If you want to grow your wealth and have a secure financial future, health insurance is a must. Over 70% of bankruptcies in the United States were caused in part by medical debt.

Luckily, most FERS employees are eligible to continue your FEHB enrollment as an annuitant. But what about family members and spouses? Can they continue their health benefits coverage on your plan even after you retire?

In this article, I’m going to do a deep dive into FEHB spouse coverage after retirement and answer the biggest questions you might have.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- My spouse is on my FEHB now. Can they stay on my FEHB after I retire?

- What happens to my federal employee health benefits (FEHB) if I get divorced after retirement?

- Can I add a spouse to FEHB after I retire from the federal government?

- If I pass away does my spouse lose FEHB coverage?

- I’m not retired yet. If I die can my spouse keep our coverage under FEHB?

- What do I need to do to make sure my surviving spouse is eligible for FEHB coverage ?

- Can my surviving spouse change to a lower-cost plan?

- Summary: Spousal FEHB coverage in retirement

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

My spouse is on my FEHB now. Can they stay on my FEHB after I retire?

The short answer is yes.

If you are enrolled in a family plan or a self-plus-one FEHB plan, your spouse can continue FEHB coverages even after you retire, even if your spouse is not a federal employee. You continue to pay the same percentage of your insurance premiums that current employees pay. However, retirees are charged monthly instead of biweekly.

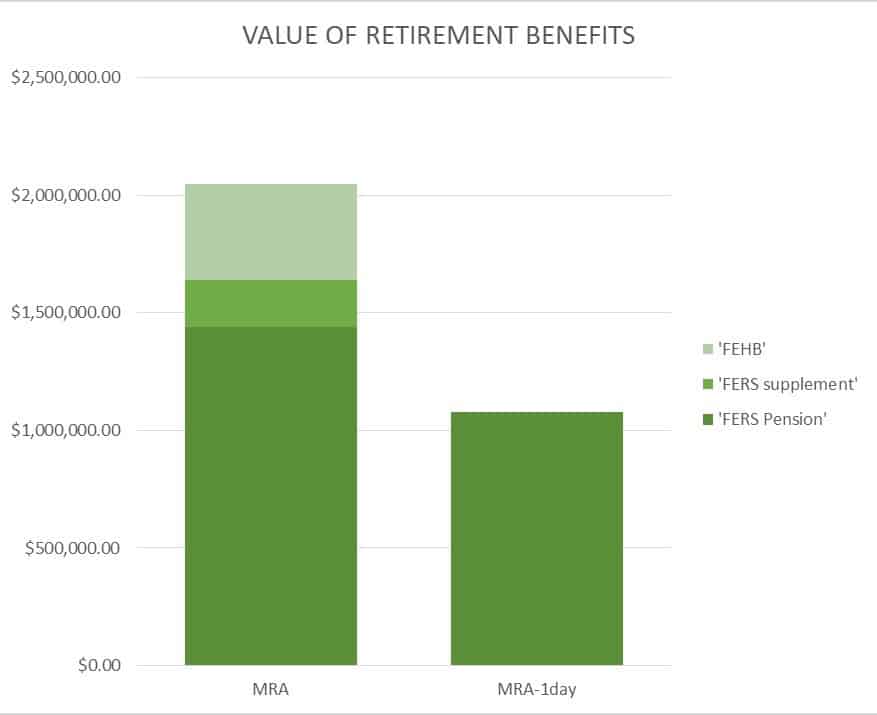

As I’ve said many times on this blog, the ability to carry FEHB coverage in retirement is one of the most valuable parts of your FERS retirement system. When I ran the numbers for my own scenario, I calculated that keeping FEHB in retirement would save me at least $400,000 over the rest of my lifetime.

Like all government benefits however, there is a lot of OPM legalese to dive through to understand health benefits coverage for you and your spouse in retirement.

Because this is such a difficult topic, I interviewed an expert, Brian Sigwart. Brian is a certified financial planner with Cummins and Associates Financial Group. He focuses his practice on educating federal employees how their benefits work. If you want to speak to a certified financial planner who knows federal employee benefits, you can contact him here.

What happens to my federal employee health benefits (FEHB) if I get divorced after retirement?

Sometimes life doesn’t always go as planned. According to the census bureau people aged 55-64 are the most likely to be divorced. When coming up with your retirement plan, it’s good to make sure that you’d be able to live comfortably with or without your spouse.

Luckily, if you’re a retired federal employee, you can drop the spouse from your FEHB plan and enroll in a lower-cost plan or option after a divorce. However, if you are a spouse reading this article, you may want to think through how you will obtain coverage in the case of a divorce.

What if my spouse carries the FEHB coverage and we get divorced after retirement?

If you’re a federal spouse facing a divorce, you are eligible to continue FEHB for 18 months while you find new insurance through a COBRA. Unfortunately, you’ll need to pay both the employer and employee contributions to the insurance plus an extra 2%. While this is a lot of money for insurance, it gives you some time to find a new plan.

Can I add a spouse to FEHB after I retire from the federal government?

Let’s flip the script and say that you want to get married in retirement. You can add a new spouse to your FEHB at any time (even in retirement) as it is a qualifying life event.

It’s also possible to add a current spouse to FEHB after you retire. Perhaps your spouse still had insurance through his job but is now retired. In this case, you can only change your FEHB enrollment during open season. So you’ll want to plan ahead to make sure that you can continue coverage for your spouse without any gaps.

If I pass away does my spouse lose FEHB coverage?

In most cases, your spouse will not lose FEHB coverage if you were to pass away. The only way that your spouse would lose coverage is if you chose to waive all survivor benefits to your FERS pension.

FERS Pension and the Survivor Annuity

If you die as a federal employee or retiree, your spouse is eligible for a survivor benefit. For FERS employees, the maximum survivor benefit payable is 50 percent of your unreduced annuity. This is the default scenario. However, you have 3 options. Here’s the exact language from the SF3107 (Application for Immediate Retirement):

- I choose a reduced annuity with maximum survivor annuity for my spouse named in Section C. If you are married at retirement, you will receive this type of annuity unless your spouse consents to your election not to provide maximum survivor benefits. If you receive this annuity, your annuity will be reduced by 10%. Your spouse’s annuity upon your death will be 50% of your unreduced earned annuity.

- I choose a reduced annuity with a partial survivor annuity for my spouse named in Section C. If you choose this option, your annuity will be reduced by 5%. Upon your death, your spouse’s annuity will be 25% of your unreduced earned annuity. You must have your spouse’s consent to choose this option. Complete form SF 3107-2, Spouse’s Consent to Survivor Election, and attach it to your application.

- I choose an annuity payable only during my lifetime. If you are married at retirement, you cannot choose this type of annuity without your spouse’s consent. No survivor annuity will be paid to your spouse after your death if he or she consents to this election and any health benefits will cease. In addition, your spouse will not be eligible to enroll in the Federal Long Term Care Insurance Program, if he/she is not enrolled at the time of your death. If you are married and elect this, complete form SF 3107-2, Spouse’s Consent to Survivor Election, and attach it to your application.

So- as long as your spouse will receive a survivor benefit (either options 1 or 2 above) he or she will be eligible for FEHB even after you pass away. If you have elected option 3, your spouse would not be entitled to a survivor annuity and would not be able to continue health care coverage through FEHB.

I’m not retired yet. If I die can my spouse keep our coverage under FEHB?

The short answer is yes. It is likely that your spouse will be covered under FEHB even if you die in service if you are currently enrolled in FEHB.

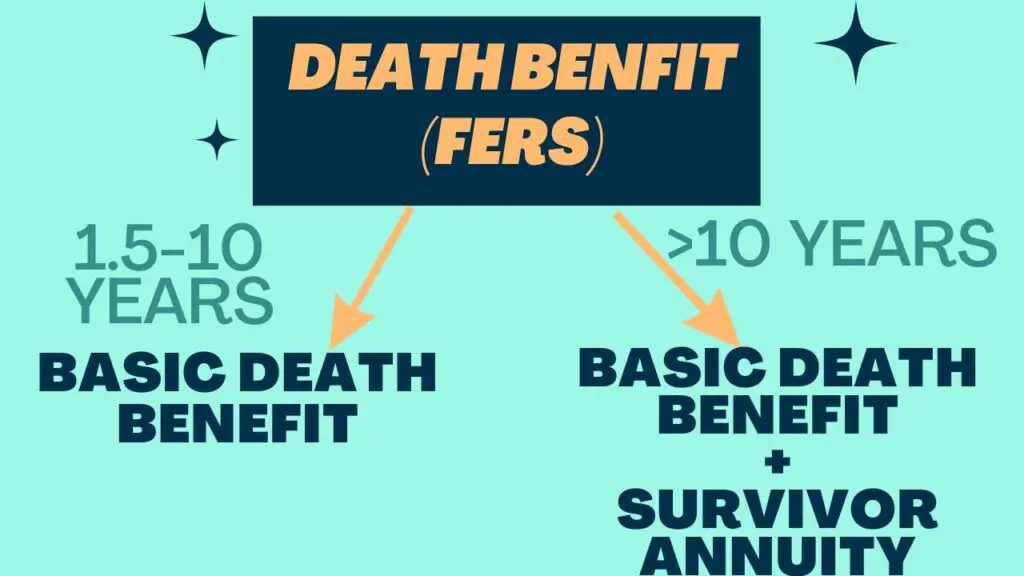

If you have been a federal employee for at least 18 months, your spouse is eligible to receive the “basic employee death benefit”. The basic death benefit is equal to 50% of your salary plus an additional $32,423.56. Leave it to the government to come up with such a random number. Brian has told me that this additional amount has been inflation adjusted to around $43,000 in 2023.

If you’ve worked for the government for over 10 years, your spouse will also receive a annuity payment, equal to 50% of what your unreduced pension would have been. (i.e. 0.5*(years of service)*(average of high three salary)*1%).

If you are eligible for the basic death benefit (i.e. 18 months of service), your spouse and surviving family members can continue to be covered under an FEHB plan even after your death.

What do I need to do to make sure my surviving spouse is eligible for FEHB coverage ?

If you want to make sure your surviving spouse can continue FEHB, just make sure they are entitled to a survivor annuity. As long as they have an entitlement to a survivor annuity (either a partial or full annuity), they should be set. If your surviving spouse will not receive an annuity, they will also lose FEHB coverage on the date of your death and will need to find private insurance or rely on Medicare instead of FEHB coverage.

Can my surviving spouse change to a lower-cost plan?

Yes- former spouses can change their health benefits enrollment during open season, or after a qualifying life event (like your passing). If you were under a self-plus-one or family plan, your surviving spouse can change coverage as a survivor annuitant.

Summary: Spousal FEHB coverage in retirement

FEHB coverage into retirement is an important topic to get right to protect your wealth in retirement. While no one wants to think about sickness or death, it’s important to set your family up for success.

However, when it comes to FEHB spouse coverage after retirement, the path is pretty clear. If you want your spouse to be eligible for FEHB after you pass away, make sure you elect at least a partial survivor annuity.

If you want additional help in setting up a wealth management plan for your family, feel free to reach out to Brian Sigwart, who helped me write this article.