What if I told you there was a TSP strategy that would beat 75% of Wall Street’s best investors?

Would you follow it?

Now what if I told you the same TSP strategy that beats Wall Street is incredibly boring. Would you still follow it?

While there are many websites and private groups that coordinate the timing of their interfund transfers to beat the market, choosing an asset allocation and sticking to it can be a winning TSP strategy for nearly anyone.

In this article, I break down why buying and holding the 5 core TSP Funds is a great TSP strategy and how you can make the most of the government match on your TSP.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What’s the TSP all about anyway?

- Is active trading in your TSP a good TSP Strategy?

- TSP Strategy #1: Max it out

- TSP Strategy #2: Never log into the TSP website

- Best TSP Allocations for the buy-and-hold TSP Strategy

- Summary- You don’t need a complicated TSP strategy to build wealth

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What’s the TSP all about anyway?

The TSP is a defined contribution retirement account available to federal employees. The TSP is similar to a 401(k) in that both have the same maximum contribution limits.

However, federal employees can borrow from their TSP and withdraw money earlier than age 59.5 in some cases. Both CSRS and FERS employees can contribute to the TSP. The government will match the first 5% of FERS employees contributions to the TSP and those contributions are vested after 3 years. CSRS employees can contribute their own money to the TSP but it is not matched. The TSP has 5 investment options that follow major indices:

- The C Fund follows the S&P 500 index

- The S Fund follows small and midcap stocks

- The I Fund can be used to add international exposure to your portfolio

- The F Fund tracks the Bloomberg U.S. Aggregate Bond Index

- The G Fund invests in special government securities only available in the TSP and is guaranteed to never lose value.

When the TSP started back in the 1980s it was revolutionary. The TSP limited investments to index funds that tracked major stock and bond markets. The government structured the TSP to have the lowest fees of any defined contribution retirement plan at the time. As an individual investor, all you had to do was select the contribution allocation that best suited your investment objectives and you could build wealth easily, automatically, and without thinking about it.

And the TSP works. There are thousands of federal employees with more than a million dollars in their TSP alone. Despite the stories of TSP millionaires who have used a “buy and hold” strategy, there are numerous employees looking for an active trading strategy (using interfund transfers) to try to make big gains in the TSP.

Is active trading in your TSP a good TSP Strategy?

If you’re reading this article, I’m guessing that you’re looking for an active TSP strategy. Perhaps you’re looking for a stock tip like move your money into the G Fund when there is a full moon and back into the C Fund every new moon.

While I’m sure some people trade stocks based upon moon cycles, most TSP strategies involve executing trades based upon past performance (i.e. the charts). Predicting the future of the stock market based upon past performance is called “technical analysis”.

Doing a full technical analysis of stock prices is complicated and a lot of hard work. There are tons of traders on Wall Street who use technical analysis every day to buy and sell stocks. It’s their job. You can also read lots of success stories about technical analysis on the internet.

So should you use technical analysis to trade in and out of stocks in your TSP? Well, I’m a firm believer in “you do you” but I can’t recommend it for the following reasons.

- If technical analysis worked, no one would lose money in the stock market, ever. Because if they could truly read the “future” of a stock price based on its past performance (the chart), then they could predict when it would go down and sell before they lost money.

- About 75% of mutual funds can’t beat index funds (available to you in your TSP). If the pros can’t beat the market, how can you expect to do so?

- Even Warren Buffett, the best investor of all time, thinks that index funds are how most people should manage their money. (And he won a large bet against a hedge fund manager who thought he could beat index funds.)

If you have a winning TSP strategy that involves active trading, then you clearly don’t needing to be reading internet advice. (You could buy the entire internet with all of the money you made.)

So my guess is that if you’re reading this article, you don’t have Marty McFly’s Delorean and therefore probably shouldn’t be making large bets about future stock prices based upon a hunch or tip from a coworker.

Here’s two TSP strategies that still work even if you don’t know what the stock market will bring next.

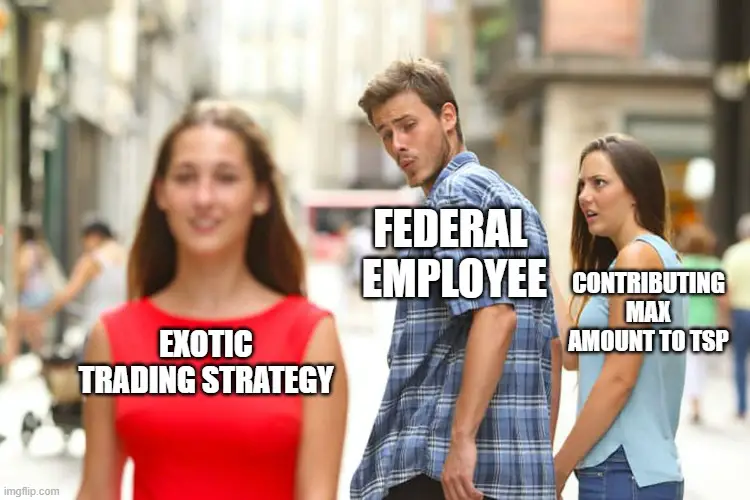

TSP Strategy #1: Max it out

So if active trading is not a winning TSP strategy, how can you end up with the retirement nest egg that you want.

The first trick to “winning” at the TSP is to put as much money as you can into your TSP. The earlier you’re able to max out your TSP the better.

Even if you can’t reach the IRS maximum contribution limits, putting the maximum amount of money you can afford into the TSP is the best way to ensure you’ll have a large TSP balance at retirement.

Why this strategy works

People joke that compound interest is the 8th wonder of the world. But it’s true.

On average, you could expect money put into the S&P 500 (or the TSP C Fund) to double every 7 years. Therefore, if you maxed out your TSP at age 25 when you joined the federal government, that $22,500 would turn into over $485,000 at your minimum retirement age of 57 if you never put another dollar into the TSP. Crazy right?

You just need to do that one thing right to be set for life.

Obviously, not a lot of 25 year olds can save the maximum TSP amount.

How to do it

The max TSP contribution for 2023 is $22,500.

The 5% government match is not included in the $22,500 limit.

If you want to set up your direct deposit to achieve the maximum TSP contribution each year, you should set up an elective deferral of $866 per pay period.

Note that if you are older than age 50, you are allowed to make “catch up” contributions. You are allowed to make an additional $7,500 of catch up contributions for a total of $30,000 per year.

I should note that the IRS “total contribution limit” for the TSP in is $66,000 between the employee contribution ($22,500) and the government match.

However, given the size of government salaries and the employer match (5%) this limit should not affect federal employees.

TSP Strategy #2: Never log into the TSP website

This strategy is a little bit tongue-in-cheek. You should log into the TSP website to occasionally check to make sure your TSP beneficiary is up to date and that your portfolio is balanced according to your overall risk tolerance.

However, you should not log onto the TSP to check how your portfolio is doing every time you hear the words “market crash” on the news. Especially if when you hear that the market is crashing you make an emotional decision to move your money to the G Fund.

Why this works

Historically, the S&P 500 experiences a loss of 10% of it’s value every 19 months!! If you’re pulling money out of the market every time there is a market correction, you are locking in these losses. Furthermore, if you don’t have your money in the market when it bottoms, you will miss out on the biggest market gains. On average, the stock market gains 8% in the first month coming out of the market correction and 24% in the first year.

Unless you’re Nostradamus and can know the exact day of the market peaks and troughs by reading chicken entrails, you’re bound to miss out on these sudden gains coming out of bear markets. Emotional traders are likely to end up locking in losses by selling when the market is down and missing out on gains by being too slow to move money back into the market.

How to do it

This one is easy. Set your ideal TSP allocation and then stick to that plan.

It may also help to write yourself a plan for how you will manage your portfolio over time. If you plan on reducing your exposure to stocks as you approach retirement, make a plan of how much you want to have in bonds at each age.

Choose a frequency at which you will rebalance your investments. And when you do rebalance, make sure you set your current allocation and future contributions to the asset allocation you are targeting. Stick to the plan you developed regardless of how you feel emotionally.

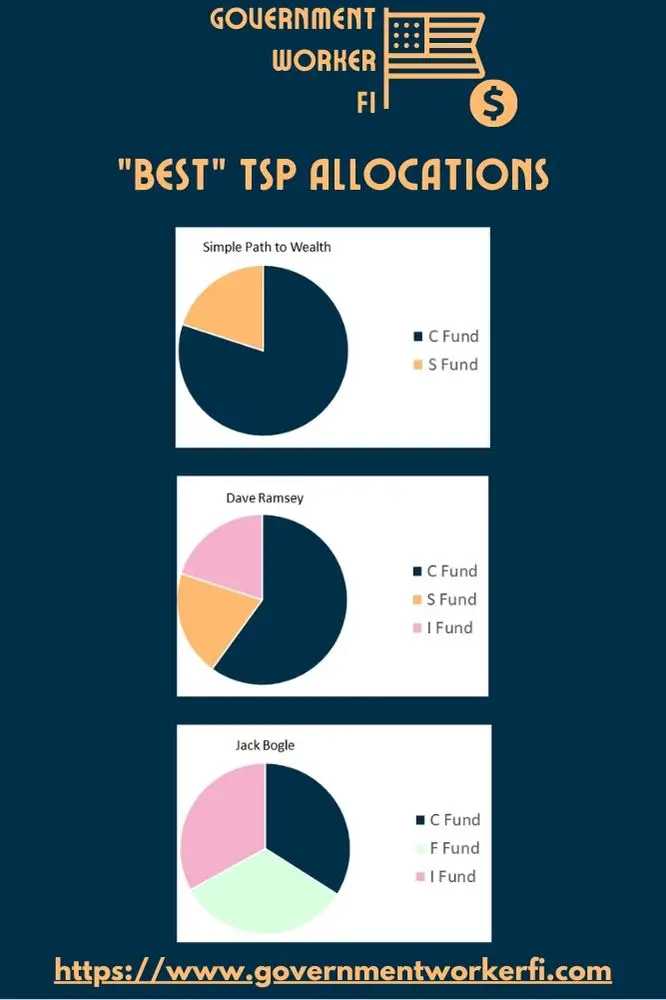

Best TSP Allocations for the buy-and-hold TSP Strategy

Hopefully by now I’ve convinced you that buy-and-hold can be a great strategy for your TSP. If so, then there’s just one question to answer: what’s the best TSP allocation.

While there is no universal, “best” TSP allocation, several famous people have suggested some target TSP allocations. Note that these allocations may work for some people, but your financial situation should determine your personal TSP allocation.

Just a reminder that a blog is not a substitute for meeting with a financial advisor. This blog does not represent financial, legal, or human resources advice.

The Simple Path to Wealth allocation

The Simple Path to Wealth changed my life. The book explains how holding just one fund (VTSAX or an equivalent total stock market fund) can be all you need. If you want to follow the simple path, you can do that by holding 70-80% of your TSP in the C Fund and 20-30% of the S Fund.

Dave Ramsey

Finance guru Dave Ramsey is one of the most recognizable voices in personal finance. While he is mostly known for helping people pay off debt, he also talks about wealth accumulation. He recommends a portfolio with 100% equities but recommends a breakdown of 60% C Fund, 20% S Fund, and 20% I Fund.

Jack Bogle

Jack Bogle invented index funds and started Vanguard. The so called “Bogleheads” who follow Jack Bogle’s investment philosophy believe that you need just three funds in your retirement portfolio: a domestic total stock market fund, and international stock market fund, and a bond fund.

You could build your own 3 fund portfolio with a combination of the C, I, and F funds.

Lifecycle Funds

The TSP Lifecycle Funds are designed specifically for buy-and-hold investors. You just need to select your time horizon and the TSP will automatically adjust your asset allocation over time.

Summary- You don’t need a complicated TSP strategy to build wealth

We all want to be rich. But you don’t need to use a complicated TSP strategy to help you achieve your goals. TSP strategies like contributing as much as you can afford and not moving money when there is a crash can help you build wealth over the long term.