If you’ve ever itemized your deductions when filling out your taxes, you’ve come across questions about whether you’ve suffered a personal casualty loss.

Personal casualty losses are catastrophic events that destroy your property but aren’t covered by insurance. For example, say you had a flash flood destroy your basement but you didn’t own flood insurance.

These catastrophic events are major financial setbacks.

But did you know that if you suffered a personal casualty loss you can also withdrawal money from your TSP?

In this article I’m going to explain everything you need to know about how a personal casualty loss affects your TSP.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is a personal casualty loss?

- Brief TSP overview

- How the TSP can help you if you suffer a personal casualty loss

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is a personal casualty loss?

A personal casualty loss happens when you lose money or property as the result of a sudden unexpected event or theft. In many cases, you carry insurance for these types of losses. However, you may not be fully insured against all types of loss.

The IRS fully defines what is and is not a personal casualty loss in their publication 547. Note that while there are a range of personal casualty losses, Congress has restricted which personal casualty losses you can claim on your taxes for the years 2018-2025. This was a result of the Tax Cuts and Jobs Act passed in 2017.

I actually was unaware that many personal casualty losses are no longer tax deductible (for the next 3 years) until I was researching this article. So for your sake, I hope a tree branch doesn’t fall on your brand new Tesla until 2026.

Examples of personal casualty losses

The IRS Publication 547 is actually quite interesting.

The IRS lists a lot of examples of potential personal casualty losses. While some of them are easily imaginable, such as car accidents, fires, and floods, it also has some crazy personal casualty losses like

- Mine cave-ins

- Shipwrecks

- Sonic booms

- Volcanic eruptions

Unless you’re Mr. Moneybags or Scrooge McDuck I’m not sure you need to worry about your personal mine caving in or your ship of gold doubloons going down in the Bermuda Triangle. Those seem less like personal casualty losses and more like something a corporation might write off.

The publication goes on to describe special procedures for personal casualty losses caused by the corrosive drywall sold in the US in the early 2000’s, deteriorating concrete foundations containing pyrrhotite, and money lost in Ponzi schemes.

In short, publication 457 contains a book of nightmare situations that I hope you never have to deal with. However, if you are going to try to claim a personal casualty loss as a reason to access your TSP, you will want to read the publication to make sure your loss classifies.

Brief TSP overview

If you’re a federal employee or a member of our uniformed services, you probably have a TSP or Thrift Savings Plan. The TSP is the government’s answer for the 401(k). In fact, unless you are a finance nerd like me, you probably aren’t even aware of some of the subtle differences that separate it from a private sector 401(k) plan.

The government offers an awesome 5% employer match on retirement contributions. Even better is the fact that the TSP has very few vesting requirements. Because of this, the TSP is the largest asset that many federal employees have.

Since it may be the largest (or in some cases, only) source of savings, it makes sense that people who have had a personal casualty loss may try to access their TSP balance to help get them back on their feet.

How the TSP can help you if you suffer a personal casualty loss

There’s good news and bad news.

The good news is that you can get your money out of the TSP if you have a personal casualty loss. The bad news is that there are a lot of drawbacks from this type of TSP withdrawal.

The TSP includes personal casualty losses as a qualifying event for a hardship withdrawal. As a result, you can withdraw money from your TSP, but will face a TSP early withdrawal penalty.

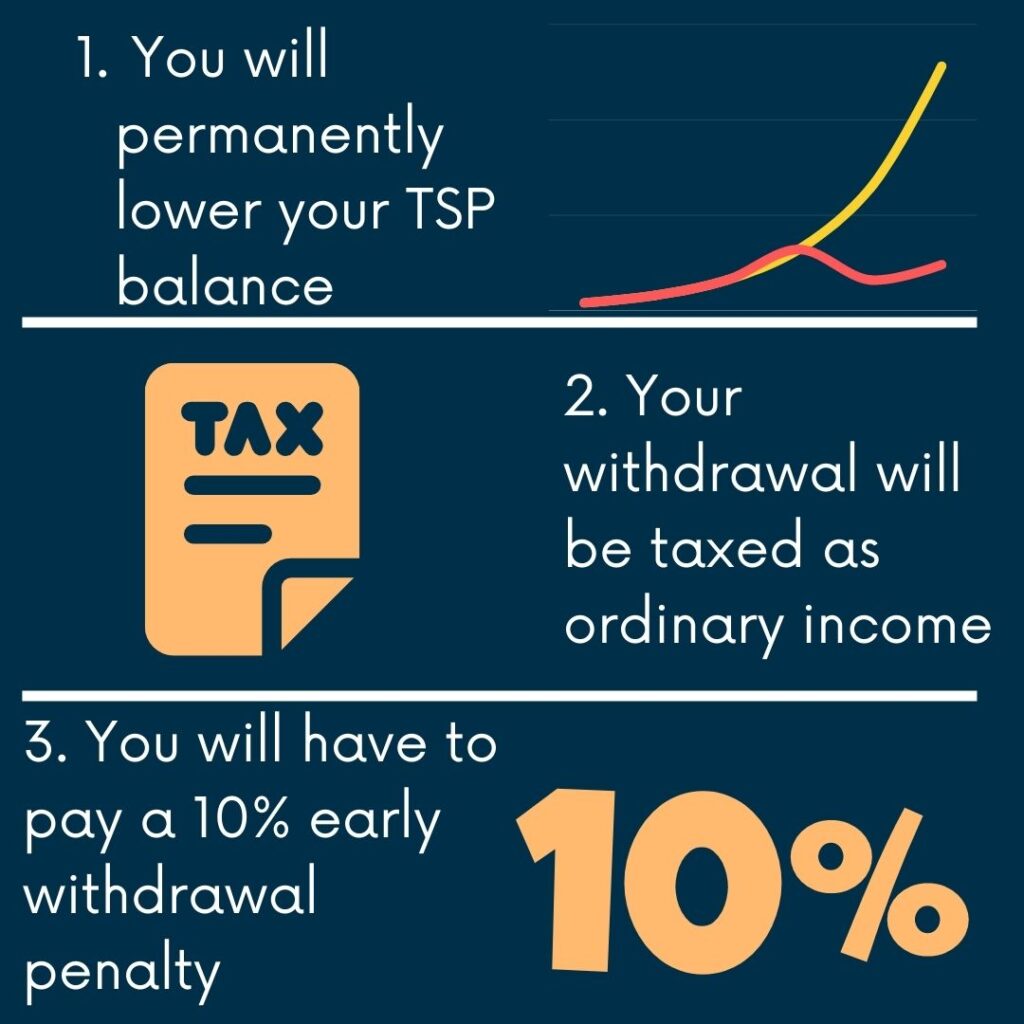

If you decide to withdraw money from your TSP following a personal casualty loss:

- You will permanently lower your TSP balance. (You won’t be allowed to pay it back, and will be limited to your maximum yearly TSP contribution each year until you separate from the government.)

- Your withdrawal will be taxed as ordinary income. If you withdraw $100,000 to repair your house, then your taxable income will increase by $100,000. Your tax liability may increase by tens of thousands of dollars and you will need to have a plan for how to pay for this withdrawal. This is especially relevant since many types of personal casualty losses are non-deductible following the Tax Cuts and Jobs Act of 2017.

- You will have to pay a 10% early withdrawal penalty. In addition to any federal or state taxes you owe, you’ll need to pay an additional 10% penalty for accessing your retirement funds early. (See TSP Book 26 for more information on this penalty.)

On the other hand, many federal employees may have no other option than to liquidate their TSP after a major emergency.

Should you take a hardship withdrawal if you have a personal casualty loss?

Let’s face it. A major personal casualty loss is something that no one ever wants to deal with. That’s why insurance is such a great tool for wealth preservation.

If you’re reading this article and have not suffered a personal casualty loss, I’d strongly recommend that you check out your insurance coverage and make sure it covers any catastrophe you can think of (including, sonic booms, I guess…).

If you have suffered a major personal casualty loss, there’s no way around it. Your life is now irreversibly different from the life you had prior to the emergency. You may have had hundreds of thousands of dollars erased in just a few seconds.

TSP hardship withdrawals are never a great option. They permanently reduce your retirement savings and are taxed at a super high rate. If you have any other options following a personal casualty loss, you should try use those instead of your TSP.

However, if you have no other options, it is nice to know that you can access your TSP following a personal casualty loss to help get you on your feet.

Get Gov Worker’s top 4 tips for federal employees!