Are you a federal employee or military member with a Thrift Savings Plan?

Would you like to have a million dollars in your TSP?

If so, this post is for you!

I break down what you need to save each pay period to become a TSP millionaire by your minimum retirement age. I also have a handy spreadsheet tool you can use to run your own numbers.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- Why become a TSP millionaire

- How to become a TSP millionaire

- What you need to become a TSP millionaire at any age

- My TSP Millionaire Tracker Tool

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

Why become a TSP millionaire

Before we dive into the specifics of how to become a TSP millionaire, it’s important to understand why it’s an essential goal for federal employees.

Having a solid TSP balance provides flexibility and security in retirement, especially at your minimum retirement age when your retirement might last 30 yeas. (Or more if you live to be a centenarian!)

While federal employees receive generous retirement benefits, such as a pension and social security, these benefits may not be enough to cover all expenses in retirement.

A TSP millionaire status provides the opportunity to retire on your own terms, with the freedom to pursue your passions and dreams without worrying about financial constraints. Additionally, a substantial TSP balance can help you weather unexpected expenses or emergencies in retirement.

It’s important to note that while becoming a TSP millionaire may seem like a lofty goal, it is achievable with consistent saving and investing over time. So let’s explore the specifics of how to become a TSP millionaire, starting with the significance of starting young and taking advantage of compound interest.

How to become a TSP millionaire

Becoming a TSP millionaire requires consistent saving, and starting young is key to taking advantage of compound interest and having your money work for you.

The younger you are, the easier it is to become a TSP millionaire due to the power of compound interest. However, it’s definitely still possible to reach $1,000,000 in your TSP by your MRA even starting at age 40.

It’s not just saving for years that will help you reach millionaire status. You also need to make sure your TSP allocation can help you get to the millionaire mark.

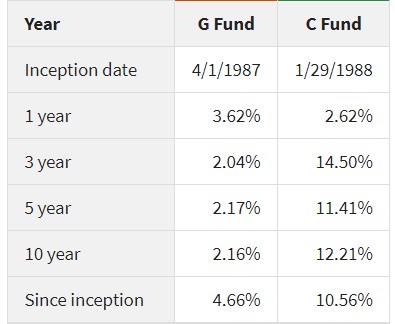

For example, the C Fund has average annualized return of over 10% since inception, whereas the G Fund only has a return of 4% per year.

Including stocks (like the C,S, or I Funds) in your TSP will add risk to your portfolio. But it can also help you get the returns you need to reach millionaire status.

Note that reading a blog post is not a substitute for actual financial advice. Your financial picture depends upon your age, number of dependents, health, and a million other factors. Please seek professional help before making a large change to your financial plan.

What you need to become a TSP millionaire at any age

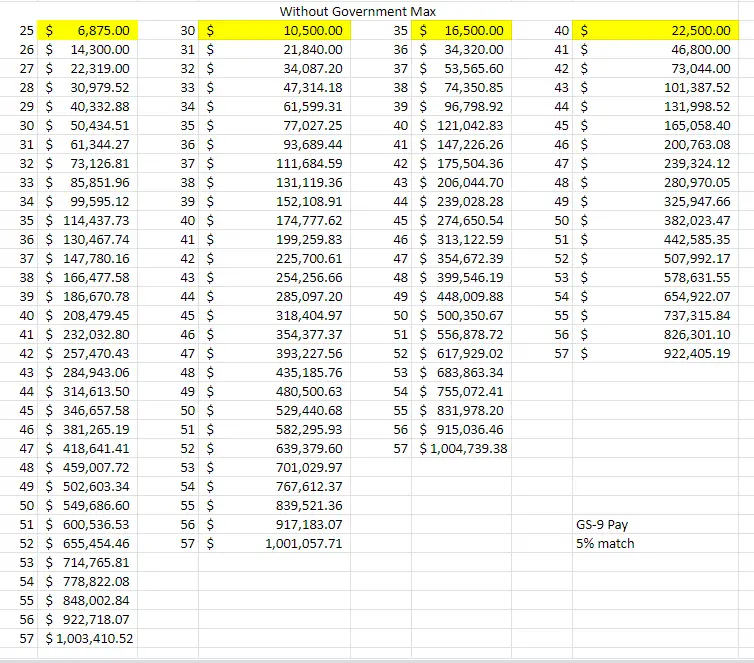

For the remainder of this post, I’m going to share what it would take to become a TSP millionaire by age 57. I’m assuming a return of 8% per year for these calculations. This is consistent with a prediction of mostly stocks and is not a guarantee of becoming a millionaire.

Here is how much you’d need to save to become a TSP millionaire by your MRA starting with a balance of $0 in your TSP:

- At age 25 $6,875

- At age 30 $10,500

- At age 35 $16,500

Note that these numbers do not include the government match. For a GS-9, step 1 employee in the Rest of the US pay scale, the government match is $2,886 per year.

With the government match you’d need to save:

- $155 per pay period starting at age 25

- $294 per pay period starting at age 30

- $635 per pay period starting at age 35

Kind of crazy how waiting until age 35 to start saving for retirement triples the amount you’d need to save each pay period to reach millionaire status.

What if you’re over 40?

If you started at age 40 and contributed the maximum amount each year ($22,500 until age 50, $30,000 per year afterward) you’d end up with $922,000 at retirement without government matching contributions.

However, if you are at least a GS-9, step 1, the $2,886 in matching contributions combined with the maximum contributions to the TSP would allow you to reach millionaire status by your minimum retirement age.

If you’re much over 40 and still have zero dollars in your TSP, then it might not be a realistic goal to reach TSP millionaire status by your minimum retirement age. However, you may wish to continue working past your minimum retirement age. In that case, you still might reach $1,000,000 before you want to withdrawal from your TSP. Especially if you contribute the maximum legal amount to your TSP.

My TSP Millionaire Tracker Tool

I created this free spreadsheet to help you run your own numbers to see how much you’d need to save or when you could potentially become a TSP millionaire.

For instructions on how the spreadsheet works, check out this video I made.

Please note that the spreadsheet is not financial advice. Nor is it a guarantee of future results. It’s just kind of a fun tool to play around and see how big your TSP balance might be by the time you reach retirement age.