Let me tell you a secret.

The I fund doesn’t invest in what you think it does.

For over a decade I held the I Fund as part of my TSP portfolio to get “international exposure” in my TSP.

And yet I was always disappointed in the results.

It turns out that although the “I” in the I Fund stands for “International” the I Fund does not invest in some of the most important international markets.

If you have some I Fund in your portfolio, (or invest in a Lifecycle Fund), read on to find out if you should reconsider your portfolio allocations.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- Overview of the Thrift Savings Plan (TSP)

- What index does the TSP I fund follow?

- How does the I Fund work?

- How do I invest in the I fund?

- Is the I Fund really international?

- What are the historical returns for the TSP I Fund?

- Does the I Fund really give you diversification?

- Is the I Fund a good TSP investment?

- Summary: The I Fund is neither international nor a mutual fund.

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

Overview of the Thrift Savings Plan (TSP)

Federal employees can invest in the Thrift Savings Plan (or TSP) as part of their retirement savings. Both civilian employees and uniformed services members can contribute to the TSP.

Functionally, the TSP operates nearly identically to a 401(k). Federal workers can contribute a maximum of $20,500 to their TSP (in 2022). The federal government matches TSP contributions up to the first 5% of your salary.

You can make pretax contributions in a traditional TSP. Conversely, you could choose to make after tax contributions to a Roth TSP. When you withdraw money from the TSP, you will pay taxes only on the money withdrawn from the traditional TSP.

If you are trying to decide which type of TSP to fund, I created an ultimate guide comparing a Roth TSP vs. a traditional TSP. In summary, it depends on:

- your current tax bracket,

- what you estimate your tax bracket will be in retirement,

- whether or not you believe Congress will increase taxes on retirees in the future.

Understanding the 5 TSP funds

Unlike most 401(k) plans that offer an array of mutual funds, the TSP has only 5 individual funds: two bond index funds and the remainder are broad market stock funds. TSP investors can choose between these 5 core funds and lifecycle funds comprised of these individual TSP funds.

- The G Fund (Government Securities Investment Fund)

- The C Fund (Common Stock Index Investment Fund)

- The I Fund (International Stock Index Investment Fund)

- The F Fund (Fixed Income Index Investment Fund)

- The S Fund (Small Cap Stock Index investment fund)

One interesting fact is that these funds are not mutual funds but instead trust funds that are regulated by the Office of the Comptroller of the Currency. That is why you cannot look up their ticker symbol but instead can only get share price information from the TSP website.

In the remainder of this article, I take a closer look at the I Fund and discuss its performance.

What index does the TSP I fund follow?

The I Fund of the TSP follows the MSCI EAFE Index. EAFE stands for “Europe, Australasia, and Far East”.

According to the TSP, “Investment in the I Fund offers the opportunity to experience gains from equity ownership of non-U.S. companies.”

While many financial advisors recommend that investors have international exposure in their portfolio, it is important whether the international exposure in the I fund diversifies TSP holdings.

How does the I Fund work?

The I Fund invests in “large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East”. Their holdings are limited to large companies in 15 countries in Western Europe, Israel, Japan, Hong Kong, Singapore, Australia, and New Zealand.

The largest holdings in the I Fund include multinational companies you’ve heard of such as:

- Toyota

- Nestle

- LVMH (Moët Hennessy Louis Vuitton)

- AstraZeneca

- Sony

The EAFE Index which the I Fund follows is comprised mainly of multinational corporations based in Europe and Japan.

However, these multinational companies have analogs within the C Fund.

- Sony competes with Apple and Microsoft.

- AstraZeneca competes with Pfizer and Bristol-Myers Squibb

- Nestle competes with General Mills and Kellogg

And so on.

How do I invest in the I fund?

You can invest in the I fund through logging on to the TSP website. You can choose to invest a portion of your future contributions (contribution allocations). Or you can rebalance your current portfolio by selecting an “interfund transfer”.

Do the TSP Lifecycle funds invest in the I fund?

Yes. All TSP lifecycle funds contain some amount of the I fund. The earlier the “target date” of the lifecycle fund, the less I fund and other stock funds it will have.

Is the I Fund really international?

The I Fund is “international” in the fact that it does not invest in companies based in the United States. However, you should consider these three important facts about the I fund.

1. The I Fund only invests in “developed markets”

If you want to add the I Fund to add diversification to your portfolio, you may wish to rethink this decision.

Since the I Fund only invests in developed markets, the investment is concentrated in large multinational corporations. The stocks within the I Fund have analogs within the S&P 500 index, which exist in the C Fund.

The rate of return of these stocks is highly correlated with their US competitors.

2. The I Fund does not have any exposure to South American or African markets

I am a big believe in index funds. The idea is that you might not be able to pick the winning stock, but we know that by buying the whole market, you can get returns that are greater than 8% per year.

Part of the reason that index funds like VTSAX are successful is because they buy the whole market.

Unlike total market funds, the I Fund excludes most of the world. Sometimes South American economies will be booming and account for most of the international market returns. Other times, they’ll lag behind other countries. But to have fully international exposure, you’d need to be invested in the whole world.

3. The I Fund does not invest in any of the “BRICS” countries

When I first started investing in the TSP, “BRICS” were where all of the hot investments were. BRICS stands for Brazil, Russia, India, China, and South America.

20-year old me wanted to make sure I had some exposure to BRICS, so I invested in the I Fund. (20-year old me never examined what the heck the MSCI EAFE index invested in).

While these companies were roaring in the early 2000s, the BRIC index has not performed well after 2010. However, it still important to know that your I Fund position does not hold any of these emerging economies.

You may remember the political turmoil that ensued when the TSP tried to switch to a broader index. Despite the fact that the federal workforce owns their TSP funds, soundbites make it sound like the US Government is investing in Chinese companies or Chinese securities.

What are the historical returns for the TSP I Fund?

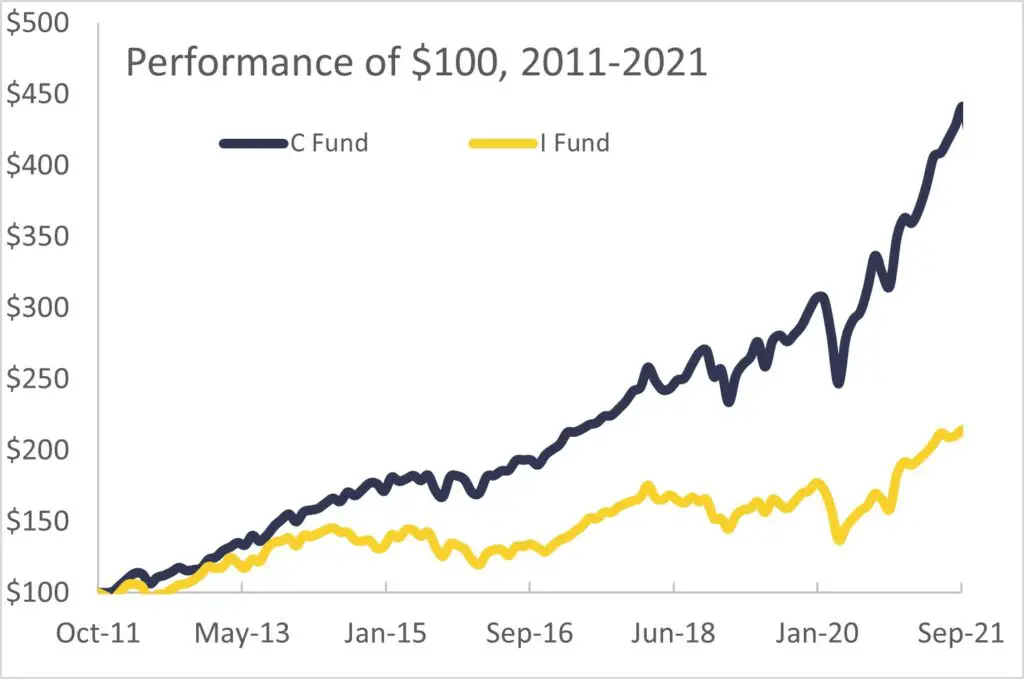

Historical returns for the I fund are aligned with the MSCI EAFE index. Over the past 10 years, the I Fund performed much worse than the C Fund. The I Fund had an average annualized return of 7.9%. In contrast, the C Fund returned 16.24% per year over the same time.

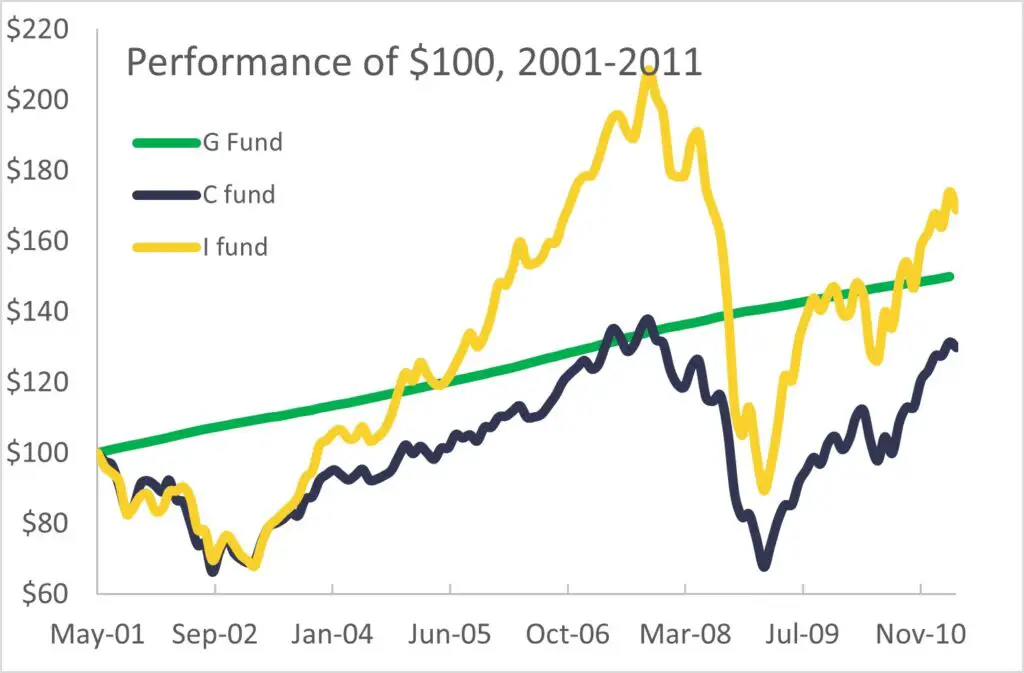

However, from 2001-2011, the I Fund outperformed the C Fund. (This was back when I wanted to invest more in BRICS countries.)

The charts show that the 2000’s were a tough decade for stock returns. Both the C and I Funds exhibit crashes in 2001-2002 (dot-com bubble) and in 2008 (US housing crisis). During that decade, the bond funds outperformed the C Fund. (I included the G Fund performance which invests in U.S. Treasury bonds).

(Note- these graphs assume no more money was added during the time period. If you were investing throughout the 2000’s your returns would be higher. In that case, you would have bought some stocks during the crashes, which would have given you very large returns.)

Does the I Fund really give you diversification?

To understand whether or not the I Fund gives you diversification, we need to understand I Fund returns.

- Most of the return on the I Fund comes from the performance of the companies. If they make money, their share price will increase and they will pay dividends.

- The company returns need to get converted from the local currency into US Dollars. The strength of the dollar relative to these foreign companies affects your returns (priced in US dollars). This is called “currency risk”.

We’ve already shown that the companies in the I Fund are similar to the companies in the C Fund. Adding the I fund to your portfolio does not greatly diversify your holdings.

This is even more clear by examining the graphs that compare the C and I Funds.

Both funds move in the same direction each month on the graph. The only differences are the magnitude of the gain or loss.

I am not sure whether the currency diversification gives you additional diversification in your portfolio. While C Fund companies are based in US dollars, they sell in markets all over the world and their returns are affected by the strength of the dollar in the markets in which they sell.

Personally, I do not believe that the I fund adds diversification to your portfolio. But I’m not alone. JL Collins has written extensively about how much of the returns of the S&P 500 are based on sales throughout the world and even Jack Bogle, founder of Vanguard does not believe you need to add an international fund to get diversification.

Is the I Fund a good TSP investment?

Personally, I do not hold the I Fund. Since the TSP only holds index funds, you should build your portfolio based upon risk and diversification.

Because of the index it follows, the I Fund does not give you much international diversification beyond the international exposure that is already in the C fund.

As a result, I personally do not think the I Fund is a good investment for many TSP participants.

Disclaimer- I’m not a financial advisor, and I’m certainly not *your* financial advisor. Please consider speaking with a financial adviser/counselor/CPA/other credentialed advisor before making a decision about asset allocation.

Get Gov Worker’s top 4 tips for federal employees!Summary: The I Fund is neither international nor a mutual fund.

In the parlance of Linda Richman, the I Fund is neither international, nor is it a mutual fund.

Hopefully after reading this post you can “talk amongst yourselves” with this detailed knowledge of how one of the most confusing funds in the TSP works.

Whether or not you include the I Fund in your investment plan is a personal decision. However, hopefully you now understand which international stock markets it follows and how it might affect your investment options.