Did you know that according to U.S. Department of Health and Human Services, 70% of Americans over age 65 will require long term care at some point in their lives?

Long term care insurance (LCTI) is a popular option for protecting retirement savings and assets against the high costs of long term care. However, like any insurance product, it may not be the best choice for everyone.

I’ve heard coworkers talk about long term care insurance over my federal career, but it always seemed like a decision to make much later in my life.

However, when I heard that John Hancock Life and Health Insurance Company decided to stop writing new policies for the federal government, I was shocked. I wanted to understand why they stopped writing policies and what LTCI is all about.

Table of Contents

- What is Long Term Care Insurance (LCTI)?

- Advantages of Long Term Care Insurance for Federal Employees

- Disadvantages of Long Term Care Insurance

- Federal Long Term Care Insurance Program (FLTCIP) and it’s drama

- How Expensive is Long Term Care Insurance?

- Should I Get Long Term Care Insurance?

- Alternatives to Long-Term Care Insurance for Federal Employees:

- Conclusion

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is Long Term Care Insurance (LCTI)?

Long term care insurance is a type of insurance policy designed to cover the costs associated with long term care services, such as home health care, nursing home care, and assisted living.

These services can be expensive, and according to the GenWorth cost of care study, a private nursing home room cost over $9,000 per month.

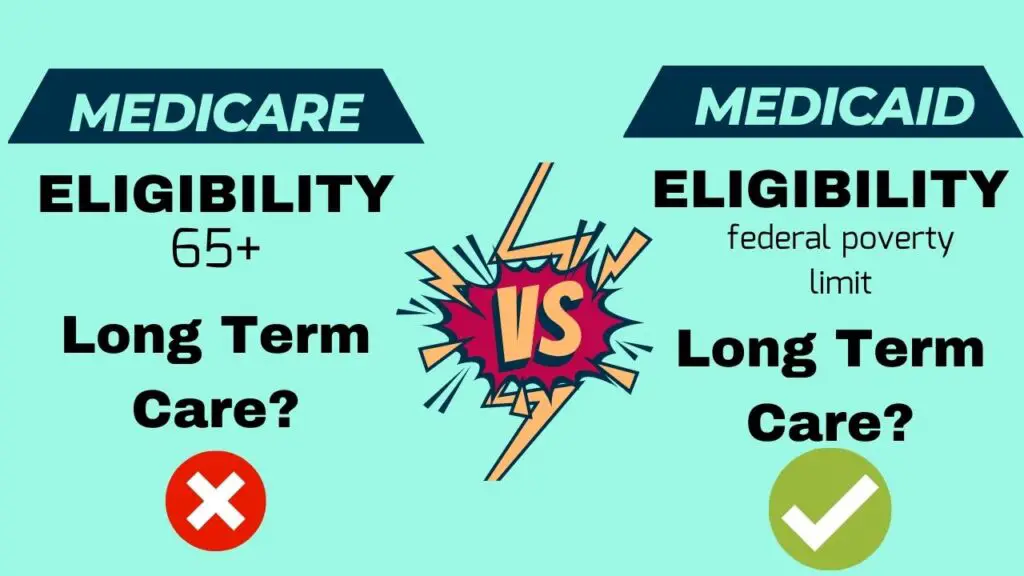

It’s important to note that Medicare typically does not cover the full cost of long term care services. While Medicare may cover some skilled nursing care and home health care services for a limited time, it does not cover custodial care or long term care services, such as help with activities of daily living (ADLs) or supervision for those with dementia or severe cognitive impairment.

Advantages of Long Term Care Insurance for Federal Employees

We all know that long term care can be astronomically expensive if you need it. Buying long term care insurance can help you have peace of mind by providing the following benefits:

- Protect your assets: Without long term care insurance, you may have to pay for the cost of care out of pocket.

- Maintain control over your care: With long term care insurance, you have the flexibility to choose the type of care you receive and where you receive it. You can choose to receive care in your home, an assisted living facility, or a nursing home.

- Provide support for your family: Long term care insurance can alleviate some of the stress and burden on your family caregivers. With coverage for professional care services, your family members can focus on providing emotional support rather than physical care.

Disadvantages of Long Term Care Insurance

While long term care insurance can offer many benefits, there are also some potential disadvantages to consider before making a decision:

- Cost: Long term care insurance can be expensive, and the premiums may increase over time. If you don’t end up needing long term care, you may end up paying more in premiums than you receive in benefits.

- Coverage limitations: Some long term care insurance policies have limitations on what types of care are covered, and for how long. It’s important to carefully review the policy and make sure it meets your needs.

- Health requirements: To qualify for long term care insurance, you generally need to be in good health when you apply. If you have pre-existing health conditions, you may not be eligible for coverage.

- Changing needs: Your long term care needs may change over time, and the policy you choose may not provide the level of coverage you need in the future.

Federal Long Term Care Insurance Program (FLTCIP) and it’s drama

For many years, federal employees and their family members could access long term care insurance through the Federal Long Term Care Insurance Program (FLTCIP).

The FLTCIP offered a range of coverage options, including both traditional and hybrid policies that combine long term care insurance with other types of insurance, such as life insurance.

Recently, the U.S. Office of Personnel Management (OPM) suspended applications for new enrollees under the FLTCIP effective December 19, 2022. The company providing the LTCI to the federal government John Hancock, stopped writing new policies. However, if you were enrolled in the program before this date, your coverage will not be affected.

According to OPM, this pause was to allow their provider to “assess the benefit offerings and establish sustainable premium rates that reasonably and equitably reflect the cost of the benefits provided”.

I don’t have any behind-the-scenes knowledge, but I’m guessing that the insurance company was paying more money out in care than they were collecting in premiums. If I were a betting man (which I occasionally am), I’m guessing that when they resume offering FLTCIP, it will be more expensive than it was before.

Warning! Long Term Care Policies are Complicated!

If you do decide to get LTCI, make sure you know what you’re signing up for.

Different policies may have different types of care they cover, how long they pay out for, and how much the premiums may or may not rise.

Make sure to read through and understand any policy you sign before signing it. (And don’t forget to shop around to make sure you’re getting the best deal possible)

How Expensive is Long Term Care Insurance?

The premiums for long term care insurance depend on a number of factors, including your age, health status, and the level of coverage you select.

According to SmartAsset.com, the average cost of long term care insurance was $2,220 per year for a single male who started paying at age 55. For a single female at age 55, the average cost was $3,700 per year. (I guess males are more likely to have a sudden death event like a heart attack and not need long term care).

The premiums increase as you age, so the earlier you enroll, the lower your premiums will be. It’s important to note that the cost of long term care insurance can be significantly higher for individuals with pre-existing health conditions or who are older when they enroll.

Unlike life insurance where you lock in a fixed premium, LTCI can increase premiums as you age. LTCI premiums may increase beyond the level you can afford them in the future. And since you lose coverage when you stop paying your premiums, when you sign up for LTCI, there’s a possibility you’ll pay premiums for decades only to lose out on coverage in the end because the insurance company jacked up the rates.

Should I Get Long Term Care Insurance?

If you’re a long time reader of the blog, you’ll know that just like TSP asset allocations or TSP strategies, there’s no one-sized-fits all answer to this question.

It really depends on what your financial situation is like and what your goals are. The only federal employee I know to have long term care insurance coverage died suddenly before they even retired.

Long term care is scary.

Nobody wants to think about themselves being unable to care for themselves. However, the good news is that if you do need long term care at the end of your life, it is likely that you will not have the cognitive ability to care for yourself… or worry about your finances.

While you may be blissfully unaware of how this is affecting the nest egg you worked your whole life to build, it may impact your spouse or children.

Dying with Zero

While many people want to leave a large legacy for their heirs, Bill Perkins gives an interesting take on legacies in his book “Die with Zero” which I strongly recommend. Perkins argues that it’s better to enjoy your wealth while you’re alive and give meaningful gifts to your heirs while they’re young enough to appreciate them.

If you end up so poor that you need Medicaid to pay for your nursing home, Bill Perkins would commend you for getting the most out of every dollar you spent while you could still enjoy them.

While it might be reckless to spend everything down to zero, I think the book contains some valuable ideas. After reading it, I want to make sure that I give money to my children:

- When they’re young enough that it could make a difference in their life choices

- I’m young enough to see the good it will do in their lives

Alternatives to Long-Term Care Insurance for Federal Employees:

While long-term care insurance can be a valuable tool for protecting your assets and ensuring access to quality care in the future, it’s not the only option available. Here are some alternatives to consider:

- Medicaid: If you’re not concerned about leaving money to your heirs, you can plan to liquidate all of your assets to pay for long-term care. Eventually, you may be eligible for Medicaid, which can cover end-of-life expenses.

- Personal Savings (“Self-Insurance”): Another option is to save a significant amount of money for long-term care expenses. This is especially viable for those who are still young and healthy enough to save money for the future. Depending on how much care you need, you may still end up on Medicaid if you need a lot of end-of-life care.

- Family Caregiving: Many people, rely on family members or caregiving support at the end of their lives. While this option may be a cost-effective, it can be a giant emotional and financial burden on other people in your life.

- Hybrid Policies: Hybrid policies, such as life insurance policies with long-term care riders, can provide another approach to long-term care planning. These policies offer death benefits if you don’t use the long-term care coverage, but if you do, they can provide a pool of funds to cover your expenses. Again, these policies may be extremely complicated. Make sure you read the fine print before signing up for one.

Ultimately, the decision to purchase long-term care insurance or pursue an alternative option depends on your personal goals and financial situation.

Conclusion

In conclusion, long term care insurance is an important consideration for federal employees who want to protect their assets and ensure their loved ones are taken care of in the event of needing long term care. While it’s not the right choice for everyone, it can offer peace of mind and flexibility in choosing the care you need.

Remember to consider all of your options, including alternatives such as Medicaid and personal savings. If you’re a federal worker who is considering LTCI, I strongly recommend you work with a financial advisor before making a decision. Also- it never hurts to shop around. While you’ll have access to FLCIP in the near future, it might not be the best game in town.

If you want to learn more about retirement planning, I encourage you to check out my YouTube channel or Facebook community. There, you can find valuable information and connect with other federal employees who are navigating the complexities of retirement planning.