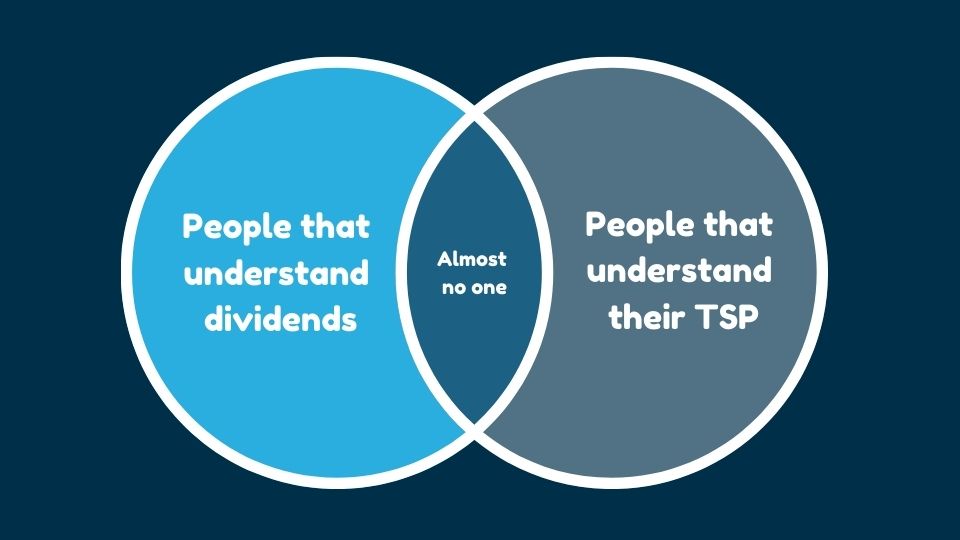

I’m convinced that most people have no idea what dividends are or how they work.

I’m also convinced that far too many people don’t fully understand how their Thrift Savings Plan (TSP) works.

And when it comes to whether or not the TSP pays dividends, let’s just say that there’s a whole lot of confusion going on.

In this article, I try to explain how TSP dividends work in simple terms so that you can be one of the few people in the center of the Venn diagram.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What’s the TSP?

- What are these weird fund choices in the TSP?

- Where are my TSP dividends?

- If I want dividends should I not invest in my TSP?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What’s the TSP?

Civilian federal employees and uniformed service members can contribute money to the TSP, a type of government retirement account. In many ways, the TSP resembles a 401(k) with the same contribution limits. TSP Investors can contribute pre-tax money into the TSP and can withdraw that money in retirement. Federal government employees can also choose to invest in a Roth TSP with after tax payroll deductions.

Read more: Traditional vs. Roth TSP which is better

What are these weird fund choices in the TSP?

One of the biggest differences between a private sector 401(k) and the TSP involves the investment options. Instead of mutual funds, the TSP has trust funds operated by the Comptroller of the Currency.

Confused about your TSP Funds? For nearly all intents and purposes, except for the G Fund which invests in government securities, they operate exactly the same way as index funds but are only available to TSP investors.

Employees can invest in stock funds including:

- TSP C Fund, which invests in companies to match the S&P 500

- TSP S Fund, which invests in small cap stocks

- TSP I Fund, which invests in international stocks

Bond funds such as the

- TSP F Fund, which invests in high quality corporate and government bonds (and follows the Bloomberg Barclays U.S. Aggregate Bond Index

- TSP G Fund, which invests in non-marketable short term government bonds and is guaranteed to not lose value

Investors can also choose to invest in the TSP Lifecycle Funds which are the TSP’s answer to private sector target-date funds.

Read more: TSP L Income Fund: Pros and Cons of a Conservative Portfolio

Where are my TSP dividends?

If you’re expecting the TSP to mail you a nice fat check from your dividends, you’re going to be waiting for a long time.

That doesn’t mean that the TSP doesn’t invest in companies that pay dividends, or that the bond fund doesn’t also generate income.

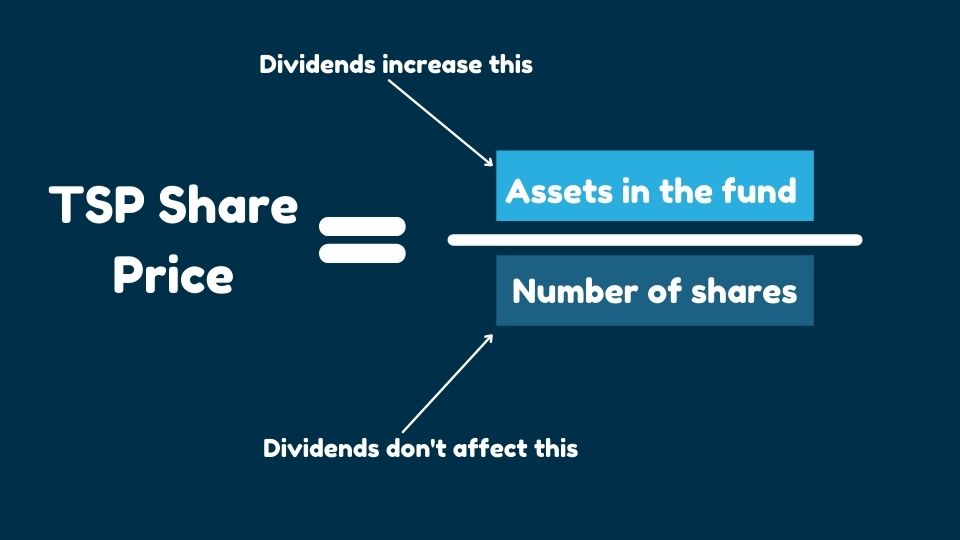

Instead, the TSP immediately takes the dividend payments and reinvests them into the fund; increasing the assets within the fund. The TSP share prices increase to reflect this increase in assets held.

If this seems confusing, it might make a little more sense to discuss what a dividend is and why a retirement plan like the TSP cannot mail dividend checks.

What is a dividend?

If you own stock in an individual company that pays dividends, they will pay you a dividend (typically quarterly).

I’m old enough to remember getting physical dividend checks in the mail but now they mostly show up electronically in your brokerage account.

The dividends you receive are a way for the company you own to return some of their profits to you.

Dividends already mess up share prices whether you know it or not

If you think the TSP’s reinvestment of dividends into an increase share price seems odd, then it’s important to take a step back and look at how dividends work.

For example, investors of individual know that stocks share prices fluctuate around the ex-dividend date and the record date.

These dates determine when you need to hold the stock to earn the dividend. Stock prices typically rise in the run up to these dates and fall afterwards. (If they didn’t, you could make a few bucks by buying a stock one date and dumping it the next).

In other words, this extra boost from the dividend payment is always incorporated into all share prices all of the time. It’s part of the efficient market hypothesis.

Why don’t I get a cash dividend payment?

So hopefully you agree with me that there is no subterfuge with TSP participants’ dividends.

The TSP owns dividend producing companies. These TSP then incorporates these dividend payments into the assets held by the fund which increases the share price.

Since both the TSP and Roth TSP are retirement accounts, they obviously cannot send you a cash dividend payment. That would count as a type of TSP withdrawal and create taxable income (and potentially early withdrawal penalties).

Instead, the money must remain within the TSP. Technically, the fund manager could place this dividends into a cash account within the TSP. For example, if you have a 401(k) or IRA that is invested in index funds, the dividends will go into a cash account within the boundaries of the IRA.

However, since money within the TSP exists only within one of five core funds, the TSP automatically reinvests the dividends for you

There’s not a huge difference between how the TSP handles dividends and what would happen if you set up an automatic dividend reinvestment at a private brokerage firm.

If I want dividends should I not invest in my TSP?

Let’s be clear. You do earn TSP dividends. In fact, you’d get the same amount of dividends that you’d get from any similar stock index fund.

However, in the TSP’s effort to reduce administrative expenses, the dividends are automatically reinvested. There’s not a huge difference between how the TSP handles dividends and what would happen if you set up an automatic dividend reinvestment at a private brokerage firm.

On the other hand, if you want to live off cash dividend payments, you’re not going to be able to do that easily in any sort of retirement account, including the TSP.

In short, the TSP dividends may be invisible, but I don’t think that’s a good reason to avoid investing in the TSP.

Get Gov Worker’s top 4 tips for federal employees!