The year I graduated college, I was eavesdropping on a conversation between two older men at a conference, when I heard the craziest thing.

One of the men offered an ultimatum to his employer.

He told them that he would quit unless they granted him one day off per week, one week off per month, and one month off per year.

And I was even more shocked to hear that his employer (non-government) approved his request. This man was a valuable part of his company. They clearly didn’t want to lose his expertise. And while the man could have retired, he still enjoyed some parts of his job enough that he wanted to stick around for a little bit.

Even though I was only 22, I knew I wanted to be like this man someday. And in 2014, the government started offering their own phased retirement program for federal employees that’s kind of like this man’s dream employment.

If working less sounds good to you, keep reading to find out how to make it a reality.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is Phased Retirement?

- Why did the government create a phased retirement policy for federal employees?

- How does phased retirement for federal employees work?

- Can I use phased retirement if I’m younger than my MRA?

- Are all federal jobs eligible for phased retirement?

- Great. My job is eligible for phased retirement. Should I start booking tee times every afternoon?

- Federal employee phased retirement case study

- Where can I learn more about phased retirement for federal employees?

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

What is Phased Retirement?

Phased retirement is a relatively new option for federal employees. OPM finalized the regulations on August 8, 2014 and agencies implemented their programs on November 6, 2014.

Federal employees who take a phased retirement work a part time schedule (0.5 FTE) and receive part of their FERS pension (annuity) that they earned throughout their federal career. Employees who engage in phased retirement are required to spend a portion of their working hours (20%) mentoring new employees.

Why did the government create a phased retirement policy for federal employees?

Anyone who has worked in the federal government knows that federal employees have very specialized, highly skilled jobs; many of which are unique to the government. When a federal employee leaves, it often creates a knowledge gap. The government instituted this program to “enhance mentoring and training of the next generation of federal employees who will be moving into senior-level positions.”

How does phased retirement for federal employees work?

Federal employees in phased retirement receive 2 paychecks! They continue to receive a biweekly paycheck from the government for the hours they have worked (50% of their previous salary). They also receive a retirement annuity check.

The retirement annuity for phased retirement is calculated using your phased retirement date. The government will calculate your phased retirement annuity using the same formula as they would for a normal retiree

1% x (years of service) x (average of highest 3 years of salary)

Then they will divide that amount in half.

In other words a federal employee in phased retirement will be paid 50% of their current salary and 50% of their earned annuity.

That means that while a phased retiree only works half-time, they will earn more than half their salary.

What happens to my TSP in phased retirement?

Since you are still an employee, you can continue to make contributions to your TSP during phased retirement. (This can be a great way to lower your taxes in your last few income earning years.)

On the other hand, while a normal retiree could choose to roll their money out of the TSP, phased retirees have the same rollover restrictions as a normal employee.

Can I use phased retirement if I’m younger than my MRA?

When phased retirement first came out, I remember excitedly reading the announcement. Since I started working for the federal government when I was 18, I thought that I might be able to use phased retirement to coast into my 57th birthday.

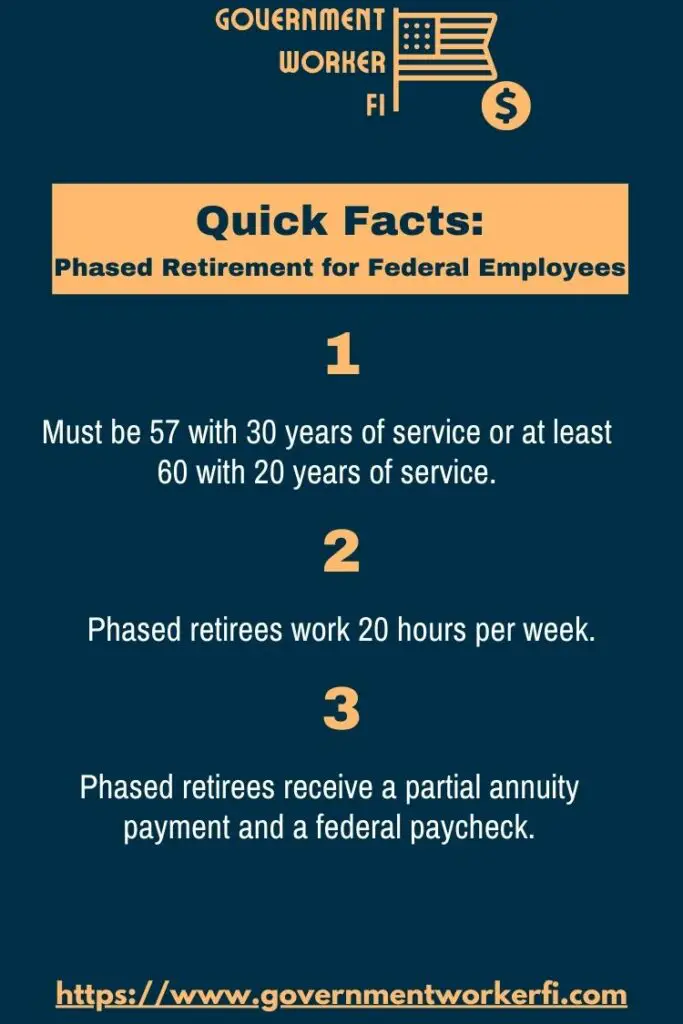

Unfortunately, phased retirement for federal employees is only open to employees eligible to retire with an immediate annuity. In other words, unless you are at your MRA with 30 years of service or have 20 years of service and are age 60, you cannot engage in phased retirement.

Are all federal jobs eligible for phased retirement?

I was surprised to learn that most federal jobs are eligible for phased retirement. Since the justification the government provides for the program focuses on mentoring, I would have assumed that only high level supervisory jobs would be eligible for the program.

Instead, most of the jobs excluded from the eligibility are in the FERS special category with a mandatory retirement age and an early MRA such as

- Law enforcement officers

- Fire fighters

- Air traffic controllers

- Nuclear materials couriers

- Capitol police

- Supreme Court police

- Customs and Border Protection (CBP) officers

Furthermore, you maybe excluded from the program if you are already working a part time schedule.

Great. My job is eligible for phased retirement. Should I start booking tee times every afternoon?

No! Phased retirement is not a right. In fact, both the government and the employee need to agree to the phased retirement is a good idea. So, before you get too excited, you should ask yourself,

- Would my boss be supportive of this?

- Would my boss’s boss sign the paperwork?

- Can I make the case that this phased retirement helps the office?

Federal employee phased retirement case study

While I remember the fanfare around phased retirement when it first came out in 2014, I hadn’t heard of anyone using the program. In fact, I think if you polled all of the employees in my office about the program, 99% of them would not even know this program existed.

To get some more context to write this article for the blog, I posted a question on the FedFam Facebook group. This group has over 25,000 federal employees and federal contractors in it. I was hoping to hear from several employees who took advantage of this program. However, only one person had firsthand experience of the program.

Shanna’s story

I received a nice message from Shanna, a USDA employee who just got approved for phased retirement. Shanna’s husband also works for USDA and is hoping to retire in 2023. While Shanna is younger than her husband, she also meets the MRA+30 criteria and could, in theory, retire today. Shanna and her husband wanted to retire around the same time but were worried about cashflow around their retirement date since they’ve heard that it is taking 6-8 months to receive your first pension payment in retirement.

By taking a phased retirement now, Shanna is able to have a much more enjoyable summer with a reduced work schedule. She also plans to continue working after her husband retires for a few months until his annuity starts showing up. This seems like a great strategy for dual federal households because the alternative of retiring on the same day could leave a big income gap.

Expect to be a trailblazer if you want a phased retirement

Shanna shared with me that she was the first phased retirement that her human resources department had ever seen. In fact she said that her human resources contact found a file in a filing cabinet labeled “phased retirement” but that it was empty. (As a federal employee myself, none of this surprised me.) Shanna did what I would have done in that situation; she educated herself on the OPM website, and advocated for herself to her supervisor and HR.

Although the process unsurprisingly had hiccups (confusion regarding which forms to fill out) and management told her many times that it may eventually get denied, Shanna was approved for a phased retirement earlier this year.

She is planning on working 10 hour shifts so she can have a 5-day weekend and a 2-day workweek. (Sounds pretty sweet… doesn’t it?)

Get Gov Worker’s top 4 tips for federal employees!Where can I learn more about phased retirement for federal employees?

As always, OPM has all of the official information you will need. They have all of the forms that you’ll need to give to human resources on the page. In addition, I found they had some helpful example calculations of how the partial annuity was calculated.

![How To Minimize Federal Tax On Retirement Pension [Avoid Mistakes]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2021/05/Federal-taxes-retirement-pension.jpg)

![How Much Do Federal Employees Contribute To Pension [Ultimate Guide]](https://cdn-0.governmentworkerfi.com/wp-content/uploads/2021/08/FERs-contributions-featured-image.jpg)