If you, like me, are a federal employee, I’m guessing you know you have some retirement benefits.

I’m always a little bit surprised that a lot of my colleagues don’t understand how FERS works. But I’ve never met a federal employee that didn’t know he or she had some sort of pension.

Have you ever had to fill out paperwork asking if you participate in a “qualified retirement plan”? If you’re like me, you might wonder what the heck a qualified retirement plan actually is and whether or not your FERS pension or TSP is a qualified retirement plan.

If you have questions like, “What is a qualified retirement plan?” and “Is my TSP qualified?” this post is for you!

Table of Contents

- What is the TSP and how does it work?

- What is a qualified retirement plan?

- What does it mean that the TSP is a qualified retirement plan?

- How do qualified retirement plans affect taxes?

- The TSP is a qualified retirement plan

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is the TSP and how does it work?

Before we can answer whether or not the TSP is a qualified retirement plan, we first need to talk about what the TSP is and isn’t.

The Thrift Savings Plan, also called the TSP, is a defined contribution plan created for employees and retirees in the federal government, members of the uniformed services and some “special” civilians like members of Congress. It was created by Congress as an extra layer of benefit for civil service employees alongside FERS and Social Security. Essentially, TSP is like a 401(k) for federal employees.

As a defined contribution plan, feds contribute a part of their pre-tax earnings into investments within the TSP. (There is also a Roth TSP option where you contribute after-tax dollars.) The TSP is called a defined contribution because what ultimately matters is how much money you can withdraw is defined by the amount of money you put into the plan (contributions) and the growth of that money.

FERS employees get help with their contributions! The government will match your first 5% of your salary you contribute to the TSP as a dollar-for-dollar match. So if you contribute 5% of your salary, at the end of the year, your TSP will have a contribution equal to 10% of your salary. This is a great deal!

What is a qualified retirement plan?

Okay- now that we’ve defined what a TSP is, we need to define what a qualified retirement plan is before we can answer whether or not the TSP is a qualified retirement plan.

A qualified retirement plan is a term used to describe a retirement plan that follows the minimum standards spelled out in Internal Revenue Code Section 401(a). These guidelines were created to restrict employers from mismanaging employee retirement plans and/or misuse their employee’s retirement assets. It also has tax implications. Popular qualified plans include pension plans, profit sharing plans, and 401(k) plans.

The TSP follows the rules of Code 401(a) so it is a qualified retirement plan. Likewise your FERS pension is also 401(a) compliant. As a federal employee you’re lucky because you have not one but two qualified retirement plans. (This will affect your taxes, keep reading to find out how).

Most retirement plans are also governed by a law called ERISA.

Who is ERISA and what does she have to do with my retirement plan?

I can almost hear you asking, “Who is ERISA and why does she have so much power?”

Well, while ERISA looks like the name of a pop star, in this case it is just an abbreviation for The Employee Retirement Income Security Act (ERISA) of 1974. ERISA was passed as a federal law to protect individuals who make contributions to a retirement or health plan. Most of them anyway.

As a federal law, ERISA sets basic standards for organizations that guide how they operate. This includes information they are required to show to all beneficiaries. For example, all organizations offering a retirement plan are compelled by ERISA to inform interested parties about the plan’s features including what is required for participation, benefit accrual, and how participants can fund their account. It also requires that pension plans participate in the Pension Benefit Guaranty Corporation (PBGC) to guarantee some of your pension in case your employer goes bankrupt.

However, ERISA only applies to plans established in the private industry. Technically, ERISA does not apply to your TSP or FERS pension. On the other hand, federal employees may not need ERISA protections since their pension is provided by the government.

What does it mean that the TSP is a qualified retirement plan?

The TSP is a qualified retirement plan because it follows guidelines from IRS. But what does this actually mean?

It means that the government/TSP board need to follow certain rules about who can participate and how they treat participants. You can read this guide by the IRS if you want all of the rules.

As a TSP participant, you don’t need to know which TSP features make it a qualified plan. You can just enjoy the benefits of participating in a qualified retirement plan.

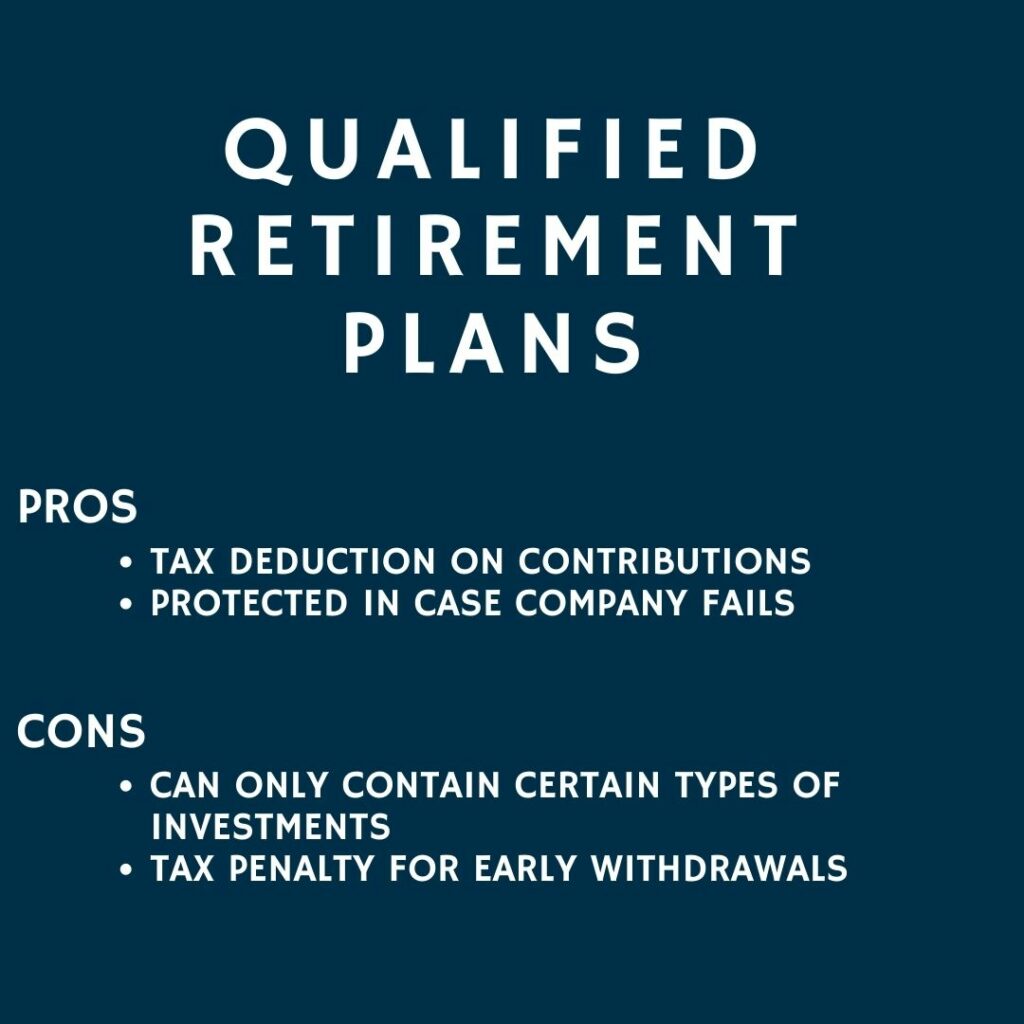

Qualified retirement plans, such as the TSP:

- Allow participants to receive tax benefits for participating. (i.e. tax deferred contributions)

- Allow for an employer match on contributions.

- Provides protections on your contributions.

- Limits the types of investments available within the account.

I know this list seems pretty boring because we have lots of experience with qualified retirement plans like 401(k)’s in the US.

However, if you worked for a small company that offered you a non-qualified retirement plan, they may want the flexibility to give you more money or some sort of equity in the company that you cannot easily sell. In those cases, you’d need to pay taxes on these benefits. Furthermore, non-qualified plans are not protected in the case of a company bankruptcy.

Again- these aren’t a big deal for the TSP, since we’d have much bigger problems than our TSP if the entire US Government went bankrupt.

How do qualified retirement plans affect taxes?

The IRS makes the rules about what is and what is not a qualified retirement plan. They made all of these special definitions so they can define the tax consequences of participation in the plan.

Since the TSP is a qualified retirement plan, it enjoys the benefits of a qualified retirement plan.

The biggest benefits are:

- You do not need to pay taxes on contributions (tax deferred) to the TSP

- You do not pay capital gains taxes on the growth of your TSP funds.

Qualified retirement plans also affect your taxes outside of your work.

If your work offers a qualified retirement plan (like the TSP or FERS), you have lower income limits if you want to make tax-deferred contributions to an IRA. In 2022, if you have a qualified retirement plan, you can only make tax-deferred contributions if your Modified AGI is less than $68,000 per year (in 2022, for single people). In contrast if you’re single and not covered by a qualified retirement plan, you have no income limit for tax deferred contributions to your IRA. Check out the IRS website for how qualified retirement plans affect your IRA contribution limits.

The TSP is a qualified retirement plan

Hopefully you now better understand that the Thrift Savings Plan, or TSP is a qualified retirement plan. If you have other questions about the TSP, feel free to post them in my Facebook Community.