Are you a federal employee or military member that want to know which TSP fund is bonds?

Both the F Fund and the G Fund invest in bonds. However, these funds are quite different! In the remainder of this post I’m going to walk you through what you need to know about these bond funds.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is the Thrift Savings Plan (TSP)?

- Which TSP Fund is Bonds?

- Understanding the Differences Between the TSP F Fund and the TSP G Fund

- What are the Risks in the TSP G Fund

- What are the Risks in the TSP F Fund

- Which TSP Bond Fund is Best? The F Fund or the G Fund?

- Summary: Both the F Fund and G Fund Give You Bond Exposure In Your TSP

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is the Thrift Savings Plan (TSP)?

The TSP is a qualified retirement plan for federal employees and members of the Uniformed Services who have taken the oath of office. Founded in 1986 through the Federal Employees’ Retirement System Act (FERS), the TSP operates in a similar manner to a 401(k) for government employees.

Federal employees can contribute up to the 401(k) maximum ($22,500 in 2023, not including catchup contributions). They even receive matching contributions up to 5% of their salary; most of it with no vesting period (free money).

Currently, employees can choose between one of 5 index funds with no added fees:

- G Fund– (short term government bonds, guaranteed to increase in value)

- F Fund– (medium term government and corporate bonds, similar to BND)

- C Fund– (a stock index fund that tracks the S&P 500 index)

- S Fund– (small and medium cap stocks)

- I Fund– (international stocks, limited to certain countries that excludes emerging markets)

Which TSP Fund is Bonds?

As you can see from the previous paragraph, there are 2 bond index funds in the TSP: The F fund and the G Fund.

The F Fund is short for the “Fixed Income Index Investment Fund” and it aims to match the performance of the Bloomberg U.S. Aggregate Bond Index.

The G Fund is short for “Government Securities Investment Fund” and the TSP states the investment objective is to “ensure preservation of capital and generate returns above those of short-term U.S. Treasury securities.”

Confused? Let’s jump into some more in-depth analysis.

Understanding the Differences Between the TSP F Fund and the TSP G Fund

What the F Fund Invests in

The F Fund is an index fund that tracks the Bloomberg U.S. Aggregate Bond Index. There are a lot of private sector funds that track this same index, such as the Vanguard Total Bond Index Fund (VBTLX) or the aptly named exchange-traded fund (ETF) with ticker symbol BND. The index contains nearly 12,000 notes and bonds including U.S. Treasury notes and other fixed income investments. Currently, the federal retirement thrift investment board (FRTIB) reports that the index contains roughly 40% government bonds, 30% securitized bonds, and 30% credit instruments. In other words, it’s about 40% government bonds and 60% private sector debt.

What the G Fund Invests in

The G Fund is unlike any other mutual fund because it invests in non-marketable securities (I.e. bonds specially issued to the TSP). In fact, the FRTIB is vague about what the G Fund actually invests in, but instead states

- (The TSP G Fund) “Earn(s) a statutory interest rate equal to the average market yield on outstanding marketable U.S. Treasury securities with 4 or more years to maturity”

- “G Fund rate is calculated by the U.S. Treasury as the weighted average yield of approximately 153 U.S. Treasury securities on the last day of the previous month”

- “The Treasury securities used in the G Fund rate calculation have a weighted average maturity of approximately 12 years.”

Basically, the government guarantees you a return rate if you choose to invest in the G Fund. Since the government is the government, their guarantees are pretty good. The advantage for investors is that you get a guaranteed rate of return that is much higher than you could get in a comparable money market fund.

What are the Risks in the TSP G Fund

While the TSP G Fund is billed as a “risk free” investment, there are always risks.

Like all investments, the G Fund is subject to inflation risk. That is, the G Fund interest rate is less than inflation. So even while you are earning a positive interest rate in nominal dollars, there is a risk that you’d have less purchasing power.

What are the Risks in the TSP F Fund

There are two types of risks with an F Fund Investment.

Similar to the TSP G Fund, F Fund investors are subject to inflation risk. The F Fund returns may not offset the reduction in purchasing power caused by inflation.

However, the performance of the Bloomberg U.S. Aggregate Bond Index also depends upon interest rate risk.

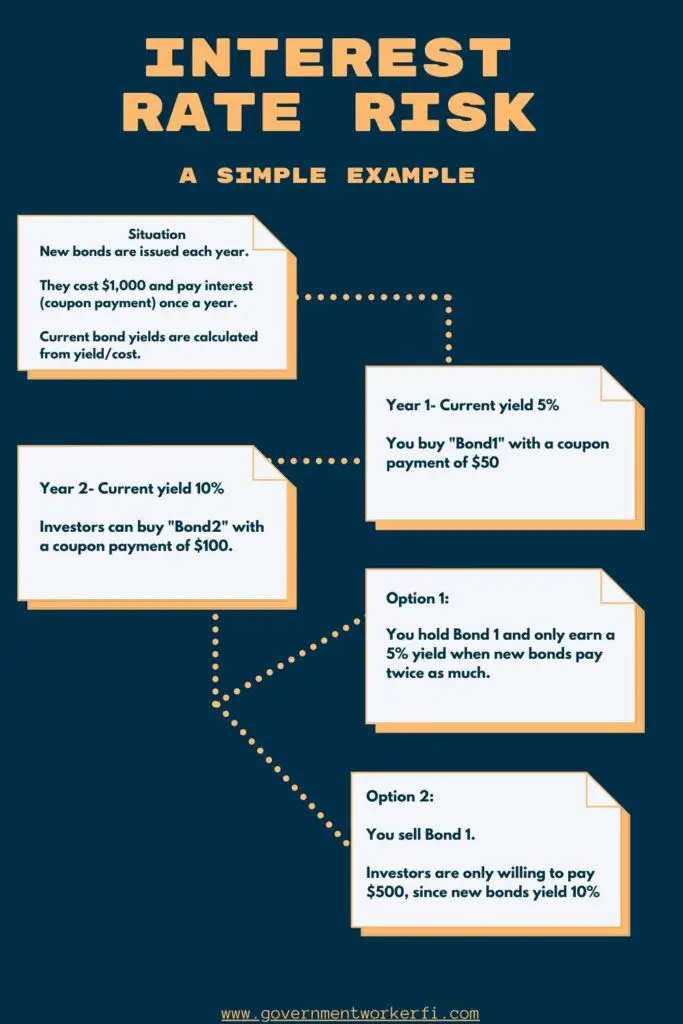

Interest rate risk

When the prevailing interest rates fall, bond prices go up. The bonds are more valuable because new bonds pay less interest. In contrast, as interest rates rise, bond prices fall. This is called interest rate risk. I tried to give a simple example in the diagram below.

Risk vs. Returns for the F Fund

When you use the F Fund, you can lose money when the Federal Reserve raises interest rates because of interest rate risk. On the other hand, when the Fed slashes interest rates, the opposite happens and the bond market experiences growth. While the F Fund provides more risk than the guaranteed interest rate paid by the G Fund, there is also a higher potential for returns.

Which TSP Bond Fund is Best? The F Fund or the G Fund?

If you’ve read my post about Best TSP Allocations, you’ll know that I will tell you that there is no one best fund for your portfolio! What’s best for you, as an individual investor depends upon your age, your level of wealth, how much of your spending your FERS pension will provide in your retirement, etc.

So while I can’t tell you which fund is best for you, I can do a broad comparison.

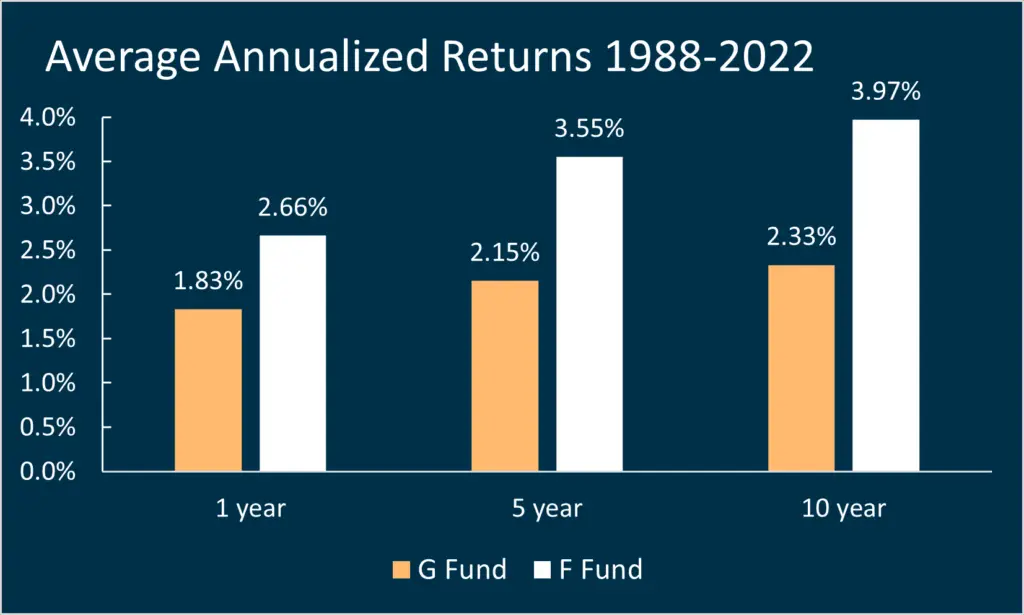

Historical Returns

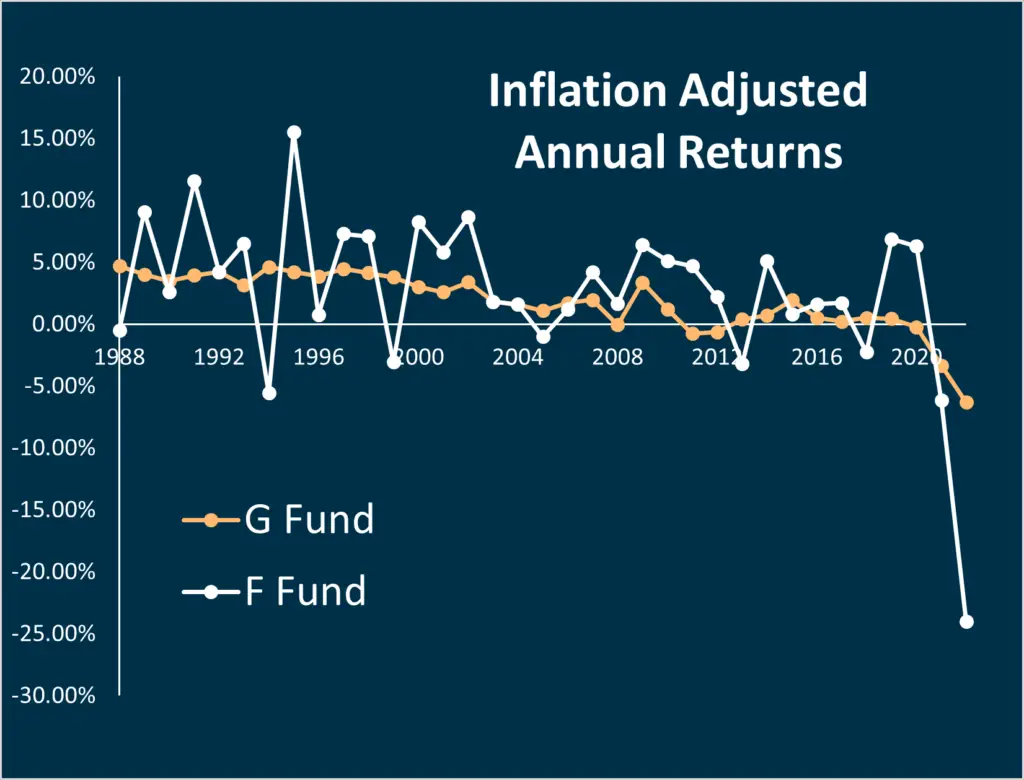

If you look at the average inflation adjusted returns, you can see that the F Fund outperforms the G Fund, over every 1, 5, and 10 year window. The average annual return for the G Fund (inflation adjusted) is 1.8% compared to 2.6% in the F Fund.

However, if you were only looking at investment returns, you’d be much better off choosing stock funds like the C Fund. People add bonds to their portfolio to balance risk from stock market fluctuations. When choosing between these two funds, you should consider not just the returns but also the risk as well.

Risk Tolerance

The G Fund’s investment objective is to provide a guaranteed positive return. While it may not keep up with inflation, it will always yield a positive return. This is not the case for the F Fund. In 2022, the F Fund had a return of -12.83%. When you consider inflation, the real return on your investment was closer to -20% in 2022.

If you’re a retiree living off the retirement savings in your TSP account, can you afford to experience a 20% loss in purchasing power in your “safe” bond market index funds? It’s definitely something to think about and/or discuss with your financial advisor.

Summary: Both the F Fund and G Fund Give You Bond Exposure In Your TSP

Hopefully by now you know which TSP fund is bonds. (There’s actually two of them, the F Fund and G Fund). If you learned something in this article and want to learn more you can check out my YouTube channel. You can also talk with like-minded individuals in my Facebook Community.