Congratulations!

I’m guessing you found this article because you are a federal retiree who wants to withdraw money from your TSP.

The good news is that the TSP Modernization Act has greatly changed your TSP withdrawal options for the better.

The bad news is that the TSP 70 doesn’t exist anymore and has been replaced with different withdrawal forms. (Check out my post on all the details you ever wanted to know about the TSP forms for more information!)

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What’s the TSP?

- What did the TSP Modernization Act of 2017 change?

- Why the TSP 70 form was so important

- Why the TSP 99 form is better than the TSP 70 form

- Where to learn more about the TSP

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What’s the TSP?

The TSP (short for Thrift Savings Plan) is a defined contribution plan– similar to a 401(k) that is only open to civilian federal employees and members of the uniformed services.

When it began, the TSP was revolutionary for its low fees and requirement that you invest in index funds. (The TSP does not contain mutual funds, but rather trust funds that track major indices such as the S&P 500 or the MSCI EAFE international stock index.

Federal agencies match the first 5% of employee contributions dollar-for-dollar. Federal employees can contribute a maximum of $20,500 per year to the TSP (not including catch-up contributions available to those 50 and over)

What did the TSP Modernization Act of 2017 change?

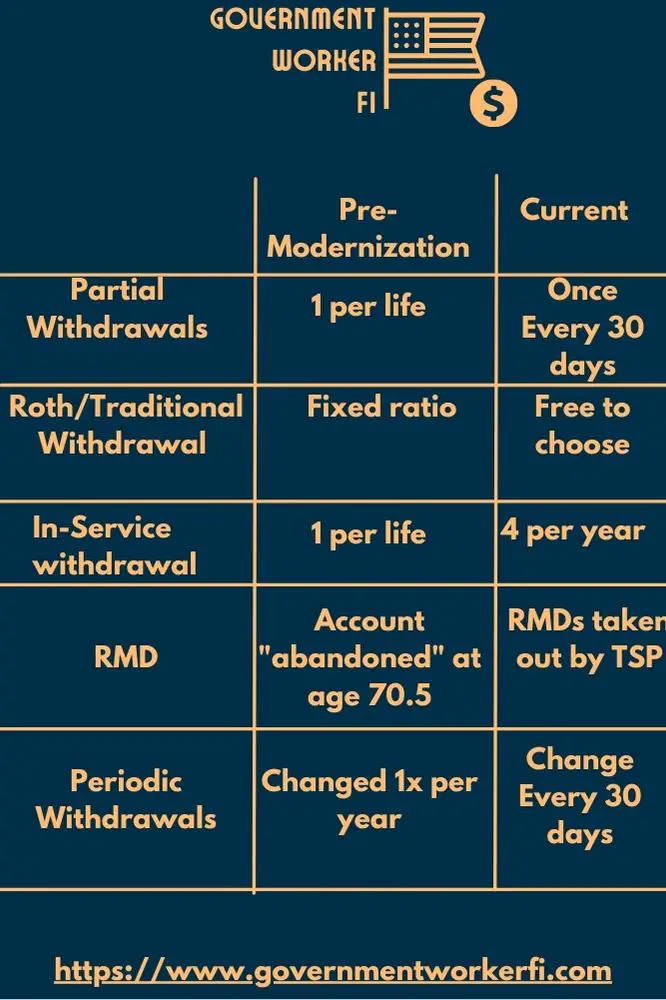

Prior to the TSP Modernization Act of 2017, getting money out of the TSP was a pain.

- You were only able to make 1 withdraw from the TSP during your lifetime (outside of fixed monthly payments or a total withdrawal). If your withdrawal request was an in-service withdrawal, either a hardship withdrawal or an age-based withdrawal, you were not allowed to make a partial withdrawal in retirement. Instead you must withdraw your entire account balance.

- Fixed monthly payments could only be changed during a short open season.

- If you still had money in your TSP at age 70.5 it was considered “abandoned” and the TSP sold your shares and moved it into the G Fund and waited for you to move all money out of the account.

- Federal employees could not choose whether to withdraw money from their Roth TSP or their Traditional TSP. Both the Roth TSP and Traditional TSP were withdrawn proportionally according to the ratio of the traditional balances to the Roth balances.

Sounds horrible right? I’m not sure why anyone would not immediately rollover their TSP to an IRA immediately upon leaving federal service.

The end of “TSP Abandonment”

One of the best changes about the TSP Modernization Act was that it ended the practice of TSP abandonment. Now if you are over age 70.5 the TSP will help calculate your required minimum distributions (RMDs) and ensure that your account is in compliance with IRS rules about retirement accounts.

Why the TSP 70 form was so important

The TSP 70 form was the “Request for Full Withdrawal” of TSP Funds. This was the only way to perform a post-separation withdrawal to an IRA or other qualified retirement account.

If you did not use the TSP 70 to get your money out of the TSP, you were stuck with fixed monthly payments or were required to purchase a TSP annuity. Neither of those were great options.

Could you imagine being retired with a million dollars in your TSP account but not be able to access it in an emergency?

Why the TSP 99 form is better than the TSP 70 form

The TSP now has one form (the TSP 99 form) that replaced the TSP 70 (Full Withdrawal) and TSP 77 (Partial Withdrawal) form.

(Looking for the TSP 99? Check out my post that explains all of the TSP Forms)

The current TSP withdrawal form (TSP 99) can be filled out electronically from within your TSP account. The form will allow you to specify the type of withdrawal you wish to make and allow you to set up recurring withdrawals or one-time withdrawal (single payment).

Post-Separation partial withdrawals can occur as often as every 30 days. If you still work for the federal government but are over age 59.5 you can take as many as four age-based in-service withdrawals per year.

The “new” TSP-99 form is so much better than the old TSP-70 form that I’m not sure why someone would still want to find it!

Get Gov Worker’s top 4 tips for federal employees!Where to learn more about the TSP

Looking for more information on the TSP? Check out my TSP School.

Want to chat with fellow federal employees on this topic? Post a question in my Facebook Group.

![TSP L 2050 Fund: [Ultimate Guide for Your Retirement Savings]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2022/01/TSP-2050.jpg)