People love to have debates about G.O.A.T.s (greatest of all time) :

- Jordan vs. Lebron

- Messi vs. Ronaldo

- Roth TSP vs. Roth IRA

Well, I guess maybe not that last one. I don’t think I’ve ever heard my coworkers get into an animated debate about whether the Roth TSP or the Roth IRA is the G.O.A.T. of retirement accounts.

But there’s no reason not to do a head-to-head comparison of the Roth TSP vs. Roth IRA. In fact, from a practical standpoint this probably has a lot more impact on your life than whether Peyton Manning was better than Tom Brady.

Let’s dive in and size up these two types of retirement accounts.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What’s the TSP all about anyway

- Roth is not an acronym

- Roth TSP vs. Traditional TSP

- Roth TSP vs. Roth IRA: You don’t need to choose one or the other

- Roth TSP vs. Roth IRA: Eligibility Requirements

- Roth TSP vs. Roth IRA: Contribution Limits

- Roth TSP vs. Roth IRA: Investment Options

- Summary: There’s no clear winner in the Roth TSP vs. Roth IRA debate

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What’s the TSP all about anyway

The TSP is a defined contribution retirement account available to federal employees. The TSP is similar to a 401(k) in that both have the same maximum contribution limits.

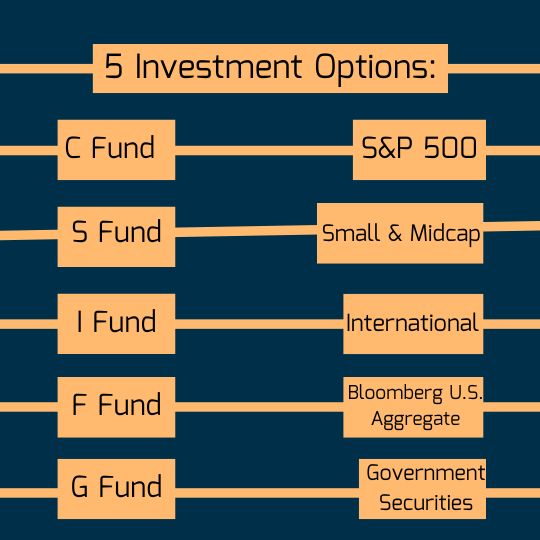

However, federal employees can borrow from their TSP and withdraw money earlier than age 59.5 in some cases. Both CSRS and FERS employees can contribute to the TSP. The government will match the first 5% of FERS employees contributions to the TSP and those contributions are vested after 3 years. CSRS employees can contribute their own money to the TSP but it is not matched. The TSP has 5 investment options that follow major indices:

- The C Fund follows the S&P 500 index

- The S Fund follows small and midcap stocks

- The I Fund can be used to add international exposure to your portfolio

- The F Fund tracks the Bloomberg U.S. Aggregate Bond Index

- The G Fund invests in special government securities only available in the TSP and is guaranteed to never lose value.

The TSP also has numerous lifecycle funds which are a set-it-and-forget it option for current employees and a TSP L income fund designed for retirees.

When the TSP started back in the 1980s it was revolutionary. The TSP limited investments to index funds that tracked major stock and bond markets. The government structured the TSP to have the lowest fees of any defined contribution retirement plan at the time. As an individual investor, all you had to do was select the contribution allocation that best suited your investment objectives and you could build wealth easily, automatically, and without thinking about it.

And the TSP works. There are thousands of federal employees with more than a million dollars in their TSP alone. Despite the stories of TSP millionaires who have used a “buy and hold” strategy, there are numerous employees looking for an active trading strategy (using interfund transfers) to try to make big gains in the TSP.

Roth is not an acronym

Let’s clear up a big source of confusion that I see on lots of retirement forums.

Roth is an adjective that describes how the contributions are taxed. It is not a noun describing your retirement account.

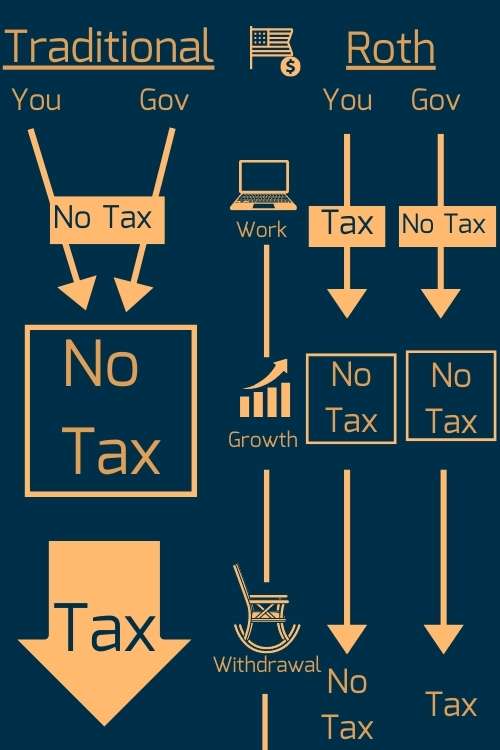

- Roth accounts are funded with after tax dollars. Money within a Roth account can grow without capital gains taxed. Withdrawals are tax exempt (tax free).

- Traditional accounts are funded with pre-tax dollars. This can lower your taxable income and place you in a lower tax bracket. Money in these accounts grows without capital gains tax. However, withdrawals are taxed.

Both the “Traditional” and “Roth” adjectives can get applied to various retirement accounts (nouns). Some types of retirement account nouns are:

- IRA (individual retirement account)

- 401(k) (defined contribution retirement plan)

- TSP (thrift savings plan)

- 403(b) (tax-sheltered annuity or TSA plan)

- 457(b) (deferred compensation plan)

I believe that some of this confusion between the Roth TSP and Roth IRA comes from the fact that in the beginning there were only Roth IRAs.

Since people were so familiar with “Roth IRA” I think people forget that Roth tax properties can now be applied to any type of account.

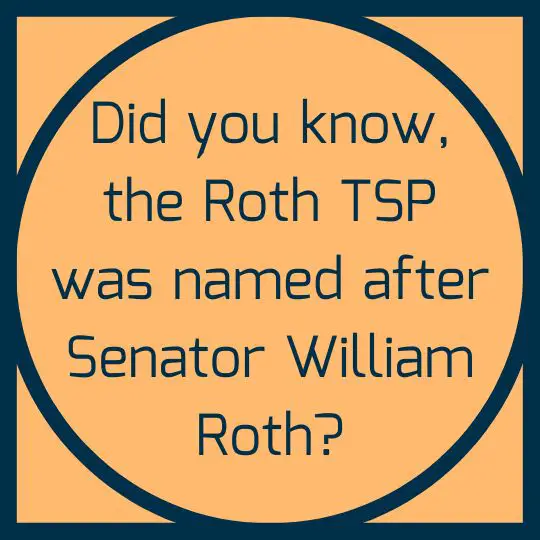

One final note about the “Roth” in Roth TSP

Technically, Roth is proper noun for Senator William Roth who championed the legislation for the tax-free retirement withdrawals. However, we now use Roth as an adjective to characterize a type of retirement account. Because it was originally someone’s last name, Roth is stylized just as you’d write a last name and not ROTH.

Roth TSP vs. Traditional TSP

In this article I want to walk you through the differences between a Roth TSP vs. Roth IRA so that you can choose which investment account works best for you.

However, before comparing the two types of Roth accounts, I think we should start with a quick refresher on the differences between Roth and traditional TSP accounts. If you want a more detailed breakdown, I wrote an entire post on traditional vs. Roth TSP where you can get more information.

This image illustrates the differences in how contributions and the government match is taxed between the Roth TSP and the Traditional TSP.

To choose between a traditional and Roth account, you need to know what your current tax bracket is and what you estimate your tax bracket will be in retirement.

If you’re in a high tax bracket now but think you’ll retire into a lower tax bracket, you may be able to save money by using a traditional account. However, if you’re in a low tax bracket now, you may find that a Roth account suits you best. If you’re like me, you may choose to contribute to both a Roth TSP and a traditional TSP at the same time to hedge your bets and get some of both types of benefits.

Choosing between Roth and traditional accounts is not a one-time decision. In an ideal world, you should evaluate your tax situation every year and adjust your tax strategy accordingly. I work with a CPA to help me optimize my strategy each year and strongly recommend that you also work with a CPA, financial advisor, or other professional before making a decision that affects your retirement.

Roth TSP vs. Roth IRA: You don’t need to choose one or the other

Just to be clear, you can save money in both a Roth TSP and a Roth IRA. You don’t need to choose just one!

You can also choose to save money in the Traditional TSP and a Roth IRA or a Traditional IRA and a Roth TSP.

And you can also choose to split your TSP contribution between Roth and Traditional contributions (which is what I do).

So while it is important to understand differences between the accounts in the Roth TSP vs. Roth IRA debate, you don’t need to put all of your eggs in one basket.

Roth TSP vs. Roth IRA: Eligibility Requirements

So you’ve decided that you want to save money in a Roth type account. That’s great! Now you need to figure our if you are eligible to contribute to a Roth account.

One of the biggest differences between a Roth TSP and a Roth IRA is who can contribute to them.

Starting in 2023, for a Roth IRA, you can only contribute up to the contribution limit if your income (technically your “modified AGI“) is less than $138,000 (or $218,000 if you are married and file jointly).

In contrast, the IRS does not have income limits for Roth TSPs or Roth 401(k)s. Therefore, the Roth TSP can be a great option for people who want to use a Roth account but make too much money to contribute to a Roth IRA.

Roth TSP vs. Roth IRA: Contribution Limits

Another factor in the Roth TSP vs. Roth IRA debate are contribution limits.

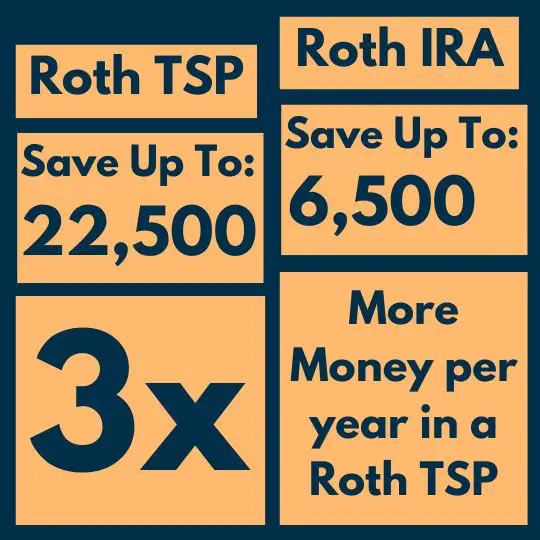

You can put more than three times as much money per year in a Roth TSP than you can in a Roth IRA.

For 2023, the IRS increased the limits for the Roth TSP to $22,500. Employees over the age of 50 can contribute an additional $7,500 in catch-up contributions for a grand total of $30,000 in contributions per year.

In contrast, you can only save $6,500 per year in a Roth IRA. Individuals over the age of 50 can save an additional $1,000 for a total of a total of $7,500.

If you goal is to save as much tax-free-in-retirement money as possible, you’re going to want to take advantage of the large contribution limit in the Roth TSP.

Roth TSP vs. Roth IRA: Investment Options

The last major difference to consider when choosing a winner in the Roth TSP vs. Roth IRA debate are the different investment options between the funds.

When comparing the investment options between Roth TSPs and the Roth IRA, the Roth IRA is definitely the most flexible account.

With a Roth IRA, you can invest in any individual company you’d like. You can even trade options within an IRA. Furthermore, with a “self-directed” Roth IRA, you can own nearly any type of asset (real estate, crypto, etc.) within your Roth IRA.

With the Roth TSP, you can invest in the 5 core index funds. As of May 2022, you can also invest a portion of your TSP balance in mutual funds through the TSP mutual fund window. However, in my review of the TSP mutual fund window, I pointed out that the mutual fund window has extremely high fees and limits your investments in mutual funds to 25% of your total TSP balance.

Therefore, if you want to invest in anything outside of the 5 core TSP funds, it makes more sense to do so in a Roth IRA instead of a Roth TSP.

Summary: There’s no clear winner in the Roth TSP vs. Roth IRA debate

Just like the other G.O.A.T debates, I don’t think there’s a clear winner when it comes to Roth TSPs and Roth IRAs. They are both great (but slightly different).

If you want to contribute a lot of money, you might give the Roth TSP a slight edge. However, you have the ability to hold more assets and perform more exotic trades within a Roth IRA.

Obviously, the best thing to do is to max out both accounts (if you can afford to). However, most of us mere mortals will need to decide how to partition their retirement savings among different types of accounts. I hope this article helped you better understand your options when it comes to these types of accounts.