2022 was a bad year for the TSP F Fund. In fact, according to my analysis, it was the worst year The F Fund ever had since its inception, losing over 24% of its value in inflation adjusted returns.

Aren’t bonds supposed to be “safe”?

If you’re wondering “Why is the TSP F Fund losing money?” then you’ve come to the write place. I’ve tried to break this down into simple terms and explain what bonds are and why their value goes up and down.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is the Thrift Savings Plan (TSP)?

- What is a bond?

- What does the Federal Reserve have to do with the bond market?

- What happens to the TSP F fund when interest rates rise?

- What makes the TSP F Fund go up?

- What makes the TSP F Fund go down?

- Why doesn’t the TSP G Fund go down when interest rates rise?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is the Thrift Savings Plan (TSP)?

The TSP is a qualified retirement plan for federal employees and members of the Uniformed Services who have taken the oath of office. Founded in 1986 through the Federal Employees’ Retirement System Act (FERS), the TSP operates in a similar manner to a 401(k) for government employees.

Federal employees can contribute up to the 401(k) maximum. They even receive matching contributions up to 5% of their salary; most of it with no vesting period (free money).

Currently, employees can choose between one of 5 index funds (or Lifecycle funds comprised of these 5 core funds) with no added fees:

- G Fund– (short term government bonds, guaranteed to increase in value)

- F Fund– (medium term government and corporate bonds, follows the performance of the Bloomberg U.S. Aggregate Bond Index )

- C Fund– (a stock index fund that tracks the S&P 500 index)

- S Fund– (small and medium cap stocks)

- I Fund– (international stocks, limited to certain countries that excludes emerging markets)

What is a bond?

In simple terms, a bond is where you loan a company (or government) some money and they agree to pay you back. It’s kind of like when a bank gives you a loan to buy a house (i.e. a mortgage). However, a bond is different from a mortgage because it’s a tradeable security. That means it’s very easy to buy and sell these loans to other investors.

When a company issues a bond, you can buy the bond at it’s “par value”. It then agrees to make “coupon payments” for the life of the bond. At the end of the bond term you get your principal back.

For example, if you buy a 30 year treasury bill, with an annual coupon rate of 4% and a par value of $1,000, you would:

- Give the government $1,000 today

- The government will pay you $1,000 30 years from now

- The government will pay you $40 per year for 30 years

The TSP has two choices for bond funds, the G Fund and the F Fund. However there is a key difference between these TSP Funds. The G Fund invests in “non-marketable government securities”. For reasons we will get into later,

What does the Federal Reserve have to do with the bond market?

Despite what you might hear on the news, the Federal Reserve does not directly set interest rates on loans or bonds you buy. Instead, when the Fed announces an interest rate change, they are changing the Federal Funds Rate.

The Federal Funds Rate is a rate at which banks can borrow money overnight from the Federal Reserve. This rate indirectly affects the bond market because changes in the federal funds rate can impact the yields on bonds and affect the price of the TSP F Fund.

Think of it this way, the federal funds rate is guaranteed amount of interest that banks can get with no risk. If you’re a bank, you can choose between getting a guaranteed amount of money at the federal funds rate, or loaning it to your crazy uncle Jimmy so he can buy a pickup truck. Since the bank knows that there’s a chance Jimmy won’t be able to make all of his payments, they need to charge him more than the federal funds rate. They need a higher rate of return to take on all that risk. When the Fed raises their rate for risk-free loans, loans to risky people need to go up too.

And while this example was about banks and their loans, we’ve covered that bonds are a type of loan for big companies. Instead of a bank however, F Fund investors are the ones loaning out the money and getting the returns.

What happens to the TSP F fund when interest rates rise?

You would think that when the Federal Reserve raises interest rates, F fund investors would be happy. Right?

Because in that case when a company issues a new bond, they’d need to have a higher coupon rate to attract investors to buy the bond.

However, when interest rates rise, the value of existing fixed-income securities, namely everything in the aggregate bond index, tends to fall because newly issued bonds offer higher yields than existing bonds. In other words, why hold a bond that pays you $20 a month, when you could buy a brand shiny new bond that pays you $25 a month.

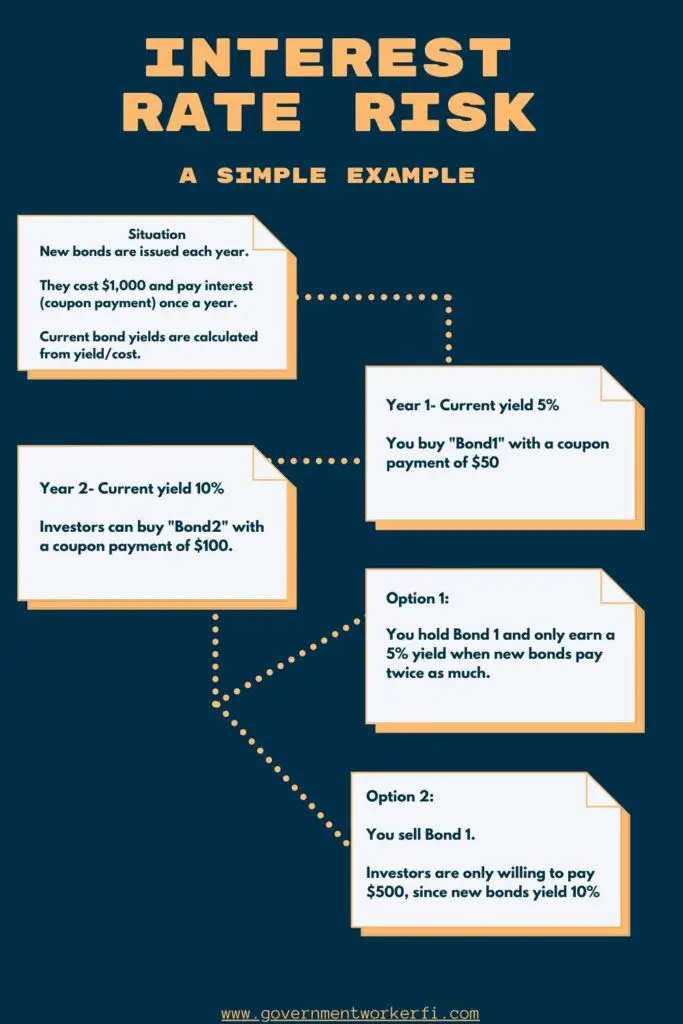

This phenomena is called interest rate risk (check out this illustration).

So in other words, if the Fed raises interest rates tomorrow, the F Fund would likely fall.

Now before you go and try to time the market, while interest rate environment directly affects the value of bond index funds, the movement isn’t 100% correlated with rate increases. Savvy investors on Wall Street also know that bond prices move in response to the Federal Reserve. So they try to trade bonds in response to what they think the Fed will do and can cause fluctuations in the price of broad index bond funds outside of actual interest rate moves.

What makes the TSP F Fund go up?

The TSP F fund can go up due to several factors, namely:

- Falling interest rates: This is the opposite side of interest rate risk. If interest rates fall, the value of the bonds that comprise the index increase because they pay more than new bonds.

- Coupon (interest) payments: The TSP F Fund earns income from the coupon payments on the bonds the fund holds. As the fund receives these payments, the value of the F Fund investment can increase.

It’s important to remember that the TSP F fund is designed to allow TSP participants to diversify their portfolio from stock funds like the C Fund. While the C and S Funds are strongly correlated, the F Fund responds to different market forces and can help make your total TSP account less volatile.

What makes the TSP F Fund go down?

The TSP F fund can go down due to several factors, namely:

- Rising interest rates: If interest rates rise, the value of existing fixed-income securities generally decreases.

- Investor sentiment: If Wall Street thinks bonds are currently a bad investment, they may move money out of bonds, which would cause bond prices to fall.

Why doesn’t the TSP G Fund go down when interest rates rise?

If you’ve made it this far, you’ll know that bond prices fall when interest rates rise. So how come the G Fund never goes down?

Remember when I said that the G Fund invests in “non-marketable securities”? That means that no one can buy or sell the G Fund bonds. Since these bonds don’t exist outside the fund, the G Fund price is only dependent on coupon payments that get reinvested into the fund.

Summary: Why 2022 was so bad for the F Fund

2022 saw the F Fund’s worst performance ever. The Fed had to rise interest rates suddenly and unexpectedly causing bond prices to plummet. Hopefully, you now understand how such an aggressive move from the Fed could cause so much damage to F Fund investors. Hopefully, we’ll return to a period of relatively low inflation and stable bond market returns.

If you want to know even more about the F Fund, I created this YouTube video that walks you through its performance over the last 10 years.