One of the best part of writing a personal finance blog is getting to interact so closely with other personal finance bloggers. A few months ago, I “met” Darcy who created a personal finance website called “WeWantGuac” in January of 2020. Although she’s only been blogging for a few months, she is prolific, publishing almost daily. (It’s an epic struggle for me to get my weekly posts out on time and I have no idea how she does it.) I really love Darcy’s posts. She is really great at weaving history and current events together. For example she has several posts about how we can look to how the economy shifted during the bubonic plague for clues as to what might happen with the coronavirus. She also has a great post about how to use job searching techniques from The Great Depression to land your next job in 2020.

Part of running a successful blog is writing guest posts for other bloggers which introduces new readers to your blog. Since I’m such a big fan of Darcy, I invited her to write a guest post for my site. She did a phenomenal job of comparing pay within and outside of the government. Obviously Darcy and I see the matter differently because we’re on different sides of the public-private divide. However, I learned a lot from her article and hope you do too. If you’re interested in reading more of her posts, here are some good ones to check out:

- The Greatest Rulers in History Were Strategically Frugal

- What Helped and Didn’t Help Me Reach $100k at 25

- Dreams and Goals and Money: Are Yours United?

While hanging around at home I’ve been plowing through The Blacklist on Netflix. In Season 1 (SPOILER ALERT) the FBI manages to capture an interesting international terrorist; specifically, a guy heading an anti-capitalist organization who’s planning on widespread money forgery. As he’s being arrested, the leader turns to Agent Ressler and comments:

Is it really worth it, this job? Risking your life for, what, the privilege of living in some crappy studio apartment?

Hearing that I scoffed – surely FBI agents make bank for all the special ops they do; they can afford more than a crappy apartment. But then I realized I didn’t know the actual numbers at all. And not just for specialized federal agents, but for government employees in general.

It’s simple stuff to find out how much you should be paid in the private sector, as the market rate will tell you that very easily. But the government doesn’t operate in a marketplace; it’s not like there’s a bunch of governments you can choose to work for like there are companies. In absence of that, do they pay the same as their private-sector counterparts? It’s not like your government salary is tied to company performance metrics, after all.

But it’s not just pay that makes government jobs different. There’s a lot more rules and program offerings than what I’m familiar with as a marketer in a software company. Some of these rules can constrict you on the climb to wealth, but some of those programs can also accelerate it.

Let’s compare the two sectors and see which one lends itself better to financial freedom.

Going Head to Head

Going into this I was positive the private sector would wipe the floor with the government sector. I mean, come on. Government employees are overworked and underpaid, right? They’re constantly under surveillance and have the added occupational hazards of getting harassed by people in a tizzy over tHoSe gOd FoRsAkEn fEdS. Or, if Hollywood is to be believed, a lot of dramatic kidnappings that involve lots of helicopter sequences and car explosions. Nobody’s gunning to kidnap some dorky marketer like myself in some high-stakes hostage situation. That’s for government-associated people to worry about.

Well, then I spoke with government employees like our very own Gov Worker. I also reached out to my friend Josh Overmyer, who works for Florida governments as a floodplain manager. And it turns out Hollywood, to no one’s surprise, got it wrong.

The Pay Comps

As mentioned before, the pay structure in the private sector (i.e. everything outside of government) is relatively straightforward. All I need to do is ask Google what the given salary is and sites like Glassdoor will immediately give me the answer. This might change depending on what city the job’s located in, but overall you have a good idea of how much a job will pay. Plus, there’s always the potential for some impressive raises or a nice bonus.

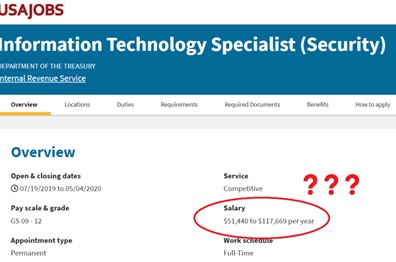

Government work, on the other hand, plays a different ball game. The pay range for any given government job title varies WILDLY. People don’t talk enough about finance as it is, and these super-broad pay ranges really don’t help. Entry-level jobs can be $45k a year, or up to $73k. More senior jobs have even larger salary ranges, which can encompass a $50,000 difference between the lowest and highest numbers offered.

These numbers, by the way, are rounded. The government is so precise that these figures always end in funky numbers, like $129,517 or $65,829.

They’re also precise because they have to be. These numbers are the product of a long and arduous process of moving through several bureaucracies. Gov Worker tells me their origins are from a bunch of studies in the 1950s that looked at compensation in the private and public sectors. Which was important to measure because government pay is funded by taxes, which Americans despise paying. They despise it so much that Congress and the President have a brawl every year over increasing pay rates for government workers.

Okay, then. That makes sense.

Public Pay is Publicly Determined

Unlike a company salary, government pay is based on complicated metrics that determine whether they’ll give you that extra dollar or not. Gov Worker started throwing phrases around like “OPM pay tables” and “GS-7 step 5 gets paid more than a GS8-1” that left me with my mouth hanging open. He had me Google the pay tables and I’m still overwhelmed.

“Well, can you negotiate your pay, at least?” I asked after looking at USAJobs postings. Salary negotiations are not as common as they should be, but they’re also what made me one of the highest-paid people in my age group. I’ve got valuable, in-demand skills that warrant such high pay; would the government recognize that and give me more?

Both Gov Worker and Josh agree that the answer is no. You cannot negotiate your pay in a government role. Government pay is – at least partly – based on your years of experience, so you won’t get paid a lot even if you’re a whiz kid. The exceptions to this are few and far between, giving you essentially zero negotiating power.

And if I stopped the conversation there, I would’ve declared the private sector to win in terms of pay. For many roles, that can definitely be the case. Josh has yet to crack the $75,000 salary threshold, and that’s while being an expert on flooding in hurricane-prone Florida. (If there’s any state I’d expect to pay top dollar to not drown, it’d be them.)

With that said, however, the extreme pay ranges actually can end up being comparable to the private sector, with the government sharing the wealth with employees. Because, statistically speaking, Uncle Sam will pay you more.

Yes, the Government Pays You More

If you’re looking specifically for a six-figure salary, the public is more likely to give that to you than a CEO. One in five (20%) government employees make at least $100,000 a year. Overall, roughly 9% of American workers reach that six-figure threshold. 1 in 5 government workers make six figures. That’s more than double the average in America (which rests at 9%). Statistically speaking, Uncle Sam is 50% more likely to get you to a six-figure income than anyone else.

{Note from GovWorker- I think part of the reason that 20% of government workers earn more than 100,000 per year is that the government has outsourced a lot of work to contractors. Those positions that remain in government are too specialized to outsource and are typically white collar, hard to fill jobs.}

And that’s while having a job that’s hard to fire you from! The red tape works in your favor! Your worries about layoffs or evil managers sabotaging your career lower dramatically in the public sector. It’s not just the salary that makes it a good position; job security with a steady paycheck is a huge perk to consider.

If you’re looking at this solely from a salary standpoint, the government gives you a statistically better chance of a high-paying job… once you’ve paid your dues. Private companies will give you more flexibility on negotiating and might not use your lack of experience against you, but you also won’t really nab a higher salary unless you work for another company entirely. Weigh the pros and cons for yourself and decide which one is best for you: a structured plan to get promoted to six figures, or something that’s not such a sure thing.

The Tax-Advantaged and Retirement Plans

For the private sector, these savings plans vary wildly from company to company. My first two jobs after college didn’t offer me a 401(k); my current company does, but is not one of the fabled that match a percentage of my contributions. (Maybe one day!) More than a third of US workers don’t have access to a 401(k) at all; of those that do, only half of those plans (56%) offer some kind of match. Don’t even get me started on company pensions, which are practically nonexistent nowadays.

The pensions in the public sector, however, are still alive and well. As are their 457(b) plans, Thrift Savings Plans (TSPs), and other plans specific to particular state and local governments. Josh, for example, participates in the Florida Retirement System, which not only acts as a pension after retirement but also lets you choose what that pension money will be invested in. Some of these make my access to a Health Savings Account (HSA) seem laughable by comparison.

Sector Plan Comparisons

In case you’re unaware, a 401(k) is a plan some private companies offer to help you save for retirement. You can allocate a percentage of your pay to your retirement investments that’s taken automatically out of your paycheck. Those contributions are tax-deferred, meaning the IRS gives you a lower tax bill if you put money into the plan. I contribute the full amount (which is $19,500 at the time of this writing) which lowers my taxable income by ~20%. Note that, with a 401(k), you can’t take that money out before you’re 60 years old (okay, 59 and a half). You can if you really need to, but there’s a penalty fee for doing so.

A 457(b) is basically the government version of a 401(k), but with one big difference for people working towards financial independence. Namely, your 457(b) doesn’t have that early withdrawal penalty. If you plan to retire early, you now no longer have to worry about not having access to a big chunk of retirement savings. Josh is a big fan: “I could literally quit my job tomorrow,” he said, “and access those funds by the end of the week.” What takes him days to access without penalty will take me over thirty years.

The TSP is another big part of what makes a government job appealing. These are only available to federal employees; state and local workers have the 457(b) instead. The TSP is another plan that acts like a 401(k), which has a Roth option if you’d like that and even provides a match. Gov Worker reports he gets a 5% match on his contributions, which means an automatic 5% return on his investments before they actually buy an asset.

The Powerful Pension Perk

And now we get to the pensions, which are one of the biggest draws for civil work. Unfortunately, not every person working for the government will get a pension; Josh learned that the hard way after being a government contractor for years and receiving zero credit towards his pension. For those workers that do get a pension, however, that significantly affects how much you need to save for retirement.

I’ll show you the math to illustrate this. Let’s say you both earn six figures in a government role and have done so for long enough to qualify for the pension program. We’re also going to assume that you will get $10,000 a year as part of your pension. A five-figure pension like that means you don’t have to save nearly as much to fund your lifestyle, shaving years of saving off of your financial-freedom timeline. If you need $40,000 per year to fund your lifestyle, you also need a cool million dollars invested to fund it in perpetuity. The 4% rule spells this out clear as day. But lo! That pension suddenly changes things. Now, you don’t have to raise $250k, or 1/4 of the final number. You only need $750k, bringing your FI date that much closer in theory.

I say “in theory” for two reasons:

1. It’s hard to calculate your pension, and

2. It’s dependent on your minimum retirement age, which is set depressingly high.

Gov Worker has other reasons for not including his pension in his financial independence calculations, which further confirms my point. Ease of understanding and flexibility goes towards the private sector, yay! Government jobs are endlessly complex, to the point that GovWorker can’t really hope to calculate his pension. Because all of his employment regulations are subject to the whims of our elected officials, things get wildly labyrinthine in nature. {Note from GovWorker- it’s fairly straightforward to calculate a FERS pension, but I am not sure when early retirement might be}

Josh’s pension options are also not so clear-cut, which should surprise no one after seeing those aforementioned pay ranges.

Despite the opaque nature of government pensions, the government sector absolutely crushes the private sector with their options for tax-advantaged savings plans.

The Turnover Rates

This seems to be the exact same as being in the private sector, based on my survey of two people. Gov Worker guffawed when I asked him about the turnover in government. “Nobody ever leaves,” he responded after (presumably) wiping a tear from his eye. After almost two decades in government service, he’s only ever seen one person quit. One.

But this seems (like the private sector) highly dependent on who you work for. A government employee in Los Angeles is going to have a vastly different experience than a government employee in Buffalo, even if they have the exact same title and job duties. The gap only widens when you compare federal vs. state and local governments, or department vs. department. And at least in the private sector, a Congress hissy fit won’t lead to my job getting shut down.

Josh tells me as much when I ask him about turnover – he’s worked as a government employee for a town, two counties, and the State of Florida, which tells me this is a culture that’s not afraid to bounce if need be. Josh has seen a lot of folks leaving government work and get massive pay increases because of it. “My boss in the emergency management job took a private sector consulting job for nearly double his salary,” Josh says, “even more if you count bonuses.”

Well, dang. Those 50s-era calculations are a hit or miss, depending on where in the country you work. But like most things in life, there’s more to the story. Despite the high turnover, Josh still sees a good amount of folks sticking around their entire careers. “Most people get a government job for the steady paycheck, good benefits like insurance, paid days off and a pension,” he told me.

Gov Worker’s response echoed that, but he made sure to quantify it. “The bigger problem is that people never retire.” Having mind-boggling benefits still won’t cut it if you don’t take advantage. “At the end of the day, people are too afraid to leave. And that’s sad.”

The Conclusion

Both Josh and Gov Worker gave me a ton of insights into government employee finance, which is a thorny web of enigma in most other places I looked online. There was a lot of information I didn’t include about work-life balance and other niche perks, like OCONUS compensation. But based on my experience and their reports, I can definitely conclude the public sector is a better path to wealth than the private sector.

Yeah. I’m absolutely shocked being the one to say that. If you know how to manage your money correctly, a government career will pay you more handsomely than a corporate career likely will. But therein lies the rub: IF you know how to manage your money. Even with all those complicated pay tables and pension plans, government employees are no more predisposed to financial literacy than the rest of the population. The access to such pay potential and accounts are fantastic, but don’t mean much for those that don’t use them. Good thing you’ve got folks like Gov Worker and Josh to help explain it!

For me in particular, I’m also surprised my private-sector praises took a backseat to the monster perks of the public sector. Even knowing all of this now, I doubt I’ll make the switch into a civil service career.

Or will I? Heck, I’m still young enough to make the switch later on. Hmm, I wonder if any New England states need a marketing director…