Why do people own bonds?

Bonds are supposed to smooth out your portfolio. While in the long run, stocks have always outperformed bonds, in the short run, stocks can lose a lot of money.

And if you’re a retiree or someone else who needs to sell assets, you don’t want a lot of volatility.

On the other hand, the returns on bonds might not keep pace with inflation. Part of what makes asset allocation is so difficult is that you need to balance risk, returns, and inflation.

Federal employees have 2 choices for bond funds within the TSP: the F Fund and the G Fund. While I’ve read lots of stuff about these funds, I couldn’t find the most valuable data you’d need to decide which fund you should choose in your TSP.

In this article I do a deep dive into the F Fund vs. G Fund to show how these funds have performed against inflation and whether the extra returns you get from the risk in the F Fund might be worth the historical returns.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- F Fund vs. G Fund: What do they invest in

- F Fund vs. G Fund: The historical data from the TSP Website

- F Fund vs. G Fund: Annualized inflation adjusted returns over different time periods

- F Fund vs. G Fund: Average returns over time time windows

- Is the F Fund worth the extra risk?

- Summary- The F Fund vs. G Fund decision is harder than I thought it would be

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

F Fund vs. G Fund: What do they invest in

Before going into a head to head comparison of the F Fund vs. G Fund performance, it’s important that we are clear about what these funds are and what they invest in.

What the F Fund invests in

The F Fund follows the Bloomberg Barclays U.S. Aggregate Bond Index which contains nearly 12,000 notes and bonds including U.S. Treasury notes and other fixed income investments.

Because the Index contains so many securities, the Federal Retirement Thrift Investment Board cannot invest in all of the securities in the index. Instead, they invest the funds for the F Fund in an index funds run by BlackRock Institutional Trust Company, N.A., and State Street Global Advisors Trust Company. (Check out the TSP F Fund Fact Sheet for more information).

What the G Fund invests in

The G Fund is comprised of special short-term U.S. Treasury securities that are “non-marketable”. In other words, the federal government makes special bonds especially for TSP participants.

Because the bonds are non-marketable, they cannot lose value. (The bonds within the F Fund can lose value due to interest rate risk. If long-term interest rates increase, the value of existing bonds decrease since investors can buy new bonds with higher yields).

Why the G Fund is Special

The G Fund gives TSP investors the investment returns of a long-term government bond with no risk of loss of principal.

In other words, the G Fund has the liquidity of a money-market fund with the rate of return of long-term government securities.

Therefore, the G Fund is a rare exception to the risk/reward tradeoff typically found in investments. You get more reward than a savings account with no additional risk.

However, it is important to note that the G Fund is not guaranteed to beat inflation. In the remainder of this article, I’ll compare the F Fund vs. G Fund vs. inflation to look at inflation adjusted returns over time.

F Fund vs. G Fund: The historical data from the TSP Website

Let’s say you want to hold bonds in your TSP.

That’s great!

However, you have to make a decision between the F Fund and the G Fund. Which one should you choose? Well, the first thing you might do is go to the TSP website to see if you can find out about the past performance of these funds.

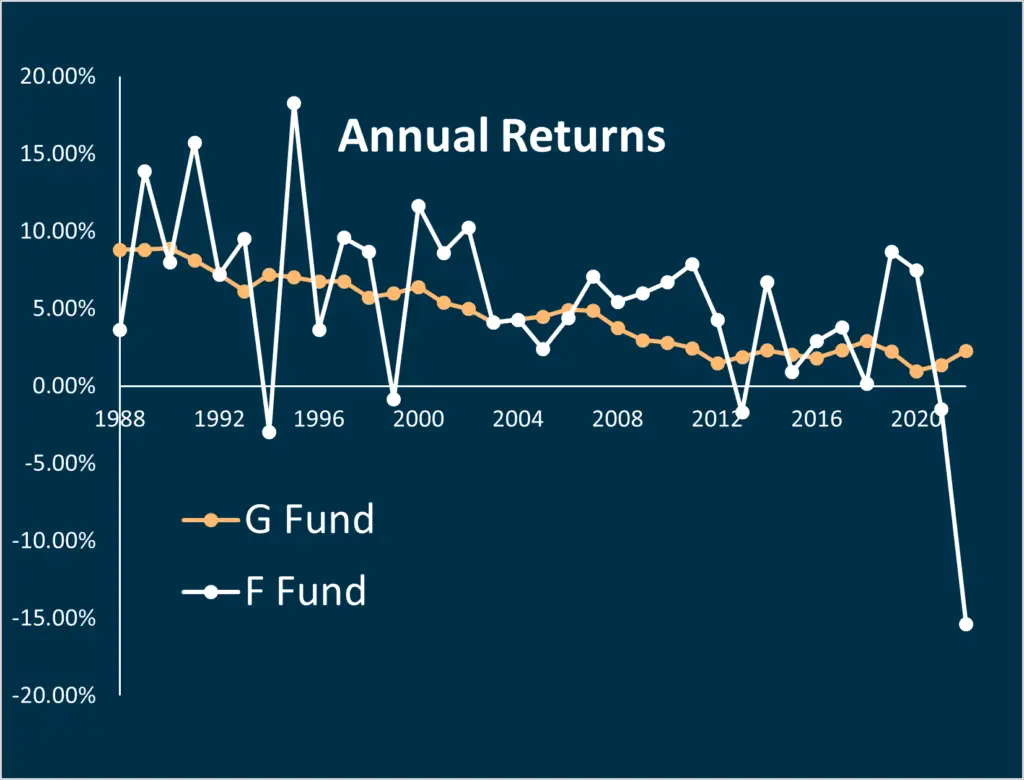

If you spend enough time on their website, you can find the raw data that I used to make this graph.

This graph gives you some information about the different funds. You can see that the G Fund never loses money. The F Fund bounces around a lot. It’s lost money in 5 years since it was created 34 years ago. Most of these years it was a very small loss.

However, the F Fund lost 15% this year alone!! (Not great if you’re counting on your F Fund to provide stability to your portfolio.)

While there’s nothing wrong with this data on the TSP website, it’s not the entire picture either. To understand that, you need to see if these investments are providing you real returns after inflation.

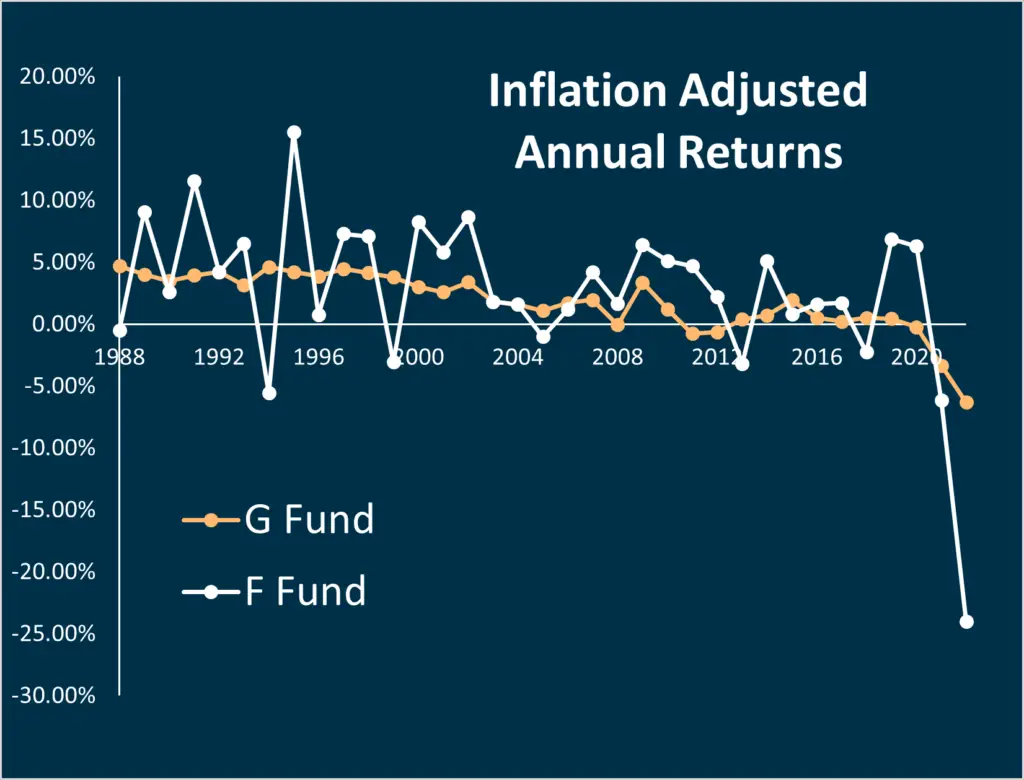

What about inflation?

Once you account for inflation, you can see that there have been years where the G Fund has provided a negative return.

Overall, there have been 6 years where the G Fund has had a negative 1-year inflation adjusted return. The F Fund only has 7 years with a negative 1-year inflation adjusted return. In fact, if you were only to look at these numbers, you might think that you were equally likely to lose money against inflation in either of these funds.

However, the magnitude of these losses are quite a bit different between these two funds. The F Fund has had its worst year ever in 2022, dropping almost 24% in inflation adjusted returns. If you were a retiree with money in the F Fund or a lifecycle fund with a high proportion of the F Fund, like the TSP L-income Fund, this has got to hurt.

(If you are curious about why the F Fund is having a horrible 2022, check out my explanation of interest rate risk in an older post.)

Not all doom and gloom for the F Fund

While recent returns in the F Fund have been rough, there were some glory days. In the 1990’s and early 2000’s the F Fund was delivering returns of over 10% a year and beat the C Fund many of these years.

On the other hand… should you really be chasing returns in your bond fund? Traditional asset allocation suggests that you use equities to chase returns in your portfolio and bonds to “provide ballast” and smooth out the ride when the economy fluctuates.

While the F Fund has provided impressive returns in the past, it is worth evaluating whether this fund is serving the purpose you want it to in your portfolio.

F Fund vs. G Fund: Annualized inflation adjusted returns over different time periods

It can be hard to make any sense of the previous graphs. There’s just a lot of bouncing around.

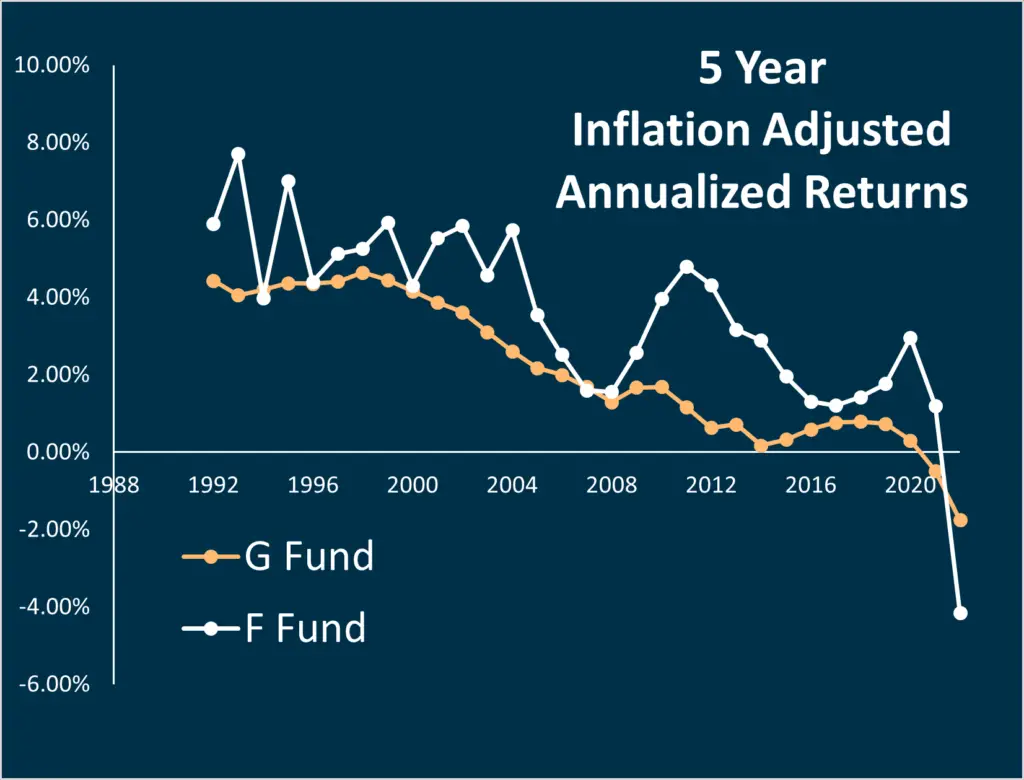

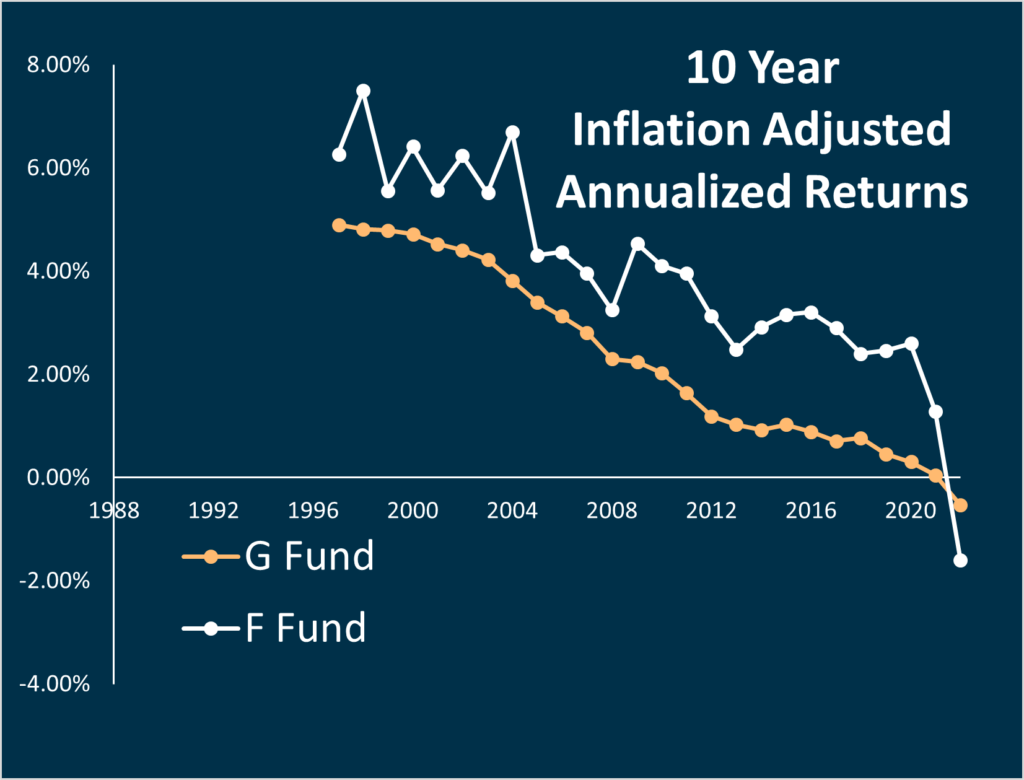

To get a better picture of how the F Fund vs. G Fund performs over time, I calculated inflation adjusted annualized returns over a 5 year and 10 year window. This takes into account the compounding of the returns year-after-year.

The data show that in general, the F Fund outperforms the G Fund. However both funds have provided positive returns against inflation in every 5 year window prior to 2021 (when inflation erased any gains these funds had).

The 10 year picture provides the same general trends but with less noise. Over time, both funds have provided diminishing but positive returns before finally crossing over into a negative return this year.

I know people often talk about a “lost decade” for stocks but we are literally seeing a lost decade for bonds in both the F and G Funds. If you invested money in either of those funds in 2010 you have less purchasing power today than you did then.

Note: I’m not saying that bonds don’t belong in your portfolio. Just as there are losses in stocks, there can be losses in bonds as well. A balanced and diversified portfolio can help you mitigate some of these risks.

F Fund vs. G Fund: Average returns over time time windows

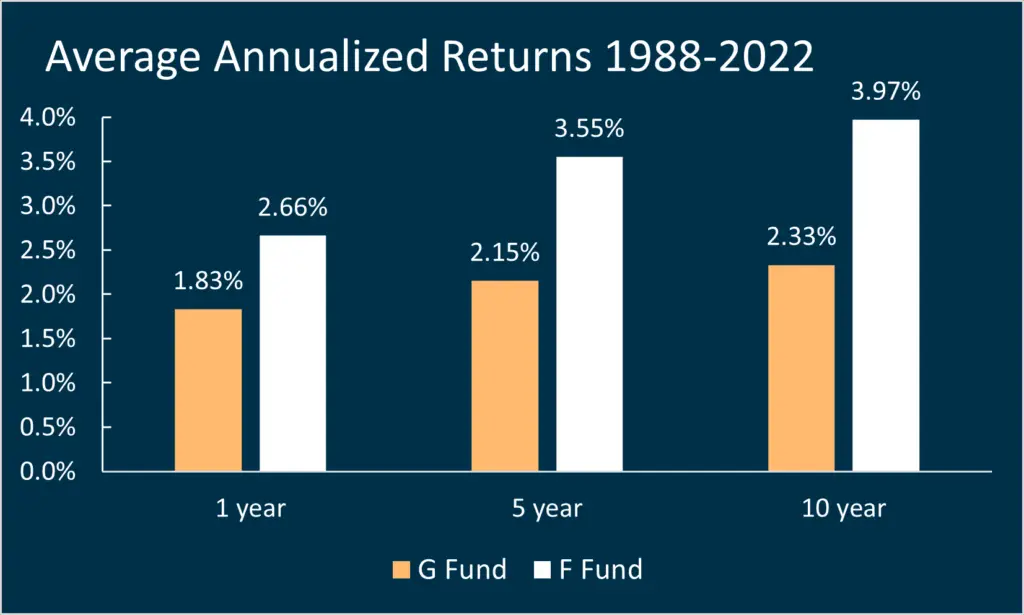

While the above analysis of the F Fund vs. G Fund was important, I think you can get the best look at the F Fund vs. G Fund with this graph.

Here I break down the average 1 year, 5 year, and 10 year returns for these funds against inflation.

You can see that the average 1 year return is less than 1% higher in the F Fund than the G Fund. They both beat inflation by about 2% but the F Fund is a little bit higher than 2% and the G Fund is a little bit lower.

Is the F Fund worth the extra risk?

Ultimately, I started this post because I am trying to figure out which bond fund will best meet my needs in retirement. (I’ll admit it, I’m a selfish blogger).

Prior to doing this analysis, I thought that surely the F Fund was the superior fund. My assumption was that the F Fund had higher returns and would be more likely to beat inflation. I also use cFIREsim to predict whether my portfolio will withstand my withdrawal strategy in retirement. the “bond fund” used in cFIREsim is equivalent to bond index that the F Fund tracks. Therefore, I thought that I needed to invest in the F Fund to be consistent with my retirement calculations.

However, writing this article has made me rethink my strategy for two reasons:

- The F Fund has had some horrible 1-year losses.

- The long term performance of the F Fund is similar to that of the G Fund

I want bonds to mitigate risk in my portfolio and help preserve my capital in a market downturn. The F Fund clearly failed at that task this past year. While the F Fund has typically outperformed the G Fund, the difference in performance is not so large.

Summary- The F Fund vs. G Fund decision is harder than I thought it would be

Ultimately, whether you decide to use the F fund or the G Fund to provide bond exposure in your TSP portfolio is your own decision. I’m not a financial advisor, and certainly not your financial advisor; only you can know what’s best for your portfolio.

However, I hope this analysis helped you think through some of the math behind the F Fund vs. G Fund.

- The G Fund will never lose value but may lose value against inflation

- The F Fund and G Fund have both had about the same number of years with negative inflation adjusted returns

- The F Fund has had several years with inflation adjusted losses that exceed 5% (and is down ~24% against inflation so far in 2022!)

- The average inflation adjusted yearly return for the G Fund and F Fund are both under 3%.

- The F Fund has slightly higher inflation adjusted returns over time.

The big decision is whether it’s worth chasing that extra bit of potential returns in the F Fund for leaving the safety of the G Fund. While I assumed the F Fund would be a slam dunk, the G Fund performed much better than I had assumed it would.