I have been writing a series of posts examining early retirement for federal employees.

One of the biggest benefits of federal employment is the FERS retirement compensation. The system is set up so that you’re rewarded with a large retirement benefit upon reaching your minimum retirement age (MRA).

If you leave the federal government before your MRA, you can still collect a pension under deferred retirement.

However, your pension isn’t your only benefit in a FERS retirement! If you make it to your MRA, you can also keep your health insurance in retirement.

Today I want to look at the total FERS retirement compensation package.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- FERS retirement compensation is more than a pension

- What is the total value of the FERS retirement compensation?

- How to think about losing this part of your FERS retirement compensation?

- What about “real” early retirement

- How much is “enough” to retire?

FERS retirement compensation is more than a pension

My previous articles have focused on what happens to your pension benefit if you retire early. Luckily, not much happens if you separate from the federal government early. This option is called “deferred retirement”. The pension benefits you have earned remain intact and you can access them at age 62 or as early as age 57 with a reduction.

Let’s discuss these in more detail.

However, total FERS retirement compensation is more than just a pension. It provides two other retirement benefits. The first is that you can continue to receive your federal health insurance (FEHB) after you retire and continue to pay only the employee portion of the premiums. The second is that if you retire before age 62, you receive a “FERS supplement” from retirement age until age 62.

FERS supplement

The FERS supplement is a supplement that is paid to you from the date you retire until you reach age 62. The amount of the FERS supplement is designed to match your social security benefit at age 62. There’s no way to calculate how big your FERS supplement will be. The only way to find this information out is to contact HR when you’re getting ready to retire.

You can also get an idea of the magnitude of your FERS supplement in your annual FERS benefit statement.

The FERS supplement is paid in addition to your pension so it’s like you get TWO PENSIONS for the first few years of retirement!

FEHB continuation

By far the largest benefit of working until your MRA is that you can keep your FEHB for life. I previously received a comment on my blog that they didn’t think FEHB was that valuable because you could go on Medicare when you reach 65. But you can keep your FEHB until death. Keeping your FEHB means that you can remain in a plan with extremely low out-of-pocket maximums until you die with Medicare as a backup.

In Tanya Hester’s book “Work Optional” (affiliate link) she talks quite a bit about how much health insurance costs retirees and early retirees. She states that the average Medicare user spends an additional $250,000 on health care on top of Medicare between ages 62 and death. That’s simply something that FEHB beneficiaries will not have to worry about.

What is the total value of the FERS retirement compensation?

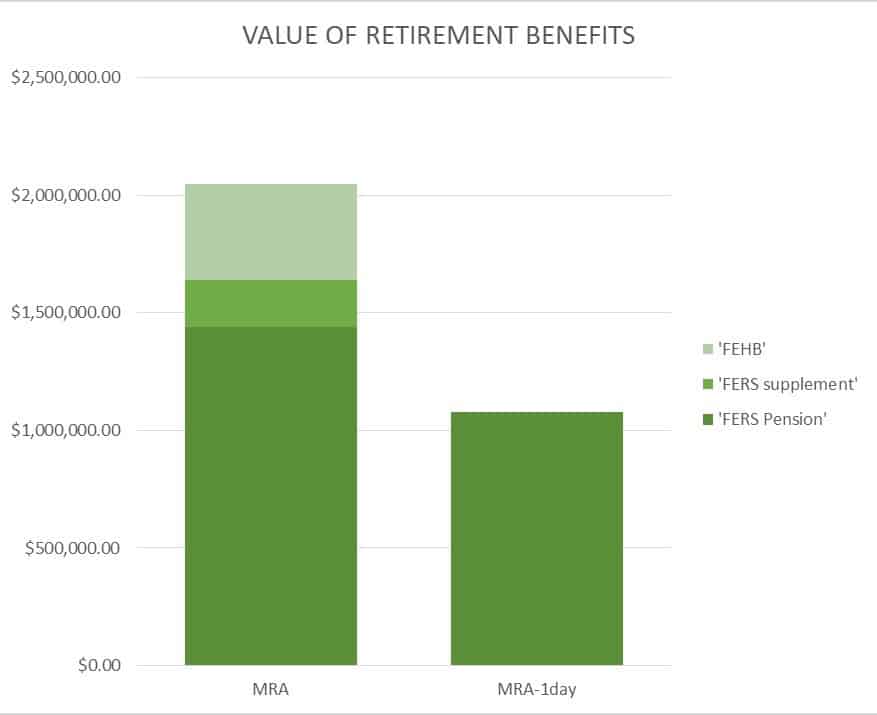

Unlike the FERS pension which has an easily calculuable formula, everyone’s FERS supplement and FEHB benefits are different. In the following example, I took an average “high 3” salary of a GS14 step 10 along with the FERS supplement predicted from my own retirement calculator. I calculated the FEHB benefit from the current value of my employer’s contribution to my FEHB. Note that this likely underestimates the value of the FEHB for two reasons. The first is that by the time I reach MRA, the employer contributions will likely be higher because of inflation. The second is that if I didn’t have the FEHB, my healthcare costs would be much greater (see note above about how much Medicare patients pay for health insurance).

I assumed in the calculation that I’d retire at my MRA (age 57) and live for 30 years. (Probably optimistic given my crap genetics).

All in, I calculated the non pension benefits of the FERS retirement compensation to be worth $600,000. (Note this is a low estimate).

How to think about losing this part of your FERS retirement compensation?

I’ve been thinking about how to illustrate the cost of early retirement for federal employees for a while. In a previous life I had a background in economics. One way to think about it is to calculate the marginal cost of early retirement. In economics, a “marginal” cost is the cost it takes to make the last widget. Marginal cost is a useful comment because it helps you decide whether to make just 1 more of something.

So how much does it cost to retire early as a federal employee? Well the least amount it would cost you is if you retired 1 day before your MRA. While this seems like a dumb example, there was an example of someone who was terminated just a few days before their MRA so that the person couldn’t receive a pension.

I made this bar chart to show the difference between the full FERS retirement compensation and early retirement by 1 day. I assumed that the person would withdrawal their pension at 57 regardless of when they retired. As you can see, retiring early will cost you at least a million dollars.

One way to think about this is that your last day of federal employment, you actually earn an extra million dollars worth of benefits. A million dollars for 1 day of work!!

What about “real” early retirement

Even though the example was extreme— nobody retires “early” on the day before they reach full retirement day— the marginal revenue for working that last day is truly over a million dollars. Of course if you made it that far, you’d work 1 more day to get an extra million dollars.

What if you were 1 year away from MRA? Would it make sense to stick it out for an extra million in benefits? Probably. Earning $1M per year is a great salary.

What if you were 10 years away from MRA? Well then it’d be like if you mentally added $100,000 to your yearly salary for the next 10 years. It might be worth it to stick around for MRA to get those benefits, but it seems less appealing.

And what if, like me, you were about 20 years away from MRA? Well, then I guess if I retire early (or leave for another job), I’m giving up about what equates to $50,000 per year of benefits if I had made it to MRA.

How much is “enough” to retire?

Putting a number on the cost of early retirement was a helpful activity for me. Obviously at some point, the benefits of making it to MRA outweigh the loss in free time that results from full time employment. If I were financially independent today, I think I’d feel comfortable giving up those benefits.

I haven’t felt the need to set a “FI date” or a timeline to FI. I think we’ll get there when we get there. Once we achieve FI, then I’ll see how far away we are from MRA and then make a decision about what we want to do.

![Had Enough? Federal Government Early Retirement [Ultimate How To Guide]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2021/05/early-retirement-federal-employees.jpg)