The first time I heard a coworker mention a TSP rollover I figured she was talking about teaching her dog a new trick!

In fact, TSP Rollovers are a useful tool for transferring money between retirement accounts.

This article will help you understand different rollover options available to current and separated federal employees.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is a rollover?

- Rollover into the TSP

- Types of TSP rollovers

- Rollover out of the TSP

- Pros and Cons of a TSP rollover

- How long does a TSP rollover take?

- Where to learn more

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is a rollover?

Rollovers refer to the process of moving retirement funds between different accounts. This article covers both rolling money into and out of the TSP.

If you change jobs, you can close accounts from previous employers and transfer the money into your new retirement accounts.

You can ask your previous account custodian to close your old account and send money directly to the TSP. This is known as a direct transfer or direct rollover.

In some cases, you can liquidate the account and mail your own check to the TSP. You must complete the indirect rollover of a valid rollover contribution within 60 days, based on IRS rules.

Rollover into the TSP

You probably already know that access to the Thrift Savings Plan (TSP) is one of the best benefits of federal employment or US military service. Specifically, if you have an existing TSP account, you can move money from most retirement accounts into your TSP.

Advantages of rolling money into the TSP

Consolidating into a single account simplifies managing your retirement accounts.

Most importantly, TSP funds have low expense ratios that help you save money on administrative expenses. The effect of paying lower investment fees compounds over time. Therefore, the longer you have until retirement, the more money you could save by rolling money into the TSP.

Disadvantages of rolling money in to the TSP

Important Note: You cannot rollover money out of the TSP while you are a current federal employee.

Your investment options within the TSP are limited to the five core funds and the TSP Lifecycle Funds. You will not have access to other common investment options within your TSP account.

There are limited ways to withdraw money from the TSP before you separate from federal service.

Importantly, the decision to roll money into your TSP can’t be reversed because you cannot rollover money out of the TSP while you are a current federal employee.

Types of TSP rollovers

Most types of retirement accounts can be rolled into your TSP.

There are several options for direct and indirect rollovers from an eligible plan into the TSP. Money is invested into TSP funds based on your existing TSP allocation setting.

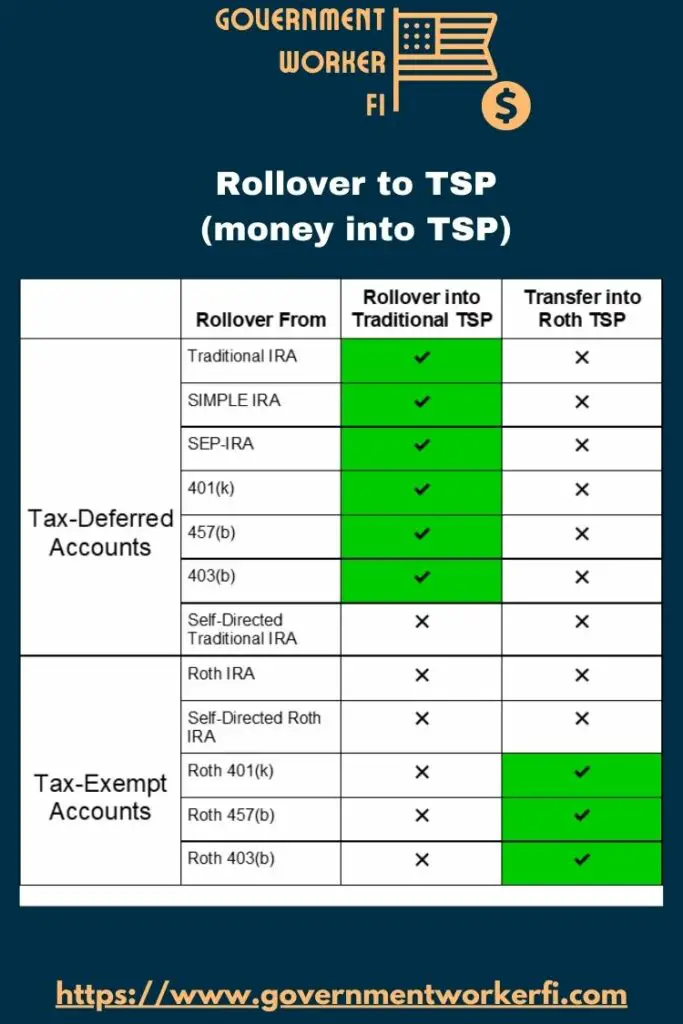

Be sure to understand the rollover eligibility requirements. Different rules apply for tax-exempt funds and tax-deferred money based on the type of account.

Can I rollover an IRA to the TSP?

You can roll a Traditional IRA into your Traditional TSP account.

However, you cannot rollover a Roth IRA into a TSP account, even if you have an existing Roth TSP account.

Can I rollover a 401(k) to the TSP?

You can roll a traditional 401(k) account into a traditional TSP account. Similarly, you can roll a Roth 401(k) account into a Roth TSP account.

What other accounts can I roll into the TSP?

You can roll tax-deferred accounts such as traditional IRAs, SIMPLE IRAs, SEP-IRAs, 457(b)s, and defined-contribution plans such as 401(k) and 403(b) accounts into your traditional TSP account. Fill out Form TSP-60, Request for a Transfer Into the TSP, to transfer traditional plan accounts into your Traditional TSP.

You can transfer tax-exempt accounts such as Roth 401(k)s, Roth 403(b)s and Roth 457(b)s into your Roth TSP. Assets from Roth accounts must be transferred directly into the TSP and are not eligible for indirect rollovers!

If your existing TSP assets are within a traditional TSP account, tax-exempt money rolled in will be placed into a new Roth TSP account. You can use Form TSP-60-R to transfer tax-exempt accounts into your TSP.

You cannot rollover a Roth IRA or a self-directed IRA into any type of TSP account.

Here is a chart showing the account types you can roll into the TSP:

Rollover out of the TSP

After separating as a civilian employee, you are eligible to rollover money out of the TSP into a different account.

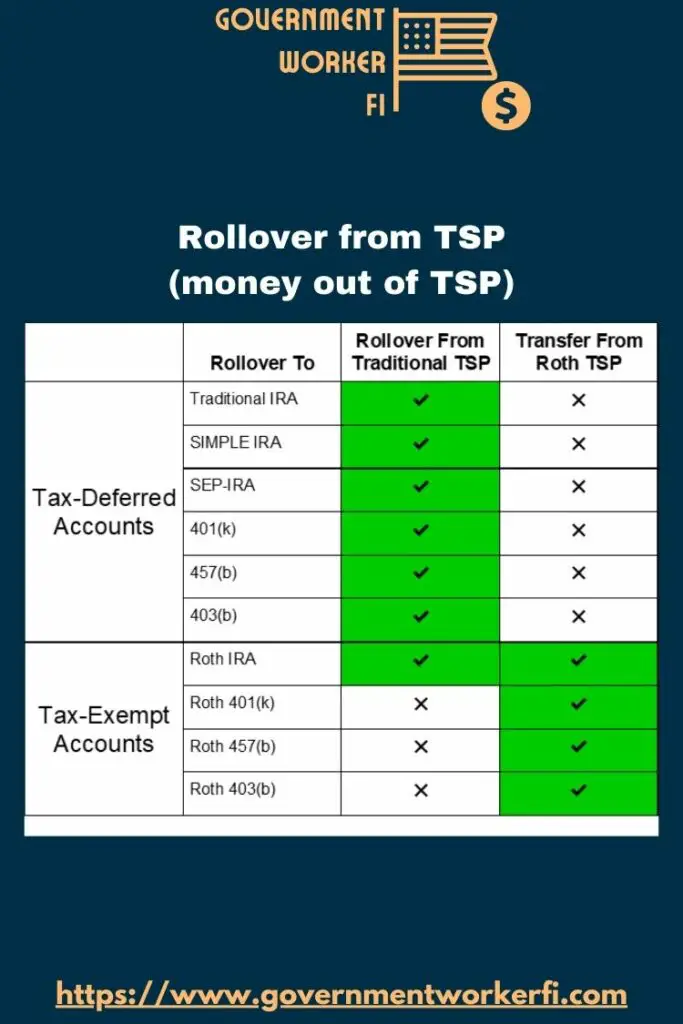

You can rollover traditional TSP assets to qualifying tax-deferred accounts, such as Traditional IRA, Simple IRA, SEP-IRA, 401(k), 457(b), or 403(b) accounts.

You can roll your Traditional TSP into a Roth IRA, which is known as a Roth conversion.

You can transfer Roth TSP accounts to qualified tax-exempt retirement accounts, such as Roth IRA, Roth 401(k), Roth 457(b), or Roth 403(b) accounts.

Here is a chart of options for rollovers out of the TSP:

Can I rollover my TSP to an IRA?

You can rollover tax-deferred contributions to a Traditional IRA, Simple IRA, or SEP-IRA.

Can I rollover my TSP to a Roth IRA?

You can transfer your Traditional TSP to a Roth IRA. This is called a “Roth conversion” and is taxable income.

You cannot transfer money from your Traditional TSP account to any other type of Roth account.

Performing a Roth conversion has major tax consequences and should be discussed with a trusted tax professional.

Can I rollover my TSP to a 401(k)?

You can rollover your Traditional TSP to a tax-deferred 401(k) account.

You can transfer your Roth TSP to a tax-exempt Roth 401(k) account.

Can I rollover my TSP while still in service?

As long as you have an existing account, you can make rollovers into your TSP account at any time. However, you cannot make rollovers out of the TSP while still in service.

Pros and Cons of a TSP rollover

Advantages of a TSP rollover

You can access a broader range of investment options by rolling your money into a different plan administrator. For example, you can invest in individual stocks, managed mutual funds, or other types of investment products outside of TSP Funds.

If you are pursuing an early retirement plan with a deferred FERS retirement, Roth conversions allow you to withdraw TSP assets before traditional retirement age.

The TSP Modernization Act of 2017 allows you to make partial rollovers of your TSP account balances. By keeping $1 in your TSP account, you preserve the option to make future rollovers back into the TSP.

Disadvantages of a TSP rollover

TSP rollovers may require you to pay federal income tax or state income tax on the distribution. Be sure to evaluate tax consequences of your rollover before moving forward.

Typically, you will pay higher fees to invest in employer-sponsored retirement plans than by sticking with TSP funds.

Tax consequences of a TSP rollover

TSP distributions are reported to the IRS and taxes may be withheld automatically if you are conducting an indirect rollover.

Rolling your Traditional TSP to a qualifying tax-deferred plan does not incur tax obligations in the current year. The receiving account custodian must certify that the account meets IRS requirements.

Rolling your Traditional TSP into a Roth IRA (also known as a Roth conversion) is a taxable event in the current year.

You must transfer Roth TSP assets directly into an eligible employer plan. You can indirectly rollover Roth TSP assets into a Roth IRA, but you may owe additional taxes based on whether the distribution is qualified.

If you have a mix of traditional and Roth TSP assets, make sure to specify which account type should be disbursed as a rollover. Otherwise, the withdrawal will be taken proportionately from both accounts.

Of course, be sure to consult a qualified financial planner for advice regarding your financial decisions!

How long does a TSP rollover take?

TSP rollover processing time varies depending on the third-party institution that you are transferring money to or from.

If you separate from service, your agency must notify TSP. Afterwards, you can access the “TSP Withdrawal Wizard” under Online Transactions in your TSP account to select rollover options.

If you are conducting an indirect rollover, make sure you understand the tax eligibility rules for completing the rollover within 60 days.

Get Gov Worker’s top 4 tips for federal employees!Where to learn more

Want to learn more about the TSP? Check out my TSP School series.

Do you have questions or comments? Drop a note in my Facebook community.

![Required minimum distributions (RMDs) and your TSP [ultimate TSP RMD guide]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2022/08/TSP-RMD.jpg)

![TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2022/01/TSP-2050.jpg)