Is there anything Americans love more than avoiding taxes?

Who hasn’t heard someone tell a story about how they’re cheating the IRS out of thousands of dollars through some scheme they cooked up.

While your crazy uncle might eventually go to jail for his tax avoidance strategy that is actually tax fraud, did you know there are tons of legal ways to avoid paying taxes… especially when it comes to retirement accounts like your TSP.

If you want to get the most out of your federal employee benefits you’re going to want to understand types of withdrawals and how TSP payments will be taxed before you reach retirement. Let’s take a look below.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is the Thrift Savings Plan (TSP)?

- Do you pay taxes on TSP withdrawal?

- How to minimize taxes on your TSP withdrawals?

- How much tax on early TSP withdrawal?

- What states tax TSP withdrawals?

- What Taxes Apply To Your TSP?

- Does TSP withhold taxes from the taxable portion of my withdrawal?

- What is the best way to withdraw money from TSP?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is the Thrift Savings Plan (TSP)?

The TSP is a qualified retirement plan for federal employees and members of the Uniformed Services who have taken the oath of office. Founded in 1986 through the Federal Employees’ Retirement System Act (FERS), the TSP operates in a similar manner to a 401(k) for government employees.

Federal employees can contribute up to the 401(k) maximum ($22,500 in 2023, not including catchup contributions). They even receive matching contributions up to 5% of their salary; most of it with no vesting period (free money).

Currently, employees can choose between one of 5 index funds with no added fees:

- G Fund– (short term government bonds, guaranteed to increase in value)

- F Fund– (medium term government and corporate bonds, similar to BND)

- C Fund– (“common stocks” i.e. S&P 500)

- S Fund– (small and medium cap stocks)

- I Fund– (international stocks, limited to certain countries that excludes emerging markets)

Do you pay taxes on TSP withdrawal?

Whether or not a TSP withdrawal counts as taxable income depends upon whether or not your withdrawal comes from a traditional TSP or a Roth TSP. It also depends upon your age and your income level during the withdrawal.

Taxes on withdrawal from traditional TSP

Since you didn’t pay taxes on your traditional TSP contributions during your working years, you’ll have to give the government a chance to tax them in retirement. The same goes for the government match. Traditional TSP withdrawals will always count as taxable income.

Taxes on withdrawal from Roth TSP

If you are over age 59.5 you may withdrawal money from your Roth TSP tax free. This money does not count as taxable income. This is as simple as it gets. However, if you withdrawal money from your TSP before age 59.5 and have both a Roth and traditional balance, you need to be careful.

A special consideration if you are accessing your TSP at age 55 and have a Roth balance

While you can make penalty free withdrawals from the traditional TSP at age 55 if you have met retirement requirements, this does not extend to the Roth portion. Therefore, you need to be extremely careful with withdrawing money from the TSP before age 59.5 to avoid a nasty tax surprise.

When you request money from the TSP, they default TSP assumption is to draw money Roth and traditional balances in proportion to the account balances. Therefore, if you just hit your MRA and request a withdrawal from your TSP without specifying more details, you will owe taxes and a 10% early withdrawal penalty on the Roth earnings that they send you.

Still confused? The TSP Book 26 has a detailed example about a poor woman named Rachel who paid a ton of tax on a Roth TSP withdrawal.

How to minimize taxes on your TSP withdrawals?

I strongly recommend working with a CPA to help you structure your retirement savings. Once you reach retirement age, you don’t necessarily have a lot of options. If all of your money is in a traditional TSP at retirement you have a tight window to make Roth conversions and/or withdraw your savings in a tax efficient manner.

As a FERS employee, you’ll have to worry about taxes on your FERS pension, TSP distributions, and social security. Your provisional income in retirement will affect how much of your social security benefits are taxed. While the best way to minimize taxes on TSP withdrawals is to have as much money in Roth accounts as possible there is no free lunch because the Roth contributions were previously taxed. That’s why a CPA or other professional can help you come up with an individualized plan based upon your tax bracket and state income taxes to come up with a savings plan with the most favorable tax treatment. Unfortunately, there’s no one-size-fits-all approach to tax minimization.

How do I avoid paying taxes on my TSP withdrawal?

There are only two ways to avoid paying taxes on your TSP withdrawal:

- Only have money in a Roth TSP. (Note that the government match is always placed into a traditional account)

- Make sure your regular income (including TSP withdrawals) are less than the standard deduction ($13,850 for singles, $27,700 for married people filing jointly).

While it might be hard to completely avoid taxes on your TSP, you can try to structure payments from your tsp account to avoid high marginal tax brackets as many years as possible. While your income needs may be fixed, you could try to withdraw more funds from your tsp in a year you have deductible medical expenses that you itemize or a personal casualty loss.

How much tax on early TSP withdrawal?

The amount of tax the IRS requires you to pay on early TSP withdrawals depend upon whether you’re withdrawing from your Roth or traditional balance. Unfortunately, if you make an early Roth TSP withdrawal the TSP distributes both principal and earnings according to the ratio of the two in your portfolio. While you can withdraw the Roth TSP principal tax free, your Roth earnings will be taxed as ordinary income (same as a traditional TSP) if withdrawn early.

For the early TSP withdrawal subject to tax, your money will be taxed at your ordinary income tax rate plus an early withdrawal penalty tax of 10%.

What states tax TSP withdrawals?

In my post on the best states for federal retirees I coved how different states treat retirement income in depth.

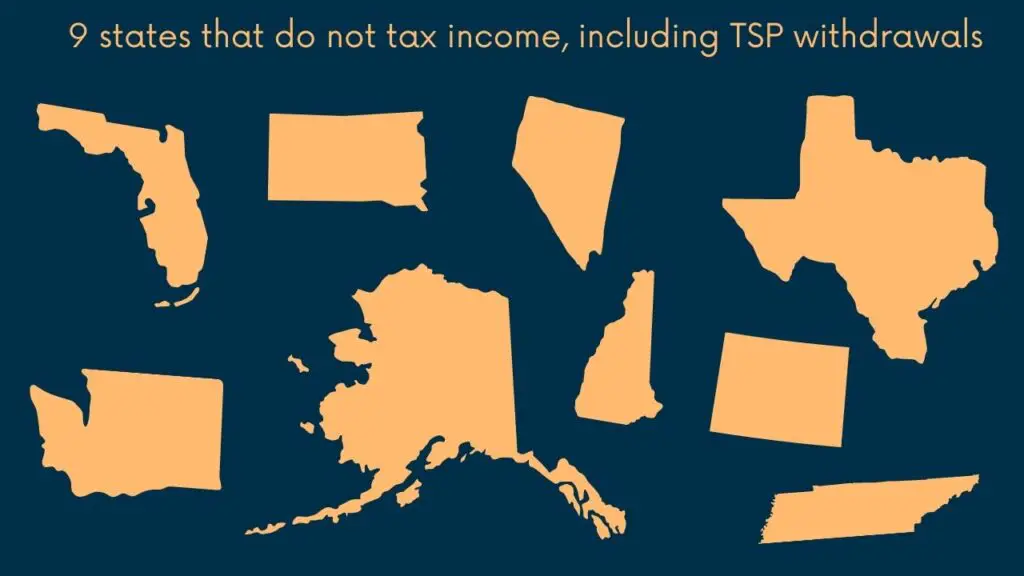

There are 9 states that do not tax income, including TSP withdrawals:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

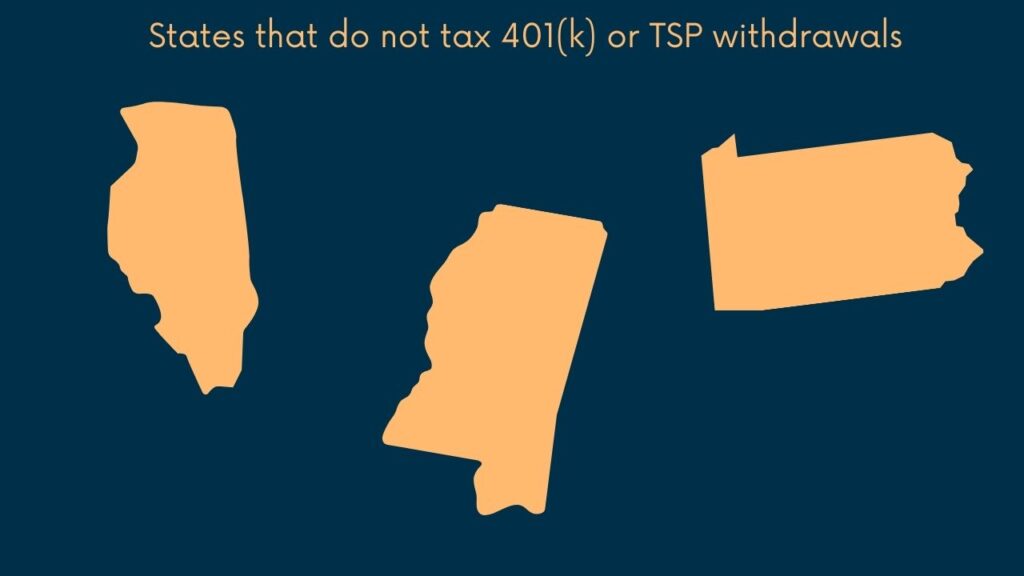

In addition, these states do not tax 401(k) or TSP withdrawals

- Illinois

- Mississippi

- Pennsylvania

In total, nearly a quarter of the states don’t tax TSP withdrawals so there are plenty of options if you are looking to avoid state taxes in retirement.

What Taxes Apply To Your TSP?

Assuming you don’t have early withdrawal penalties, your traditional TSP payments are subject to pay state and local income tax in addition to federal income tax. Roth TSP savings are not subject to tax on withdrawal after age 59.5.

While you still need to pay income taxes on your traditional portion of your TSP, there is still one type of tax that you avoid by saving in the TSP over a brokerage account. You do not pay capital gains taxes when you sell securities in qualified retirement accounts. (Special rules apply to weird securities like master limited partnerships, but that’s not a problem for your TSP because of the plan rules.)

Does TSP withhold taxes from the taxable portion of my withdrawal?

Now that we’ve covered whether or not you have to pay taxes on your TSP, let’s talk about how to pay those taxes. First, it’s important to know that the TSP reports all TSP distributions to the IRS. You’ll also receive a 1099-R form each tax year with the amount withdrawn and the taxes withheld.

In most cases, the TSP is required to withhold 20 percent of the taxable portion of of the withdrawal. Certain types of payments may not be subject to automatic withholding or instead have a 10% automatic tax withholding. Depending on how much other income you receive in retirement, you may need to pay more or less than 20% federal tax on that money. If you want a different amount withheld at the time of payment, you can contact the TSP to adjust withholding. Note: in some cases you can increase federal income tax withholding but you may not decrease it. Please see TSP Book 26 page 16 for a detailed description of tax withholding.

Note that whatever money you withdraw from the TSP will be taxed at your marginal tax rate. If you think about your income as a filling your tax buckets, your social security and FERS pension are your base income. Adding more income from a required minimum distribution or other withdrawal option will be taxed at whatever marginal bracket you are in.

What about state taxes?

The TSP does not withhold state taxes on your withdrawal. However, the TSP does report all withdrawals to your state of residence and you will be required to pay state taxes on the taxable portion of the distribution. You will need to save a portion of your withdrawals to pay state taxes at the end of the year or the end of the quarter.

What is the best way to withdraw money from TSP?

You should work with a CPA or financial advisor to come up with the best TSP withdrawal strategy for you. While you have lots of TSP withdrawal options, you will want to make sure that your strategy minimizes your tax burden over the rest of your life. Your current financial needs, life expectancy, and tax information will determine the best withdrawal choice for you.