Turning 40 is a wake-up call. You start to realize that (statistically speaking) you’ve burned through about half your life. And you ask yourself what you have to show for it.

At the same time, you might start to wonder about your finances. And the big question… will you ever be able to retire?

If you’re in your 40’s (or almost in your 40’s) and haven’t thought a lot about retirement, perhaps you own some L 2040 Fund in your TSP. Or maybe you heard that TSP Lifecycle Funds are an easy solution to your retirement needs but haven’t picked one out yet.

In this post I’m going to walk you through the investment objective of the TSP L 2040 Fund, who it targets, and why you might consider investing in it. Read on below to find more about the L 2040 fund.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- Overview of the Thrift Savings Plan (TSP)

- Understanding the TSP Lifecycle Funds

- What is the L 2040 Fund?

- Who should consider investing in the TSP L 2040 Fund?

- Should I combine the TSP L 2040 Fund with other investments?

- What are the downsides of the L 2040 Fund?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

Overview of the Thrift Savings Plan (TSP)

The Thrift Savings Plan was established in 1986 by the Federal Employees Retirement System Act (where we get the acronym FERS).

Investing in the TSP is limited to civilian federal employees and uniformed services members. TSP contributions are made exclusively through payroll deduction.

There are two different TSP contribution options, Roth TSP and traditional TSP. You can choose between Roth TSP contributions, traditional TSP contributions, or both to optimize your tax situation.

In a traditional TSP, you pay the tax after retirement when you start withdrawing your savings (but do not pay taxes on the contribution).

However, in a Roth TSP, you pay taxes every year but do not pay taxes on the withdrawals. This can help you minimize your taxes in retirement and minimize your taxes paid on social security.

For either TSP account, the maximum amount of deposits you can make in a year is $20,500. If you are over age 50, you can invest another $6,500 as a catch-up contribution.

One of the best parts of the TSP are the matching contributions; the government matches your contributions up to the first 5 percent of your salary.

Understanding the TSP Lifecycle Funds

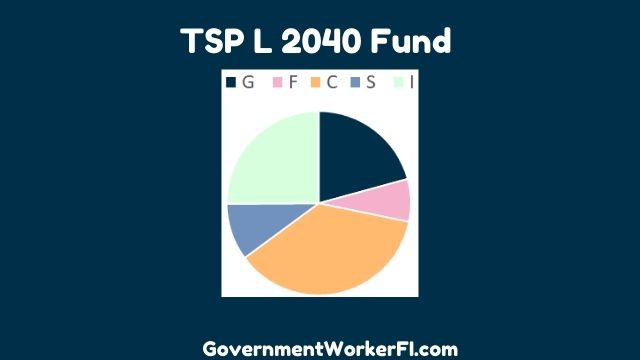

The TSP lifecycle funds are an amalgamation of the G, F, C, S, and I funds, five of the core funds. In other words they are a fund of funds. Let’s talk about the underlying funds that make up the TSP Lifecycle Funds.

The G Fund invests in government bonds that guarantees capital preservation with no risks. This fund has the lowest return rate in all core funds.

The F Fund is the second of the bond funds that comprise the Lifecycle Funds. In the F fund, your capital investment is in debt instruments including corporate, and government bonds. It does have a slightly higher risk than a G Fund but has outperformed the G Fund over the long term. Unlike the G Fund, the F fund can go down and you can lose money.

In the C Fund, your capital investment is spread across the 500 largest US stocks weighted according to their market capitalization. This fund has a higher amount of risk than G and F funds, but it also has a potential for higher returns.

The S fund invests in 4500 medium and large US company’s stocks. It is one of the higher risk funds which shows greater volatility and thus a potential for better returns.

Finally, the I fund invests in international stocks. The international stocks within the I Fund are only held in developed markets and are focused in Europe, Australasia, and the Far East. (It is not possible to invest in emerging-market stocks within the TSP)

Every new federal employee automatically starts with their TSP invested in a lifecycle fund suitable for their age. The TSP plan estimates the future target retirement dates by considering retirement age at 63 years, and it creates asset allocation strategies based on that.

What is the L 2040 Fund?

The TSP L 2040 fund is one of the target date funds (called Lifecycle funds) offered to federal employees by the Federal Retirement Thrift Investment Board. TSP L 2040 fund is a retirement plan for investors who plan on retiring between 2038 and 2042.

The current fund selection contains approximately 37% C Fund, 25% I Fund, 21% G Fund, 10% S Fund, 7% F Fund.

The fund allocation automatically becomes conservative as you approach your retirement age. The TSP board adjusts the allocation once per quarter. Since the re-balancing occurs within tax favored accounts, no capital gains are generated. (Note that you can end up with some end of the year tax surprises if you hold a target date fund in a taxable investment account outside of your TSP or IRA).

How does the TSP L 2040 Fund compare against private sector target date funds?

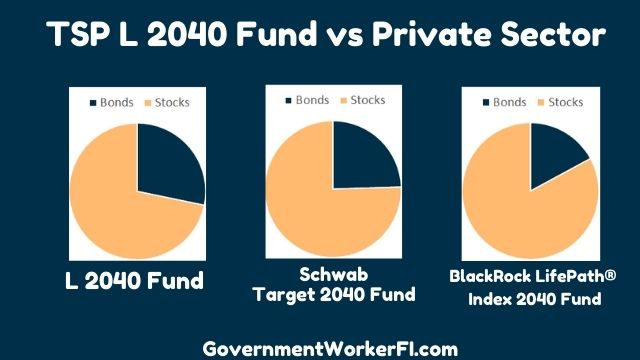

While private sector target date funds invest in exchange-traded funds instead of TSP funds, it is still possible to compare the target asset allocation of private sector funds against the L 2040 funds.

The TSP L 2040 Fund is more conservative than the BlackRock 2040 Fund and the Schwab 2040 target date funds. These target date funds contain more than 75% stock funds whereas the L 2040 Fund only contains 71% equities.

Read More: TSP Dividends: Find Out How This Money Builds Your Portfolio

Who should consider investing in the TSP L 2040 Fund?

The TSP board designed the L 2040 fund for federal employees who would like to withdraw their money from 2038 – to 2042.

Currently, the target allocation focuses on capital accumulation. However, the glide path will automatically adjust the fund to have an emphasis on preservation of assets as you approach retirement age.

A TSP L 2040 fund is excellent for you if you don’t want to have to worry about your asset allocation. The TSP board takes care of risk management for you and you just need to invest in a single fund.

Should I combine the TSP L 2040 Fund with other investments?

Combining your TSP L 2040 fund with other investments is not a great idea.

The TSP board created the lifecycle funds to have the optimal asset allocation plan for a given level or risk.

You should not combine your TSP L 2040 fund with other investments as it increases your risk without the potential to increase your returns.

If you are planning to retire between 2038 and 2042 but want a more aggressive portfolio, you could choose a Lifecycle Fund with a later target date like the L 2050 Fund. On the other hand, if the L 2040 plan feels to aggressive for you, you could instead use the L 2030 Fund.

However, mixing and matching Lifecycle Funds will only leave you with a suboptimal combination of risk and return… so don’t do it!

What are the downsides of the L 2040 Fund?

The main downside of the L 2040 fund is that your investment objectives might not align with the objectives of the fund.

If you read my post about the Best TSP Allocation, you’d know that the best TSP allocation for you depends upon your life situation. Do you have kids? Will you have to care for aging parents? Are you expecting a big inheritance?

While the TSP L 2040 Fund is a default retirement selection, the level of growth may not match with what you need. You might decide you need a more conservative fund or more aggressive investments. In those cases, you can either select a different lifecycle fund or build your own portfolio from the individual core funds.