Remember those commercials with an “easy button“?

Things were going poorly in a dreary office and then someone suggests hitting a giant red button labeled “EASY” which magically fixed the problem.

Well, the TSP tried to develop an easy button for your TSP that they call Lifecycle Funds.

But can a one-size-fits-all approach work for something as personal as your own retirement nest egg?

In this post I break down everything you need to know about the TSP L Funds and whether or not they’re a good fit for you.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- 1. The TSP Lifecycle funds are made up of the 5 core TSP Funds

- 2. New employees are automatically enrolled in the TSP Lifecycle Funds

- 3. The TSP Lifecycle Funds are a “set it” and “forget it” investment

- 4. The Thrift Savings Plan board (FRTIB) recommends investing 100% of your assets in the same Lifecycle Fund or avoiding them altogether

- 5. The FRTIB changed the asset allocation “glide path” in 2018

- 6. The TSP Lifecycle Funds are (still) MORE conservative than most private sector counterparts

- 7. Federal employees can have more aggressive investments in their TSP than private sector counterparts

- 8. How to build an appropriate TSP portfolio for your risk tolerance

- Want to learn more about a specific Lifecycle Fund?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

1. The TSP Lifecycle funds are made up of the 5 core TSP Funds

The TSP, short for Thrift Savings Plan, is a defined contribution plan for civilian federal employees and uniformed services participants.

TSP participants can contribute a max of $20,500 (in 2022) to the TSP, the same limit as a 401(k). The government matches employee contributions up to a maximum of 5% of their salary.

Unlike a 401(k) however, you cannot invest in a mutual fund. Instead, there are 5 core TSP Funds that are designed to follow specific indices.

- “Common stock fund“: The TSP C Fund follows the S&P 500 index

- “Small cap stock fund“: The TSP S Fund follows the Dow Jones U.S. Completion TSM Index

- “International stock fund“: The TSP I Fund follows the MSCI EAFE Index

- “Fixed income index investment fund“: The TSP F Fund follows the Bloomberg Barclays U.S. Aggregate Bond Index

- “Government securities investment fund“: The TSP G Fund invests in special non-marketable government securities.

While investors can build their own portfolio from these 5 individual TSP funds, the TSP developed Lifecycle Funds in 2005. There are many different Lifecycle Funds, each with a target date.

The TSP automatically adjusts the target allocation of these target date funds as you approach the target retirement date. This allows investors to place all of their money in a single fund without having to ever rebalance their portfolio.

2. New employees are automatically enrolled in the TSP Lifecycle Funds

The federal government automatically enrolls new employees in the Thrift Savings Plan. Recently, the government changed the default contribution to 5% of employee pay. This ensures that people who do not pay attention to their TSP get the maximum amount of the government contribution.

New civilian employees (and military employees in the blended retirement system) are automatically enrolled in an “age-appropriate” Lifecycle Fund by default. Prior to this, employees who did not submit paperwork on the TSP were placed into the G Fund. This rule change ensures that the federal workforce is guided towards an appropriate investment strategy for retirement in the absence of employee intervention.

3. The TSP Lifecycle Funds are a “set it” and “forget it” investment

The TSP Fund Managers automatically rebalance the lifecycle portfolio and adjust the amount of stock and bond funds every three months.

These quarterly adjustments do two things:

- Adjust the allocation from stocks and bonds to ensure a consistent portfolio. (For instance, if the stock market increases by 5% over 3 months but a bond index fund only returned 0.25% your asset allocation would be out of whack unless you rebalanced it).

- Change the stock/bond asset mix so that it is more conservative as it approaches the target date. As you approach retirement, capital preservation becomes more important. The TSP L Funds follow a predetermined glide path to ensure this transition.

4. The Thrift Savings Plan board (FRTIB) recommends investing 100% of your assets in the same Lifecycle Fund or avoiding them altogether

Because the TSP carefully examined the ideal asset allocation at each age, they do not recommend mixing the TSP Lifecycle Funds with other funds.

“[The TSP LIfecycle Funds] were designed to let you invest your entire portfolio in a single L Fund and get the best expected return for the amount of expected risk that is appropriate for you.”

(TSP Lifecycle Fund Prospectus)

If you go deep through the FRTIB’s notes, they map out expected return as a function of risk and create an efficient frontier. The lifecycle funds represent the most return you could expect for a given level of risk.

Therefore, if you combine a TSP L Fund with any other TSP Fund you are moving off the efficient frontier. In other words, your portfolio has more risk than your expected return.

5. The FRTIB changed the asset allocation “glide path” in 2018

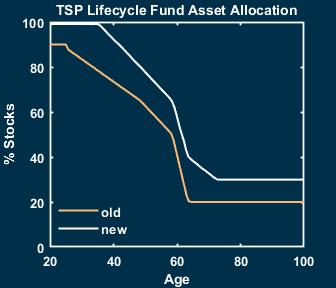

Glide path refers to the amount of equities in the retirement portfolio as the user approaches their target date. Prior to 2018, the TSP had the most conservative glide path of any retirement date fund.

The old TSP Lifecycle Fund path had a maximum amount of 90% stocks. The amount of equities began to decrease starting at age 25 until it reached a minimum of 20% stocks at retirement age.

In 2018, the TSP updated their glide path so that participants now have 99% stocks until age 35 and reach a minimum of 30% stocks in retirement age. (See the September 2018 meeting minutes in their archive)

It is also important to note that the TSP Lifecycle (L Funds) contain a high amount of the non-US equities (i.e. the I Fund). The I Fund represents 35% of the stock portfolio within the TSP.

One of the reasons I avoid the TSP L Funds in my portfolio is their high amount of the I Fund. As I have previously written, the I Fund does not give you the international diversification you think it does. Furthermore, I Fund performance lagged behind the C and S Funds and the I Fund has a larger expense ratio.

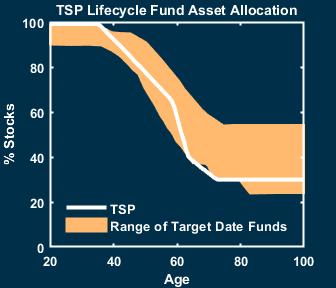

6. The TSP Lifecycle Funds are (still) MORE conservative than most private sector counterparts

Even with the 2018 change, the TSP L Funds are some of the most conservative target date funds in the market.

This is especially true for the TSP L Income Fund whose investment objective is to maintain a stable portfolio for retirees.

Other target date funds for sexagenarians have over 50% equities. The TSP L Income Fund has only 30%. (Of which a large portion is invested the I Fund).

Investing is a tricky balance. If you are too aggressive, a large crash could deplete your savings when you desperately need it. On the other hand, if you are too conservative, the rate of return on your investments might not grow fast enough to meet your lifestyle needs (inflation risk).

While the TSP Lifecycle Funds are a set-it-and-forget-it mix of core funds, you should understand what the investment manager designed the funds for.

According to consultants hired by the FRTIB, the TSP optimized the L Funds such that,

“The desired outcome is to create a series of L Funds such that an “average participant” in those L Funds, in combination with the FERS defined benefit plan and Social Security, will be projected to have sufficient assets to maintain a reasonable standard of living throughout retirement.”

(FRTIB meeting minutes, September 17, 2018)

Therefore, the age-appropriate TSP Lifecycle Fund is not an optimal portfolio mix, but instead one that the TSP thinks will work best for an average participant with an average FERS pension.

7. Federal employees can have more aggressive investments in their TSP than private sector counterparts

If you have read this far, you know that I am not a fan of the amount of the I Fund in the TSP Lifecycle Funds. Furthermore the TSP L Funds are more conservative than almost all of their private sector counterparts.

If anything, the government employees should be more aggressive investors than their private sector counterparts.

Why?

Because government employees have two guaranteed sources of income in retirement; their FERS pension and social security. These monthly payments will help you survive tough economic conditions. As a result, you can chase higher rates of return with your TSP and use that extra capital to increase your standard of living in retirement.

(Note, I’m not a financial advisor and certainly not your financial advisor. Please don’t make investment decisions based solely based off of a blog you read.)

8. How to build an appropriate TSP portfolio for your risk tolerance

Hopefully you now understand what the TSP Lifecycle Funds are all about.

The Good:

- You never have to think about your TSP allocation. In fact, you never need to log on to the TSP website at all if you have the TSP L Funds.

- Holding the TSP L Funds is certainly better than parking your entire retirement savings in the G Fund.

The Bad:

- The TSP Lifecycle Funds have a heavy dose of the I Fund.

- The TSP Lifecycle Funds are extremely conservative.

Now that you know these facts, you need to think about yourself. Are you someone who hates thinking about money? Then maybe it’s worth investing in the TSP Lifecycle Funds. They’ll get you pointed in the right direction with almost no effort.

On the other hand, if you are an über optimizer, the TSP L Funds are not for you. (But I’m guessing you already knew that… didn’t you.)

Get Gov Worker’s top 4 tips for federal employees!Want to learn more about a specific Lifecycle Fund?

I’ve written posts on many of the TSP Lifecycle Funds. Check out my analysis of the fund you are interested in below!

- TSP L Income Fund: Pros and Cons of a Conservative Portfolio

- TSP L 2035 Fund- Your Secure Path to Retirement

- TSP L 2040 Fund- Risk and Reward Balanced by a Professional

- TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings]

- TSP L 2065 Fund: A Retirement Plan for New Employees

If you still have more questions about the TSP L Funds you can post them in my Facebook Group! Or if you want to learn more about the TSP you can check out my TSP School.