Since Bitcoin was started in 2009 it has been a wildly fluctuating asset. Now there are thousands of cryptocurrencies from the relatively established Bitcoin and Ethereum to meme coins like Dogecoin and “CumRocket”.

I have been fascinated with crytpos since I was bombarded by Dogecoin posts on Reddit. I tried to get rich off Dogecoin, but all I got was a lousy blog post.

Do you want to invests in these alternative assets in your TSP account? While investing in bitcoin in your TSP is not possible today, there are ways to get your TSP funds eventually converted into a cryptocurrency IRA. Hopefully by the of this article you’ll be able to answer your coworker’s questions when they ask you, “Can I buy crytpo with my TSP?”

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is the Thrift Savings Plan (TSP)?

- What are cryptocurrencies?

- Can I buy crypto with my Thrift Savings Plan?

- Can I invest in cryptocurrency or Bitcoin through the TSP Mutual Fund Window

- Can you buy crypto in any retirement account?

- What is a self-directed IRA (SDIRA)?

- Is investing in cryptocurrency like Bitcoin in my TSP a good idea?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is the Thrift Savings Plan (TSP)?

The TSP is a qualified retirement plan for federal employees and members of the Uniformed Services who have taken the oath of office. Founded in 1986 through the Federal Employees’ Retirement System Act (FERS), the TSP operates in a similar manner to a 401(k) for government employees.

Federal employees can contribute up to the 401(k) maximum. They even receive matching contributions up to 5% of their salary; most of it with no vesting period (free money). Employees can choose between a Roth TSP and a Traditional TSP option.

Employees can choose between one of 5 index funds with no added fees:

- G Fund– (short term government bonds, guaranteed to increase in value)

- F Fund– (medium term government and corporate bonds, similar to BND)

- C Fund– (a stock index fund that tracks the S&P 500 index)

- S Fund– (small and medium cap stocks)

- I Fund– (international stocks, limited to certain countries that excludes emerging markets)

What are cryptocurrencies?

Crypto is a shorthand code for an asset class of different currencies that aren’t backed by a government (as opposed to fiat currency used in most countries). Cryptocurrency transactions are tracked using the “blockchain”, a decentralized recordkeeping system.

Why do people buy crypto?

When you buy a cryptocurrency, you’re buying a currency that only exists in a digital world. It only has no inherent value and its price is determined by how much someone else is willing to pay for your piece of digital currency. Some people buy crypto because

- They believe that fiat currency will lose value as governments print more money and that crytpo will be a better store of value

- They believe the blockchain technology that crypto is built on is the future

- They believe demand for cryptocurrencies will increase and therefore the value will increase in the future (supply and demand)

Can I buy crypto with my Thrift Savings Plan?

When the TSP was started in 1988, investors could only choose between two bond index funds (the F Fund and G Fund) and one stock fund (The C Fund) in their TSP Plan. Later on, the TSP added options for investing in international and small cap stocks (the I Fund and S Fund, respectively). None of the 5 core TSP funds gives you an exposure to alternative assets like cryptocurrency or precious metals. However, some of the stocks in the C, S, and I Fund, depend upon those sectors. For example, gold mining stocks like Freeport McMoran depend strongly upon the price of assets like gold and copper, and the stock Coinbase, a cryptocurrency exchange, moves in response to the crypto market.

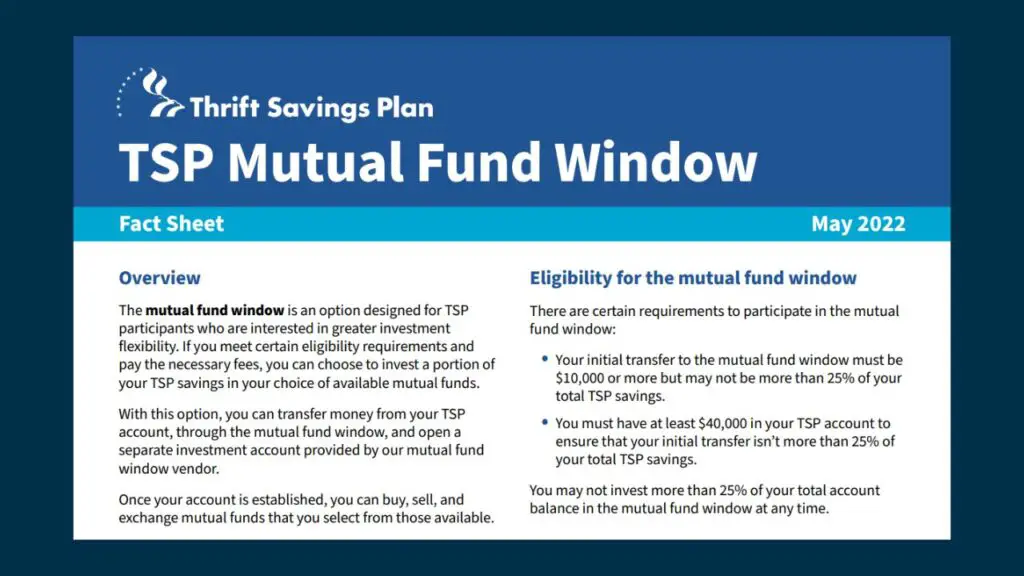

Starting in 2022, investors could also invest in one of 5,000 mutual funds through the TSP’s mutual fund window. The mutual fund window is loaded with fees, and you can only invest 25% of your TSP balance in it. But if you are convinced that crypto will outperform stocks, then I’m sure you’d be willing to pay the fees to buy and sell it in your tax-advantaged TSP.

Can I invest in cryptocurrency or Bitcoin through the TSP Mutual Fund Window

I went through the list of 5,000 funds offered by the TSP. Interestingly, many of the funds offered a duplicates of what you can already buy with the TSP. There are several index funds that track the S&P 500. The mutual fund window also offers target date funds that are similar to the TSP’s lifecycle funds.

Unfortunately, there are no crypto specific funds within the TSP mutual fund window.

In fact, there are not many mutual funds or exchange traded funds (ETF’s) that track cryptocurrencies at all. That’s because mutual funds and ETFs need to be registered with the SEC. The SEC has so far avoided regulating cryptocurrencies.

As far as I know, there is only one SEC approved fund that tracks crypto- the Bitcoin Strategy ProFund BTCF.X and it is not offered by the TSP.

Can you buy crypto in any retirement account?

Whether you have a 401k, IRA, Roth IRA, 457b or 403 plan, you are pretty much limited to the same investment options- stocks, bonds, and mutual funds. While the types of investment funds vary across the plans depending upon the plan custodian, in most plans, you’re limited to funds that are traded on exchanges (See IRS Publication 590-A for more details).

However, self-directed IRAs are a special type of retirement account that allow you to own (almost) any asset.

What is a self-directed IRA (SDIRA)?

A self-directed IRA is a type of IRA that allows you to hold almost any asset type, including many assets that are prohibited in most IRAs. As I’ve described in previous posts, an IRA is like drawing an invisible box around some of your money which gives it tax advantages. Most IRA custodians only allow you to draw that box around stocks and bonds to make it easy for their accounting. However, several companies provide self-directed IRAs which allow you to invest in alternative asset classes like real estate, precious metals, or cryptocurrencies.

How to move money from the TSP to a SDIRA to buy crytpocurrencies

If you want to buy Bitcoin in your TSP, you will need to do a rollover to move the money from the TSP to a SDIRA and invest in the digital assets through that company. Note that current employees aren’t able to roll money out of the TSP. So you won’t be able to buy or sell crypto with your TSP until after you separate from the government.

When selecting an appropriate company for your SDIRA, try to find one that specializes in offering cryptocurrencies and check their fees to make sure it is the best investment account for you.

Is investing in cryptocurrency like Bitcoin in my TSP a good idea?

I’ve talked with many TSP millionaires over my time as a blogger. These TSP participants were able to build their retirement savings to over $1,000,000 in their TSP without needing to add Ethereum or Dogecoin in their portfolio. In fact, most of them had a very boring TSP strategy of contributing to a TSP regularly, throughout their career. These examples go to show you that you don’t need a risky asset to get to your target retirement number.

Unlike stocks, which represent partial ownership in a company and pay dividends, in reality, you can only make money in crypto given the greater fool theory. That is, you’re hoping to find a “greater fool” to pay more for your token than you paid for it. That doesn’t mean that crypto is a bad investment. It just means that it may have more volatility and risk than other investment options.

If you really want to invest in alternative assets, there’s nothing stopping your from doing these trades outside of your TSP in a taxable account. That way you can balance the benefits of a TSP (the match, tax-deferred growth) with having some “mad money” that you use to chase big gains.