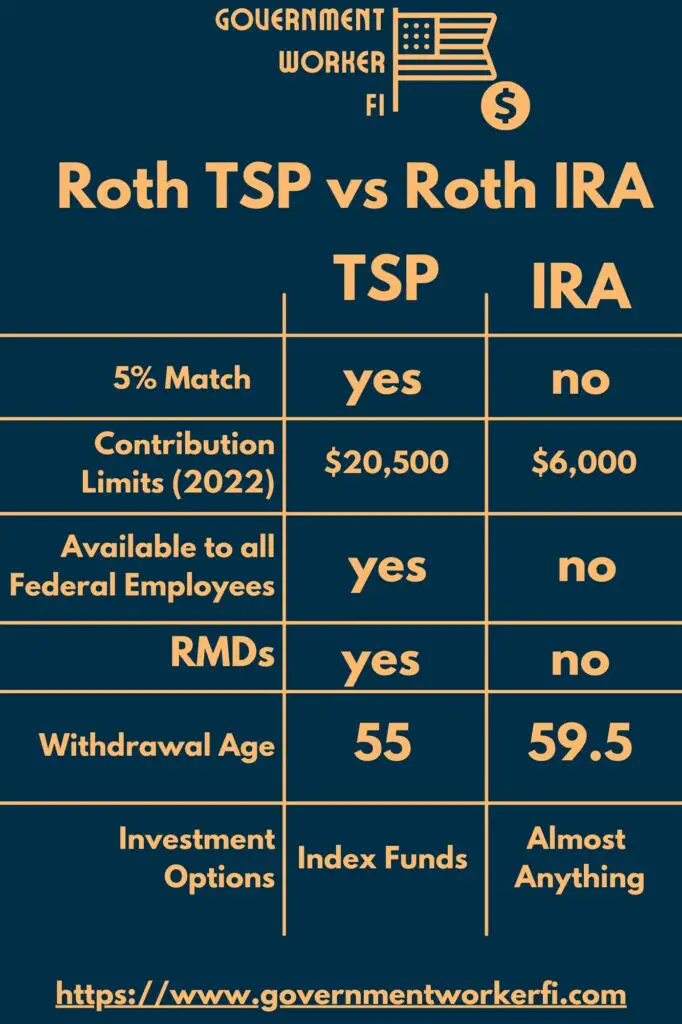

Readers often ask me questions that show that they don’t quite understand the differences between the Traditional TSP and the Roth TSP, and differences between the Roth TSP and the Roth IRA.

Apparently, the IRA must get the same types of questions because they created this handy comparison chart between these three types of retirement accounts.

Roth is an adjective that describes how the contributions are taxed. It is not a noun describing your retirement account.

- Roth accounts are funded with after tax dollars. Money within a Roth account can grow without capital gains taxed. Withdrawals are tax exempt (tax free).

- Traditional accounts are funded with pre-tax dollars. This can lower your taxable income and place you in a lower tax bracket. Money in these accounts grows without capital gains tax. However, withdrawals are taxed.

Is a TSP withdrawal considered earned income?

Whether or not a TSP withdrawal counts as taxable income depends upon whether or not your withdrawal comes from a traditional TSP or a Roth TSP. Whether or not you pay taxes on your TSP withdrawals also depends upon your age and your income level during the withdrawal.

Withdrawal from traditional TSP are considered income

Since you didn’t pay taxes on your traditional TSP contributions during your working years, you’ll have to give the government a chance to tax them in retirement. Withdrawals from your traditional TSP are considered earned income. You will receive a 1099-R Form showing the amount of money withdrawn and the taxes withheld.

Qualified withdrawals from Roth accounts are not considered income

If you are over age 59.5 you may withdrawal money from your Roth TSP tax free. This money does not count as taxable income. This is as simple as it gets. However, if you withdrawal money from your TSP before age 59.5 and have both a Roth and traditional balance, you need to be careful. You may end up paying taxes on your Roth earnings and potentially an early withdrawal penalty. (Check out my article on TSP Taxes on Withdrawals for more information).

Do I need to report my TSP withdrawal on my taxes?

Yes! The TSP reports all withdrawals to the IRS. If you don’t claim your TSP withdrawals on your taxes, the IRS will know that you did not report this income. In many cases, the TSP is required to withhold part of your TSP disbursement for federal taxes. The amount withheld from your TSP payments will help you avoid tax penalties for underpayment throughout the year. However, you should work with a professional for tax planning purposes. You can change how much is withheld on many types of TSP withdrawals to make tax filing easier at the end of the tax year.

Note that the federal income tax withholding only applies to the taxable portion of a TSP withdrawal. Eligible tax-exempt Roth withdrawals are not subject to withholding. More details can be found in TSP Publication 26, Tax Rules About TSP Payments.

How do I report TSP withdrawal on my taxes?

The TSP will send you a 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. form with the amount of your TSP distributions from the previous years and the amount of taxes withheld.

Depending on your state of residence, you may also owe state taxes when withdrawing money from the TSP. Several states do not apply state income tax to TSP withdrawals. You can check out my previous posts on Taxes on TSP Withdrawals and the Best States for Federal Retirees for more information on which states require you to pay state taxes.

Does TSP withdrawal count as income for Social Security?

When it comes to social security, you will need to calculate your “provisional income”– (see my post on minimizing taxes on your pension for more information).

In short, your provisional income is all of your taxable retirement income plus half of your social security income. Payments from your TSP account are included in your provisional income (and are fully taxable as ordinary income) if they are from the traditional TSP balance. Withdrawals from your Roth TSP account do not count towards your provisional income.

Why is provisional income important? Provisional income determines whether and how much your social security benefits are taxed.

- If your provisional income is greater than $34,000 (or $44,000 married, filing jointly), 85% of your social security benefits are taxable.

- On the other hand, if your provisional income is less than than $25,000 (or $32,000 married, filing jointly) you will not have to pay taxes on any of your social security income.

- Finally, if your income is between these two brackets, the government will tax 50% of your social security income.

Can you withdraw all money from TSP?

Yes- once you leave the federal government, you can roll the traditional balance of your TSP into an IRA and the Roth portion into a Roth IRA. You are also free to withdraw all of the money at once and receive it as cash. However, this has serious tax consequences, as you’d have a large amount of taxable income in one year and the majority of the money would be taxed at a high marginal tax bracket. This would greatly reduce the spending power of your TSP. While I know some people talk about making a large withdrawal request to pay off their mortgage upon retirement, it is likely not the best financial move. If you are thinking of withdrawing all of your TSP savings at once, you may want to consider working with a CPA so that you understand the tax implications of the move.

Are Required Minimum Distributions (RMDs) from the TSP considered income?

Yes- the tax treatment of RMDs is the same as any other time employees take money out of their TSP. In fact, the government created RMDs because people want to avoid paying taxes and TSP is taxed only upon withdrawals. While traditional contributions were not taxed during your working career, RMDs help make sure that money will be taxed in retirement.