The TSP is great… until you need to change something.

In a world where you can do nearly anything from your smart phone, the TSP still relies on forms.

Luckily you no longer need to fax forms to the TSP. In many cases you can upload a PDF.

But the fact remains that you still need to find a form, fill out at form, and upload a form to change many aspects of your TSP.

In this post I’ve tried to consolidate all of the forms you could ever need for your TSP and it make it a one-stop shop. I’ve also tried to explain what the form is and why you’d need it in the first place.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What’s the TSP?

- Form TSP-1: Election form (civilian employees) and Form TSP-U-1: Election form (uniformed service employees)

- Form TSP-3: Designation of beneficiary

- Form TSP-9: Change in Address for Separated Participant

- TSP-15 Change in Name for Separated Participants

- Form TSP-16 Exception to Spousal Requirements

- Form TSP-17 Information Relating to Deceased Participant

- Form TSP-20 Loan Application

- TSP-21-R-CL Residential Loan Checklist

- TSP-25 Automatic Enrollment Refund Request

- TSP-26 Loan Payment Coupon

- TSP-41 Notification to TSP of Nonpay Status (Agency use)

- TSP-60 Request for a Transfer Into the TSP

- TSP-65 Request to Combine Uniformed Services and Civilian Accounts

- Form TSP-75 Age-Based In-Service Withdrawal Request

- Form TSP-76 Financial Hardship In-Service Withdrawal

- TSP-92 TSP Retirement Benefits Court Order Division

- TSP-95 Changes to Installment Payments

- TSP-99 Withdrawal Request for Separated

- What happened to the TSP-70 Form?

- Summary

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What’s the TSP?

TSP stands for Thrift Savings Plan, a “defined contribution” retirement plan for civilian employees and uniformed services members. The IRS treated TSPs similarly a 401(k)’s; you can contribute a maximum of $20,500 (in 2022).

TSP participants can invest their retirement money in one of five different funds: C Fund (common stock), S Fund (small cap stocks), I Fund (international stocks), F Fund (bonds), G Fund (government securities)

Participants can withdraw money as early as age 55 upon retirement from the federal government, or age 59.5 if they took a deferred retirement or other early retirement. TSP participants can also purchase a TSP annuity or tap their TSP balance before retirement with a TSP loan.

At some point, TSP participants will need to submit forms to change their contributions, take out a loan, or set up installment payments in retirement. Here’s a guide to the forms you will need.

Form TSP-1: Election form (civilian employees) and Form TSP-U-1: Election form (uniformed service employees)

According to the TSP, you can use this form to, “Start, stop, or change the amount of your contributions (including contributions toward the catch-up limit if you’re turning 50 or older).”

These forms should not be sent to the TSP, but instead returned to your personnel office or benefits office.

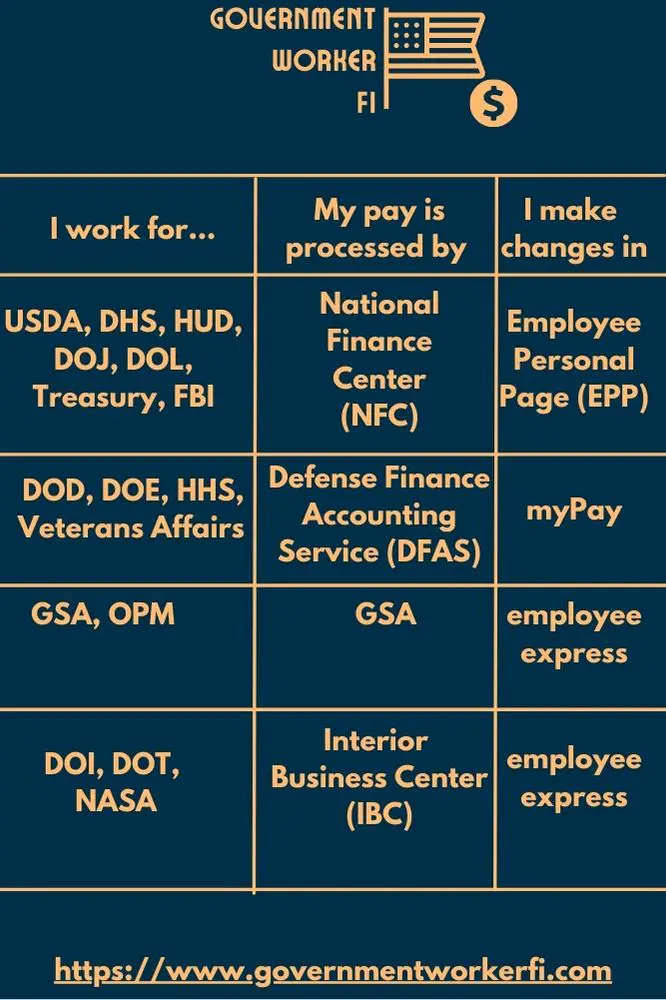

For example, if you are an agency that uses the National Finance Center (NFC), you do not need to submit a form TSP-1, but instead you can make changes online on the Employee Personal Page. If you are a Department of Defense employee, you would make the changes in MyPay, which interfaces with the Defense Finance Accounting Service (DFAS).

While I think most agencies have external forms or other ways to process this information I’ve included links to the TSP-1 form. Note that there are two forms, one for civilian employees and another one for those in the uniformed services.

Link: TSP-1 Election form for uniformed service employees

Form TSP-3: Designation of beneficiary

According to the TSP, you can use this form to, “Name a person or persons to receive your account balance after your death.”

This is a super important form! The TSP-3 form overrides any statutory guidance about how assets are disbursed after your death. By law, the TSP must pay distribute your assets according to your TSP-3 upon death.

If you have never filled out a TSP-3, your TSP is distributed according to your estate planning documents or statutory order of preference (i.e. spouse first, if no spouse, children, etc.).

If you have ever filed a form TSP-3, now is a good time to make sure it is up to date. (You wouldn’t want your ex-husband getting all of your money after you die, would you?)

The TSP has a form wizard to help you with this form if you log into your account. However, I’ve also included a link to the form if you are having problems logging in.

Link: Form TSP-3 Designation of Beneficiary

Form TSP-9: Change in Address for Separated Participant

According to the TSP, you can use TSP-9 to “Change your TSP account address if you are separated from Federal service.”

Current federal employees and uniformed services members can change their address in their official HR web-interface. (MyPay, Employee Personal Page, etc.)

The TSP will only allow you to access the form within your account area if you have already separated from service. (Sorry, I can’t link to it because I can’t access it myself!)

TSP-15 Change in Name for Separated Participants

This is another form for participants who have left federal or military service. Current employees who change their name would enter these requests through their official HR web software.

Thankfully anyone can access the TSP-15 form through the TSP website.

Link: Form TSP-15 Change in Name for Separated Participants

Form TSP-16 Exception to Spousal Requirements

I hope you never need the TSP-16 Form. According to the TSP, You use the TSP-16 form to “Request a waiver of the spouse signature requirements for loans and withdrawals.”

If you are using this form, chances are that you had a tough marriage and by extension tough life.

For example, the form walks you through what to do if you don’t know what happened to your spouse. (In that case, you need to spend 90 days making a good faith effort to locate your spouse before they will grant the exception).

Luckily, you can still withdraw money in these situations without the signature of your spouse. But unfortunately, it will require some work on your part. (Note there are two forms, one for uniformed services members and one for civilian employees)

Link: Form TSP-16 Exception to Spousal Requirements

Link: TSP-U-16 Exception to Spousal Requirements (for uniformed services participants)

Form TSP-17 Information Relating to Deceased Participant

Good news! If you are a federal employee or uniformed services member YOU never need to use the TSP-17 form.

The bad news… your heirs will need to use the form after you die to get their inheritance.

If you have a family emergency binder or some other estate planning documents, you might want to tuck this form into the folder to help your family navigate this process.

Link: Form TSP-17 Information Relating to Deceased Participant

Form TSP-20 Loan Application

If you want to take out a TSP Loan, you will need to submit a TSP-20 form. TSP Loans are one way that you can withdraw money from your TSP while you still work for the federal government.

To clarify, TSP Loans are one important difference between TSPs and IRAs.

The TSP offers loans with terms of up to 15 years for the purchase of a primary residence or terms of up to 5 years for any reason. While the TSP loan interest rate is based upon the G Fund interest rate, you should know that you would lose out on any gains that your TSP balance may have incurred during the life of the loan. (During a bull market TSP loans can be very expensive).

If you want to take out a TSP Loan, you will need to log onto your TSP account to make that happen.

TSP-21-R-CL Residential Loan Checklist

If you are applying for a residential TSP loan, you will need to complete the TSP-21-RL-CL. This form is merely a checklist to help you make sure you attach all important documentation to your application.

Link: Form TSP-21-R-CL

TSP-25 Automatic Enrollment Refund Request

Are you a new federal employee who just completed your background check and took the oath of office? In that case, you can fill out a TSP-25 form. This form will refund your automatic contributions to the TSP.

The government automatically enrolls new employees at a contribution rate of 5% of their salary in the appropriate Lifecycle Fund. (This helps employees earn the maximum 5% government match on their contributions).

However, if you decide that you do not want to participate in the TSP, you have 90 days from your first contribution to recover your pay that was automatically placed into the TSP.

Link: Form TSP-25 Automatic Enrollment Refund Request

TSP-26 Loan Payment Coupon

The TSP 26 is another form that deals with TSP Loans. If you took out a TSP loan and want to pay it back faster than the original terms of the loan you can use the TSP-26 to make an extra payment.

You can make the extra payment by filling out the TSP-26, writing a check, and mailing the form and the check to the TSP at the following address:

Thrift Savings Plan

P. O. Box 979004

St. Louis, MO 63197-9000

Link Form TSP-26 Loan Payment Coupon

TSP-41 Notification to TSP of Nonpay Status (Agency use)

You should not need to fill out the TSP-41. The form is form agency use only.

The TSP-41 form is used to notify the TSP if you move into a non-pay status (furlough or LWOP) AND you have a TSP Loan. If you do not pay back your TSP Loan according to the original loan terms, it could have serious consequences for you as the IRS may treat it as a taxable withdrawal of the funds.

The TSP-41 form helps the TSP and your agency document your movement into non-pay status to avoid these events.

Link: Form TSP-41 Notification of TSP to Non-Pay Status

TSP-60 Request for a Transfer Into the TSP

You can use the TSP-61 form to roll money into the TSP. There are two flavors of the TSP-61; one for traditional IRAs/401(k)s and one for Roth accounts. (Here is an introduction to the Roth TSP if you are confused about what the Roth TSP is).

While I’m not sure why you’d want to roll a Roth IRA into the Roth TSP, (or a Roth (401(k) into the TSP for that matter), you may wish to roll an old employer’s 401(k) into the TSP to have access to the G Fund in retirement.

Whatever your reasons for doing so, you will need the TSP-60 to complete a rollover into the TSP.

Link: Form TSP-60 Request for a Transfer Into the TSP

TSP-65 Request to Combine Uniformed Services and Civilian Accounts

Veterans who join the federal government have two TSP accounts; one from their military service and one from their civilian employment. Technically the reverse is true too if you worked for the federal government before joining the military. (But I’m guessing that situation is much rarer).

You have the option (but not requirement) to merge the TSP accounts into a single TSP account. While merging the two accounts makes money management simpler (only one account!), making the merge is irreversible. As an alternative to merging to two accounts, you could also roll your old military account into an IRA/Roth IRA which may give you more flexibility.

If you decide to merge your TSP accounts, you can do so with the TSP-65.

Link: Form TSP-65 Request to Combine Civilian and Uniformed Services TSP Accounts.

Form TSP-75 Age-Based In-Service Withdrawal Request

If you are over age 59.5 AND you still work for the government, you can make “age-based in-service withdrawals” from the TSP.

Age based in-service withdrawals are different from hardship withdrawals, which incur at tax penalty for accessing your retirement funds before age 59.5.

However, you should know there are some differences between TSP-75 withdrawals and withdrawals for current retirees.

- You can only make 4 age-based in-service withdrawal requests per year

- The TSP automatically withholds 20% of your withdrawal of traditional funds for taxes. (I’m not really sure why they hold 20% for everyone. I would think that federal employees taking these withdrawals would be in a range of tax brackets).

- If you are withdrawing from a traditional account after age 59.5 it will count as taxable income. Since this taxable income will be in addition to your federal salary, you may have a higher than expected tax burden.

The TSP-75 form is only available after logging into your TSP Account.

Form TSP-76 Financial Hardship In-Service Withdrawal

I hope that you never need to use the TSP-76 for hardship withdrawals.

Hardship withdrawals are a permanent withdrawal from your TSP. You will not get the opportunity to contribute the money back to the TSP. Furthermore, the IRS adds a 10% tax penalty onto your withdrawal for accessing your money early.

If you think you need a financial hardship withdrawal, you still need to convince the TSP that you qualify for one. You may only be granted a hardship withdrawal for one of four reasons.

- Medical expenses/medical debt

- Legal expenses following a divorce

- Property losses that are not covered by insurance

- “negative monthly cash flow”

If you fit into one of those categories, you can use the TSP-76 to apply for a hardship withdrawal.

The TSP-76 form is only available after logging into your TSP Account.

TSP-92 TSP Retirement Benefits Court Order Division

The TSP-92 is another form that I hope you never need to use.

You will need to use the TSP-92 form to verify the value of your TSP balance for divorce proceedings.

Typically, retirement accounts in divorce are split using a “qualified domestic relation order” or QDRO. Because federal employees are special, FERS and the TSP are not judged with a QDRO but instead a Retirement Benefits Court Order Division (RBCOD).

Link: TSP-92 TSP Retirement Benefits Court Order Division

Link: TSP-92 TSP Retirement Benefits Court Order Division (for benefits specialists)

TSP-95 Changes to Installment Payments

When it comes time to withdraw money from the TSP you have options! You can choose to either take one-time withdrawals (as frequently as once every 30 days) or set up an installment payments.

If you decide to go with installment payments, you’ll need to use the TSP-99 form to start these withdrawals. However, if you’re not happy with how you set up your installment arrangement, you can change it with the TSP-95 form.

The TSP-95 form is only available after logging into your TSP Account.

TSP-99 Withdrawal Request for Separated

Once you’ve reached retirement age and separated from the federal government you can use the TSP-99 form to get money out of the TSP.

You can use this form to set up installment payments or take a one time payment.

The TSP-99 form is only available after logging into your TSP Account.

What happened to the TSP-70 Form?

The TSP-70 is a legacy form for a full withdrawal of the TSP account. This form is no longer needed as a result of the TSP Modernization Act of 2017.

Still confused? I wrote a longer article about what the TSP-70 Form is and why you don’t need it any more.

Get Gov Worker’s top 4 tips for federal employees!Summary

That was *a lot* of forms! Hopefully you were able to find what you needed.

If you have more questions about the TSP, you can check out my free TSP School or post a question in my Facebook Community.