“When can federal employees retire?” That question seems easy enough. A lot of people think that FERS retirement eligibility as an age requirement. That is- people look forward to their minimum retirement before retiring. But actually, there are a lot of important milestones along the path to a full retirement package.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- Disclaimers

- 1.5 years

- 3 years

- 5 years

- 10 years of service

- 15 years of service

- 20 years of service

- 25 years of service

- 30 years of service

- Summary

- What did my post about when federal employees can retire miss? Leave a comment!

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

I want you to stop thinking of “When can federal employees retire” as a specific age and number of years of service. Even if you’re not planning for an early retirement and want to stay in government until full retirement, you might not make it there.

A dream job might come up or you might be forced out of your job. Or perhaps you’re facing a really toxic situation and feel you need to leave government service.

Whatever your reason, I want you to understand how your federal retirement benefits package changes as you grow in your tenure.

I like to think of these service requirements the same way you’d think about leveling up in a video game. Once you’ve gained that many experience points, the game gets way easier and you can forget about how hard it was before you reached that level. Perhaps instead of asking yourself, “when can federal employees retire” you can instead ask yourself, “how long until my next retirement achievement is unlocked?”

Disclaimers

Who this post covers

This post is written for employees in civilian service under traditional retirement categories. If you’re a law enforcement agent or one of our nation’s air traffic controllers, you will have different guidelines. I would start with the Office of Personnel Management website. I wrote the guide for FERS (i.e. Federal Employees Retirement System) employees. So if you belong to CSRS (the Civil Service Retirement System), you will need to look elsewhere for information.

What this post excludes

I excluded two different retirement benefits in this post.

- Postponed Retirement– a special category of a deferred retirement available to people who have reached their MRA.

- Increase in FERS annuity calculation for people with 20 years of service and at least 62 years of age.

I wanted to write about what you can collect if you were interested in leaving as soon as possible. Also- both of these topics require their own full posts. The postponed retirement is difficult to understand and not covered very well on the OPM website. And while you can earn a higher annuity at age 62, you lose out on the FERS supplement, so I’m not sure that one is a better deal than the other.

Not financial advice, represents my personal views

This is a personal blog. I wrote it for informational purposes and it expresses my viewpoints, not that of the US Government, nor any government agency. Please do not mistake my blog for legal, financial, or human resources advice.

1.5 years

After 1.5 years of federal service, you are eligible for a disability retirement from FERS. I’m pretty sure that no one reading my blogwants to achieve early retirement by becoming permanently disabled. However, it is another benefit of working for the federal government.

You are eligible for a disability retirement if you are no longer able to perform your current job in a “useful and efficient” manner. (The FERS disability handbook goes into details about how the government defines “useful and efficient”). Furthermore, the government must certify that they cannot find reasonable accommodations to allow you to do your current position. They also must certify that they cannot move you into another position at an equivalent grade within the same commuting area. Finally, you must apply for disability benefits through social security. (Remember how I wrote that social security was more than just checks to retirees?)

The government calculates the FERS disability payments differently from the traditional FERS annuity. For the first 12 months, you would earn 60% of your high three salary minus 100% of your social security disability benefits. After that you would be paid 40% of your high three minus 60% of your social security benefits. However, if you are close to retirement age, and your earned annuity (1% x Years of Service x high three) is greater than the FERS disability payment, you can collect your earned annuity.

Again- I hope that none of you ever have to apply for a FERS disability retirement. However, I think it’s good to know all your benefits and this is a huge one because it can help you stretch your social security payments in case of a crisis.

3 years

Although 3 years does not grant you some magical powers with your FERS pension, it is a milestone worth celebrating. At 3 years you start earning 6 hours of annual leave per pay period (10 hours in pay period 26). (Note- technically this is 3 years after your “SCD for leave” not “SCD for retirement”.) (And now I wrote more parenthetical statements in this section than actual statements).

You can also celebrate a thrift savings plan (TSP) milestone after 3 years- becoming vested in the TSP. Importantly, the “vested” TSP funds only applies to the 1% automatic agency contribution. You can already access the remainder of the TSP funds (including matching contributions whenever you want to withdraw money from the TSP.

5 years

Believe it or not, the “5 year” mark was what got me thinking about this post. Someone on r/govfire asked me if it was worth it to stick around in government to the 5 year mark. As someone with nearly 20 years of government service, I had no idea what they were talking about. Then I put my thinking hat on and came up with a list of things that change once you reach 5 years of government service.

At 5 years of service, you can

- Collect a “deferred retirement” at age 62

- Retire with an immediate annuity if you are 62 years old

Deferred retirement after 5 years of service

Unless you started working for the federal government exactly at age 57, the main benefit of working 5 years for the federal government is that you can collect a deferred pension. This is a big deal. You may be asking yourself, “If this is such a big deal, how come Gov Worker didn’t know about it?” To which I can only answer that I thought you needed 10 years of service (see next section).

What is a deferred retirement you might ask? (Maybe it is time that I wrote an ultimate guide to deferred retirement under FERS so I could link to it here). A “deferred retirement” is one option for collecting your FERS retirement benefits if you leave the government before you’re eligible for a full retirement. The other option is that you can get your retirement contributions refunded to you. If you have less than 5 years of service, the refund is the only option. Working for 5 years unlocks the possibility of a deferred pension.

Why deferred retirement is important

Why is this such a big deal? Well, for starters, you may not “pay” all that much for your FERS basic benefit plan. In looking at my paystub, I contribute $37.47 per pay period towards my FERS retirement. (However, the government contributes $810.19 per pay period towards my retirement). Getting a refund would mean that I’d be giving up 95% of that money.

(Side note, if you were hired after 2013, you are contributing a lot more towards your FERS pension each pay period than I am.)

How to calculate your deferred retirement

You can calculate the value of your deferred FERS retirement annuity the same way as any other annuity. So, if you worked for the government for 5 years, you could expect roughly 5% of your final salary for the remainder of your life.

Should you stick around for 5 years just for this benefit? Let’s discuss. Getting a guaranteed payout of 5% of your salary is pretty magical. I live on less than half of my current salary; a deferred pension of 5% would cover nearly 10% of my retirement income needs.

Unfortunately, you need to think about inflation in these calculations. If you started working for the federal government 5 years ago and retired today at age 27, your “high three salary” will be frozen in 2020 dollars. When you reach the age of 62, (35 years in the future), a dollar will be worth about $0.50 after inflation (assumes 2%). So you can expect your deferred retirement in this case to replace about 2.5% of your current salary (in real dollars)- in the worst case scenario. If you were older than age 22 when you started for the government, your deferred pension will cover even more!

While I doubt you can live on 2.5% of whatever you are making now, this deferred pension is a nice benefit and will stretch your retirement savings further. (It is almost certainly better than getting your FERS retirement deposits back out as cash).

When can federal employees retire immediately with 5 years of service?

If you have 5 years of service and reach 62 years of age, you can begin collecting your FERS retirement annuity immediately. This is not an earth shattering amount of money (~5% of your salary). However, taking the immediate annuity allows you to continue your health insurance into retirement. And I would still be happy to add a guaranteed, inflation indexed sum of money to my retirement portfolio.

10 years of service

When can federal employees retire immediately with 10 years of service?

If you have 10 years of service and are at your minimum retirement age, you can retire from the government and receive an immediate annuity. The government will reduce your annuity by 5% for each year before 62 you retire. Or in other words, if you retire at 57 with 10 years of service, your annuity will be 75% of the full amount. You can calculate it through this formula: 75% x 1% x H x Y.

Importantly, you can keep your health insurance in retirement with the MRA+10 retirement. However, you are not eligible for the FERS annuity supplement. I calculated that keeping my health insurance will save me about a half million dollars over my lifetime. So reaching 10 years of service is a big deal!

Deferred retirement

Making it to 10 years as a federal employee unlocks a lot more benefits for deferred retirement. Once you reach 10 years of service, you can choose to collect your deferred FERS annuity at your minimum retirement age, or MRA. Curious about what your MRA is? While OPM provides a giant table on how to calculate your MRA, most of the table applies to people born long enough ago to be past their MRA. Most likely, your MRA is your 57th birthday; however, if you’re in your late 50s, you may have a slightly early MRA.

Before your plan on collecting your deferred annuity on your 57th birthday, you should be aware that the government incentivizes you to wait to begin your annuity. If you begin a deferred annuity at your MRA, your monthly payment will be reduced by 25%. (You can calculate your annual pension benefit by 75% of your “high three average” by the number of years of service). If you want to collect the full amount of your earned annuity, you must wait until you are 62 years old.

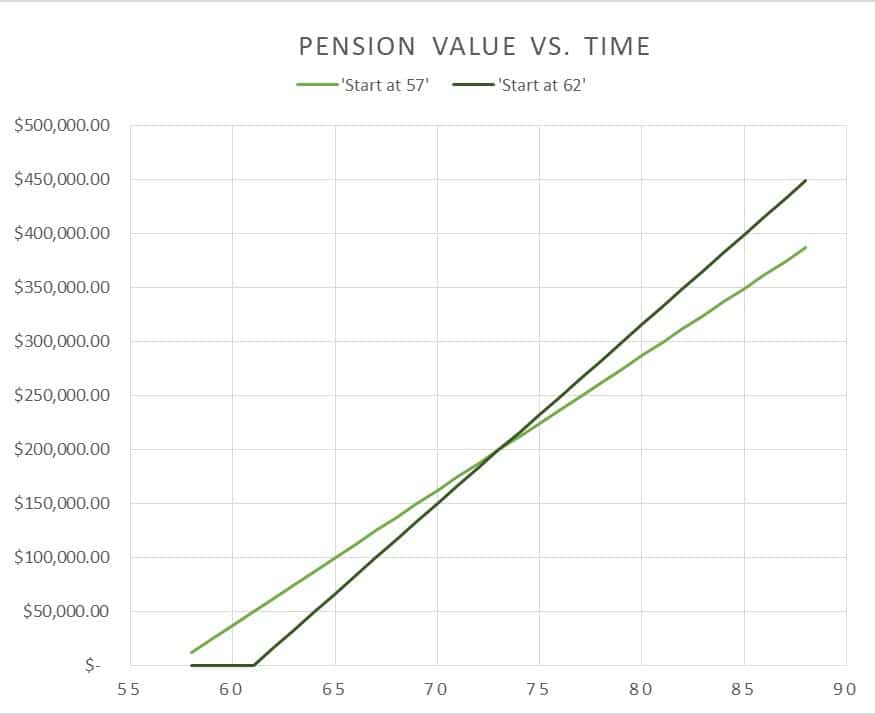

I know that sounds confusing. Also, while I’d rather have choices than not have choices- this raises the question of when you should start collecting your deferred annuity. To answer this question, you need to ask yourself if you think you’ll live longer than 76. Why 76? I made a graph to illustrate the total amount of money you can expect to collect in both retirement scenarios. Over your lifetime, you’ll collect more money waiting until 62 to start collecting if you live past 76.

Of course, I ignored the fact that you could start investing the deferred pension benefits you collect at age 57 in my simple analysis.

Death in service

Reaching 10 years of service gives you another benefit as well. If you die, your spouse will receive the “survivor benefit” of your FERS pension. In simple terms, this means that your spouse will receive annual payments that total 50% of what your pension would be on the day you died. Mathematically you can calculate this through the formula: 50% x 1% x H x Y. So for example, if you died on your 10th work anniversary and made 100,000 per year, your spouse receives $5,000 per year for the remainder of his or her life.

While this benefit starts off small, the longer you work for the federal government, the bigger the survivor benefit becomes. On a personal note, I decided to cancel my life insurance policy because we had a large amount of savings and guaranteed income through the survivor benefit.

15 years of service

While 15 years of service doesn’t change your retirement benefits, you do earn one giant benefit for reaching this milestone. You begin to earn 8 hours a leave per pay period. This might be my favorite benefit of working for the government! I like to think that I only work 0.9 FTE with all of this extra leave. Between all of this annual leave and my “maxiflex” schedule, I am able to really be there for my kids in meaningful ways. I know I could make more money in the private sector. But I have been thinking lately about what I really value in this world. Surprisingly, (or maybe not surprisingly) I have decided I would much rather be able to attend all of my kids’ cross country meets than earn an extra $50k per year.

20 years of service

Deferred retirement

When I first started hanging out on r/govfire and the ChooseFI Facebook group for federal employees, I couldn’t figure out why everyone was all super focused on reaching 20 years of service. I went through my mental milestones and nothing jumped out at me. That’s because OPM hid the biggest benefit of reaching 20 years of service in a parenthetical citation on their website. (WHY OPM‽‽‽ WHY‽)

After you leave federal service after 20 years, you can withdraw your deferred pension at age 60 with no reduction. This changes the “when to withdraw your deferred FERS annuity” question quite a bit. If you begin withdrawing at age 57 you receive a 25% reduction in your monthly benefit. However, waiting to age 60 unlocks your fully earned benefit (i.e. 20% of your “high three” salary).

If you’re on the financial independence path, you’re likely living on about half of your salary- so receiving a guaranteed 20% of your salary for the remainder of your life is a big deal!

When can federal employees retire immediately with 20 years of service?

Note- if you are 60 years old with 20 years of service, you can retire immediately with full FERS pension benefits. Your retirement benefits will be calculated by 1% x H x Y and begin immediately upon retirement.

Voluntary Early Retirement Authority (VERA)

Once you reach 20 years of creditable civilian service, you (might) unlock another retirement benefit; VERA. To take a VERA with 20 years of service, you also need to be at least 50 years old.

The government uses VERAs to reduce the size of the federal workforce when the budget is tight. I remember about 4 or 5 times my office has offered VERAs in my 20-year government career. When the government offers a VERA, they abolish that position on the organizational chart. Therefore, even if your office wants people to take a VERA, they might not let *you* take the VERA if you have a critical role in the organization?

The VERA is a sweet deal if you want to retire early. As a VERA recipient, you can

- Begin collecting your full FERS annuity immediately (i.e. 1% x H x Y)

- Retain your FEHB health insurance for the remainder of your life

- Collect a FERS annuity supplement from ages 57-62.

Basically, once you select a VERA you get all the benefits of your FERS pension before your minimum retirement age. If you want to retire early, taking a VERA will give you the most retirement benefits. However, VERAs depend on factors outside your control, so you cannot plan on taking one.

25 years of service

Once you reach 25 years of service, you’re eligible to take a VERA even if you’re younger than age 50. If you started working for the federal government right out of college, you could be eligible for a VERA as young as age 47. Again- not only does this require planning and saving money, it also involves some luck that your office offers a VERA and your job series is eligible to take it.

30 years of service

When can federal employees retire immediately with 30 years of service?

Finally, we reach the big milestone- 30 years of service. If you worked for the government for 30 years, and have reached your minimum retirement age, you are eligible for an immediate retirement benefit.

If you retired on your 57th birthday with 30 years of service, you would receive:

- A FERS annuity, equal to 30% of your “high 3 salary”

- A FERS supplement, from ages 57-62, designed to roughly match the social security benefits you’d expect to receive at age 62. You can get an estimate from your benefits statement about how big this might be. You may also wish to check with the social security administration to calculate how big your social security checks might be.

- The ability to keep your FEHB benefits. (This is a huge benefit, which I describe in detail in the linked post).

Summary

Hopefully you found this post useful. I know that I used to think of when can federal employees retire as binary- either I hit my MRA or I didn’t. In actuality, you earn another tier of benefits about every 5 years. On top of that, your pension increases by another percentage of your salary because you have more years of service. I know that as federal employees, we often get fixated on our MRA, but the reality is that even if we don’t quite make it there, we will receive some benefit for all of our time as a federal employee.

![How To Minimize Federal Tax On Retirement Pension [Avoid Mistakes]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2021/05/Federal-taxes-retirement-pension.jpg)