Last fall, I made a big announcement on the blog.

I was officially transitioning to part time federal employment.

Part time work had been a dream of mine for several years. It’s like the perfect fusion of many of the benefits of early retirement without messing up my FERS pension or the ability to carry FEHB into retirement.

Now that I work part time I am able to

- Meet my kids when they get off the school bus

- Do laundry during the week instead of saving it for the weekend

- Take my dog for extra long hikes

- Spend some time on meaningful projects (like this blog and my YouTube channel)

Ever since this big announcement, my email subscribers have been asking me to write something about part time federal employment. I’ve been reluctant to do so… mostly because I felt a little bit guilty that I was able to negotiate restructuring my position into part time, which wouldn’t be possible for every position in the federal government.

In this post, I start to answer reader questions about part time employment starting with the easy questions about what part time employment does to your leave, pension, and other benefits.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What does OPM say about part time federal employment

- What happens to my pension if I switch to part time federal employment?

- Does part time federal employment affect my FEHB (Federal Employees Health Benefits)

- Do I still get vacation and sick time if I switch to part time?

- Summary- Part time federal employment is pretty sweet

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What does OPM say about part time federal employment

If you want to know anything about a federal job, there’s no better place to start than the Office of Personnel Management (OPM). Interestingly, despite the fact that part time federal employment is extremely rare in my experience, OPM has a mini-whitepaper about why part time employment is good for the federal government.

To quote OPM:

“The key to achieving family-friendly workplaces in the Federal Government is to make full utilization of all the personnel flexibilities and resources available. As an employer, the Federal Government has long recognized the value of part-time employment. Legislation encouraging part-time employment for Federal employees has been in place since 1978.“

The OPM website then goes on to mention some key directives related to part time federal employment:

- Federal Employees Part-time Career Employment Act of 1978

- President Clinton’s 1994 memo on Expanding Family Friendly Work Arrangements in The Executive Branch

If you’re like me, you’ve noticed that despite the positive language, The federal government hasn’t done anything to encourage or codify part-time employment in almost 30 years.

As we come out of a pandemic that has completely upended our perceptions of what “office work” requires, it would be great if we could also reevaluate whether government workers who sit in front of a computer all day get more done in 40 hours a week than they do in a 28-32 hour week…

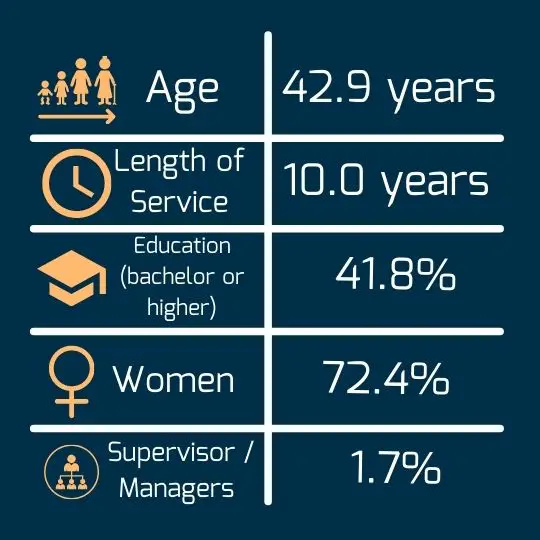

Statistics on the number of part time federal employees

The Federal Employees Part-time Career Employment Act of 1978 requires government agencies to provide a semiannual report to Congress about their part time employment activities. While I’m assuming this includes the number of part time employees in the government, the OPM website statistics on part time employment haven’t been updated since 1999. (Perhaps there was a Y2K bug in the reporting system…)

In 1999 there were around 42,000 part time federal employees. I believe this was out of a total Executive Branch workforce of 1,820,000 in1999.

That means that in 1999 about 2% of the federal workforce was part time. I would love to know what that number looks like in 2022. My guess is that it would be about the same.

If you further dive into the statistics, you will see that women make up almost 75% of the part time federal workforce. I found this a little disheartening but not surprising.

My wife and I both work part time. When my wife negotiated her part time role, everyone’s reaction was “that’s so great you will be able to spend more time with the kids“. When I told people I moved to part time work, people were shocked and then asked what I was going to do with all of my “extra” time. [It’s laundry folks…] If we want an equitable society, it starts at home with splitting domestic labor. I would love to see a society where no one would be shocked to hear that a man chose to work part time.

Can federal supervisors work part time?

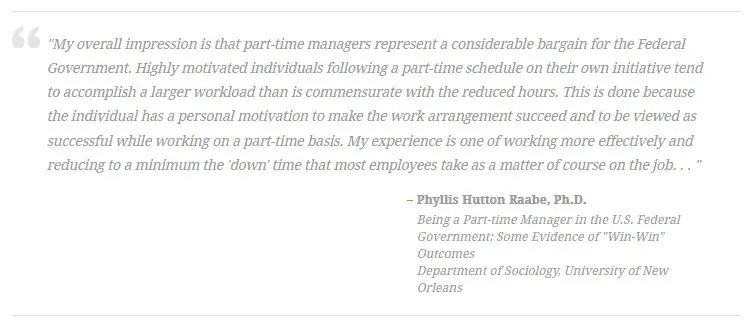

Yes! Part time federal employment is also available for supervisors. As a part time federal supervisor myself, I can’t tell you how happy I am that OPM allows this. According to those OPM statistics from 1999, less than 2% of the federal part time workforce are supervisors. But they did include this interesting quote, which I feel needs to be repeated.

I can vouch for my experience firsthand. Even though I only work 70% of the hours I used to work, I am still producing at least 90% of the outputs I did when I worked full time. And I’m happier. And the government is getting more work out of me for every dollar they pay me. It’s a win-win situation.

What happens to my pension if I switch to part time federal employment?

The FERS pension is one of the biggest benefits of becoming a federal employee. It’s part of why it is so difficult to leave your federal job before your minimum retirement age (MRA). For a federal retiree who eventually reaches his or her minimum qualification requirements, it provides a guaranteed, inflation indexed annuity for the remainder of their life.

In the simplest cases, your FERS annuity is equivalent to 1% of the average of your highest 3 years of salary multiplied by your years of service. So if you worked for 30 years and had a final salary of $100,000, your annuity would be $30,000 per year. If you retire after 62, the 1% multiplier gets bumped up to 1.1% but you lose out on the FERS supplement.

If you work part time, your annuity calculation gets much more complicated. You will need to work with your human resources department to get an accurate calculation of your expected annuity before you retire. (See Chapters 50 & 55 of the CSRS/FERS Handbook.)

However, we can go through some example math in this post.

Part time employment does not affect your years of service

Chapter 55 of the CSRS/FERS Handbook explains how to calculate a part time federal annuity.

One of the best parts of the FERS part time calculation is that you continue to accumulate 1 year of service for each calendar year you are in the position. So I will still reach my magical 30 years of service on the same date I would have reached it working full time.

The FERS annuity for part time employees is also based upon the “high 3” salary years that a full time employee would make.

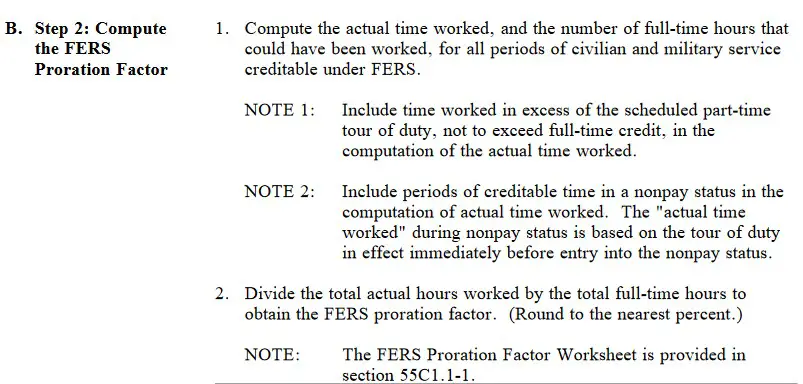

In fact, the first step to calculating your FERS part-time annuity, is to calculate a FERS annuity for a hypothetical case where you worked full time. You then multiply it by a “FERS Proration Factor” to obtain your actual annuity.

The FERS Proration Factor is calculated by dividing the total number of hours you worked over your career by the total number of hours in a full time tour of duty. (Note that the government uses 2087 hours of work per year instead of the typical 2080 hours used in the private sector.)

Let’s run through that for my situation- assuming I leave at my MRA with 35 years of service and a final “high 3 salary” of $100,000. Let’s also assume that the first 15 years of my career were full time and the last 20 were part time at my 70% FTE schedule.

In that case, my annuity would be $35,000 per year if I never worked part time.

The FERS Proration Factor would be

( 15*2087 + 0.7*20*2087 ) / ( 35*2087 ) = 0.828

So at the end of my career, my pension would be about 83% of the pension I would have earned as a full time employee (or $29,000 per year in this example)

In essence, the FERS Proration Factor is a way to properly credit your pension for periods of part time and periods of full time employment.

Note- this example calculation was for informational periods only. Please check with your HR department for an accurate pension calculation.

Does part time federal employment affect my FEHB (Federal Employees Health Benefits)

Yes. While part time employees still are eligible for FEHB, they have to pay a lot more for these benefits.

My FEHB premiums shot up by 71% per month after I went part time!!!

If you go back and read the Federal Employees Part-Time Career Employment Act they describe the process for a reduction in the amount that the government contributes to FEHB. In short, the government contribution to your FEHB is reduced in proportion to your number of hours worked (Note that if you work even 1 hour more than 0.8FTE, the government does not reduce their contributions).

Since I work a 70% schedule, the government contributed 70% of their normal FEHB payment and I was on the hook for the remainder of their contribution.

While paying this extra 30% didn’t sound like a lot of money when I was going to shift to part time, it was actually a huge financial burden. I went from paying $237.98 every 2 weeks for a high deductible health plan to $406.65 (An increase of 71%)!!!

Why do FEHB premiums go up so much for part time employees

The percent increase in FEHB cost is higher than the percent decrease in your hours because the government contributes a high percentage of the FEHB premiums for full time employees.

While some employers offer part time employees full benefits, the federal government chose to reduce benefits for part time federal employees. While on some level I understand the logic (why should the government pay the same amount if I am getting less hours of work), I think this logic completely is divorced from what many federal employees do for a living.

I’ve already stated that the government is getting a good deal since I’m producing ~90% of my previous full time job while only earning 70% of the pay. Did they really need to slash the FEHB contributions too?

Ultimately, we decided to switch to my wife’s insurance because of the large increase in FEHB premiums. While we were lucky to have that option, I would still choose to work part-time even if we had to pay the higher FEHB premiums. I’m a huge fan of Your Money or Your Life and we were in a financial situation where I could choose my life/life-energy (through part time work) over more money.

Do I still get vacation and sick time if I switch to part time?

Totally! You still continue to earn annual and sick leave when you work part time at the same rate of accrual that full time employees do.

Prior to my switch to part time, I earned 8 hours of vacation per pay period. I still earn 8 hours per every 80 hours I work (but I obviously don’t earn 8 hours a pay period because I work less hours each week). In other words, I earn 1 hour of annual leave for every 10 hours I work.

If you want more information, you can check out this Fact Sheet on Annual Leave put together by OPM.

Summary- Part time federal employment is pretty sweet

In short- part time federal employment reduces your benefits in proportion to your reduction in hours. (Although in the case of FEHB, it can be a very steep financial curve.)

As someone who is a big believer in the FIRE movement and has considered saving up and taking a deferred retirement, I am glad I explored whether or not a part-time role was possible with my agency. I feel like I’m able to combine some of the best parts of early retirement (like more leisure and family time) with the purpose and intellectual stimulation of a job I am passionate about.