My daughter brought up an exciting concept the other day. She asked me “What do you call an alligator wearing a vest?”, and then immediately answered herself, amidst a spate of uncontrollable giggles: “An in-vest-i-gator!!!”.

And suddenly my mind jumped to TSP vesting (as a finance blogger’s mind does).

What is vesting, you ask? Well – it has nothing to do with fleece, tweed, or synthetic down, that’s for sure.

A better line of questioning might be – Are you vested in your TSP balance? Do you NEED to be? How would you even know?

Most of us are fully vested in our TSP accounts after 3 years of eligible service. Some of us are vested after 2 years. Some funds don’t have any vesting period!

Does this sound confusing? Don’t worry, my in-vest-i-gation into TSP vesting answers all of these questions!

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- TSP Basics

- Who is Eligible for the TSP?

- How do regular employee contributions and agency contributions work for the TSP?

- TSP vesting requirements

- Care when making matching contributions

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

TSP Basics

The TSP, or Thrift Savings Plan, is comparable to a private-sector tax-deferred 401k or similar eligible retirement savings plans. In addition to Social Security, the TSP is part of federal employees’ retirement benefits save money for their years post-employment. Each year, you can contribute money up to the elective deferral limit into any combination of Traditional or Roth investments within this employer-sponsored retirement plan.

Who is Eligible for the TSP?

If you are a federal employee covered by FERS, CSRS, or CSRS Offset, then you can participate in the TSP. However, unlike FERS employees participating in the TSP, CSRS employees won’t receive any government contributions. That doesn’t mean that CSRS shouldn’t participate in the TSP. Even without the match you can minimize your taxes by maxing out your TSP.

How do regular employee contributions and agency contributions work for the TSP?

They say the only guarantees in life are death and taxes. Well, I don’t know who “they” are, but I say this – For FERS employees, there’s another sure thing – a 1% Agency automatic contribution to their traditional TSP funds. Regardless of whether you contribute a dime to your TSP fund balances, Uncle Sam is going to give you this money.

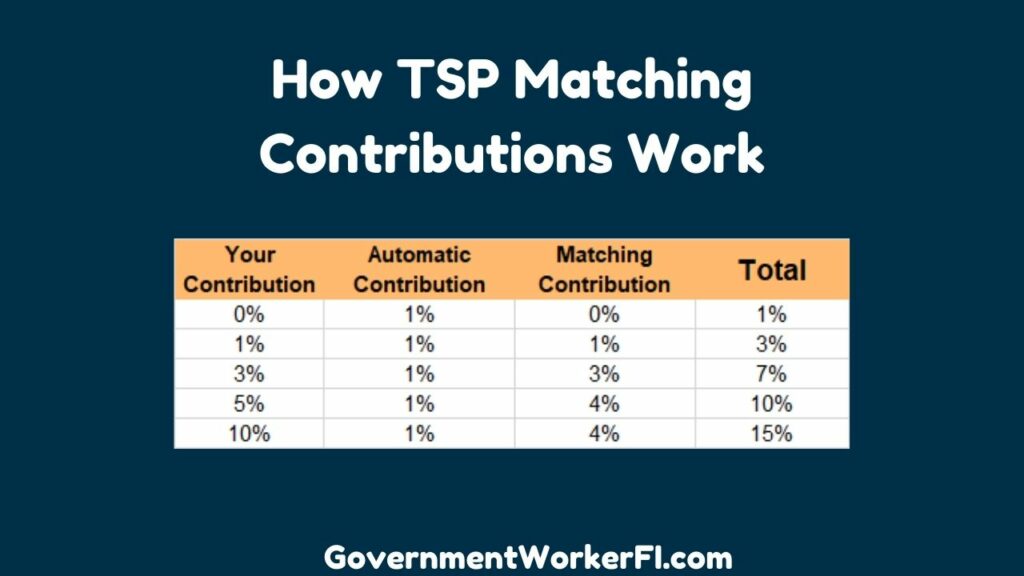

Additionally, the federal government will match a portion of your own employee contributions. For the first 3% of your basic pay that you elect to invest in your TSP as part of your contribution plan, the Federal Government will give you a dollar for dollar matching amount into your traditional balance.

Above that, if you increase your regular employee contribution further, you’ll receive a half-percent in additional matching contributions for up to the next 2 percent of your basic pay. In other words, there will be government matching contributions of re will be government matching contributions of 50 cents for each additional dollar, up to a total match of 4% of your basic pay.

Here’s an example: Suppose you want to maximize your opportunity for future withdrawals as painlessly as possible. You choose an investment plan that allocates 5% of your basic pay into the TSP. This qualifies for the full agency match (of 4%). Next, add on that lovely agency automatic 1%.

That combines to a total investment that’s equivalent to 10% of your basic pay, put to work for potential investment earnings. And remember – you receive half of it simply as a benefit of your employment; It’s not coming out of your regular income at all. Also of note: the government contributions don’t count towards your IRS annual limit.

It might sound complicated, but it’s not. It looks like this:

Next, If you haven’t already, check the level of your contribution through your payroll. I like to contribute at least 5% of my salary to be invested into TSP investment funds, regardless of whether they are Roth or Traditional. This allows me to capture the full Agency Matching Contributions that FERS or BRS participants are eligible for.

Finally, be aware that the agency’s contributions will always go into your traditional balance – Uncle Sam only contributes pre-tax money.

TSP vesting requirements

Alright, for those of us who only associate vesting with wearing an armless garment on our torsos, I pulled up the Merriam-Webster.com definition as it might relate to our defined-contribution retirement plan (aka the TSP): “the conveying to an employee of inalienable rights to money contributed by an employer to a pension fund or retirement plan especially in the event of termination of employment prior to the normal retirement age.”

In lay-people’s terms – Once you are vested in your agency contributions, that money is yours to take with you upon leaving federal service.

Now that you know what vesting is – how do you know if you’re vested? An easy method is to pull up a copy of one of your TSP statements – easily accessible by logging in to your account – and look for the vesting date in the colored box on the front page of the statement. Has that date passed? If so, then you’re vested. It’s that simple.

Automatic TSP contributions – vesting requirements

As I mentioned earlier, eligible participants in the Thrift Savings Plan will receive an automatic 1% contribution from the United States, every pay period, just for being in civilian service. This isn’t money that comes out of your basic pay – some people consider it “free money”, invested pre-tax into the traditional TSP account. The investment will follow the fund allocation you have set up for your own contributions. (And if you didn’t set anything up it will be invested in either the G Fund or a Lifecycle fund depending on when you started working for the government.)

Most FERS employees will be “vested” in this money and its earnings after completing 3 years of eligible service. Some positions, including FERS employees in congressional and non-career positions, as well as participants in the Blended Retirement System (BRS), are vested after just 2 years of service.

Matching TSP contribution vesting requirements

There are no vesting requirements for matching contributions.

In other words, if you’re contributing at least 5% of your pay into the TSP and you leave the government before the vesting period, at least 90% of your funds are vested and you can take them with you when you leave. (5%= your money, 4%= not subject to vesting, 1%= at most 3 year vesting period).

And if you are not contributing at least 5% of your pay to the TSP… … … you are missing out on FREE MONEY.

The fact that there are no vesting requirements on the matching funds means that there is really no reason for you not to participate in the TSP.

If you quit tomorrow, all of the agency matching contributions are already yours. The earnings those matching contributions have made, plus any future earnings, are also yours.

Care when making matching contributions

Additionally, there’s one thing to keep in mind as you plot your TSP investment strategy for the year.

The TSP matches your contributions each pay-period, not each year. Therefore, if you stop contributions for any pay period, you won’t be able to get 5% of your annual salary matched.

Therefore, you definitely don’t want to max out your TSP early in the year and then stop your contributions.

Consider planning ahead to ensure you get that full match for each pay period throughout the entire year.