Who would win in a battle of the Traditional TSP vs. Roth TSP? That is one of the most-asked question I’ve gotten from my readers. It is also something that I have been very confused about myself for a long time. The TSP is one of the best retirement benefits of working for the federal government and a big part of federal retirement benefits. When I started investing for retirement in my 20s, everyone told me that Roth accounts were so much better than traditional accounts. Now in my 30s, I invest the bulk of my retirement savings in traditional, tax-deferred accounts. In this post I try to break down the differences between the Roth TSP vs. traditional TSP so that you can make a decision on which one is better for you.

Get Gov Worker’s top 4 tips for federal employees!Table of Contents

- What is the TSP?

- Traditional TSP vs. Roth TSP: What’s the difference?

- What is a Roth TSP?

- Traditional TSP vs. Roth TSP: Is one *always* better?

- Example 1: Where they are exactly the same.

- When the Traditional TSP is better

- When the Roth TSP is better

- Update: YouTube case study

- Summary

Please do not confuse my personal blog for financial advice, tax advice or an official position of the U.S. Government. This post may contain affiliate links. If you make a purchase after clicking on a link, I get a small percentage of the sale at no additional cost to you.

Note- I’ve written several posts that talk about my own TSP strategy. If you want to know more about my journey, you can read about how I am working on maxing out TSP contributions. Retirement age? Read my complete guide on how to withdraw money from the TSP.

Disclaimer– I am not a financial advisor or a CPA. Please do not confuse my blog for professional advice or an official position of the US Government. Also, I should note that this analysis focuses on civilian contributions to the TSP. Active duty military members may have a different tax structure and incentives.

What is the TSP?

For those of you who don’t know, TSP stands for “Thrift Savings Plan”. The TSP is a defined contribution retirement account available to federal employees. The TSP is similar to a 401(k) in that both have the same maximum contribution limits.

However, federal employees can borrow from their TSP and withdraw money earlier than age 59.5 in some cases.

Both CSRS and FERS employees can contribute to the TSP. The government will match the first 5% of FERS employees contributions to the TSP. CSRS employees can contribute their own money to the TSP but it is not matched.

The TSP has 5 investment options that follows major indices. The C Fund follows the S&P 500 index and the I Fund adds international exposure.

Traditional TSP vs. Roth TSP: What’s the difference?

What the heck is a “Traditional TSP”?

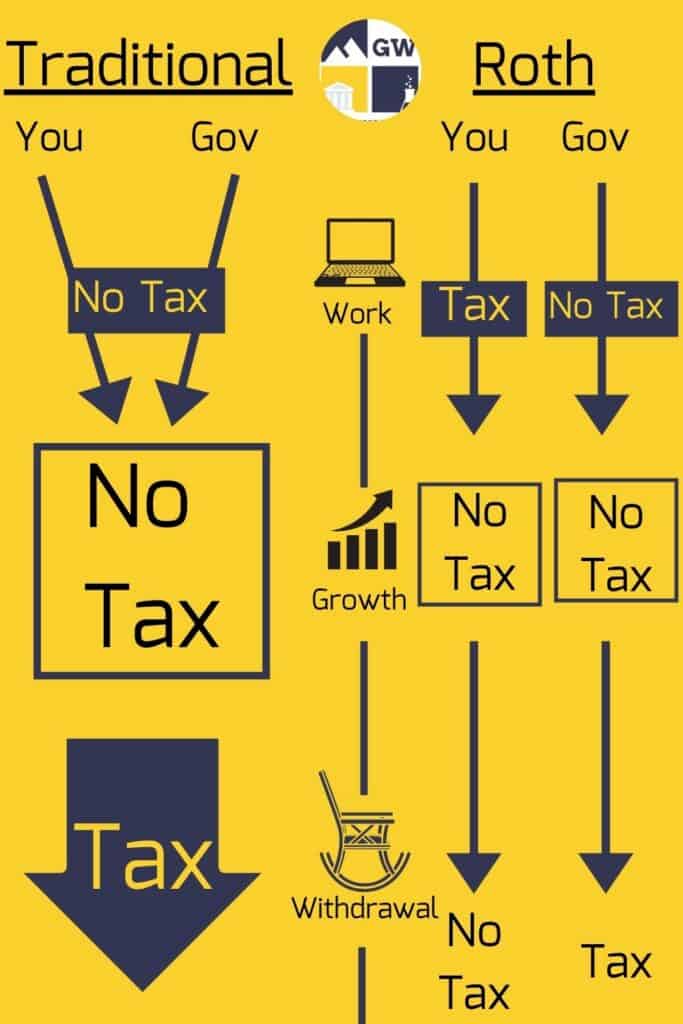

In a traditional TSP, employees contribute pre-tax money. Likewise, the government contributes their matching funds with before tax money. This money grows until you retire. Then, when you withdraw money, you pay taxes on the amount you withdraw.

Advantages of a traditional TSP

- You don’t have to pay taxes on your contributions. Contributing to the TSP helps you lower your taxes today. This is great if you make a lot of money.

- You don’t have to pay capital gains tax on any transactions you make in the TSP. Your money can grow tax free.

- You get matching funds from the government.

Disadvantages of a traditional TSP

- You have to pay taxes once you retire.

What is a Roth TSP?

A Roth TSP has a similar tax structure to the Roth IRA, named after Senator William Roth. In the Roth TSP account you contribute money after you’ve paid taxes on it. The money then grows tax free forever. Also, you get to take the money out without paying more taxes after you retire. The contribution limit on the Roth TSP is the same as the traditional TSP ($20,500 in 2022). However you can’t $20,500 to your Roth TSP and then an additional $20,500 to your Traditional TSP.

It’s important to note that the government matching contributions for the Roth TSP still is treated as a traditional TSP. Therefore, the government match will always be tax deferred.

Advantages of the Roth TSP

- You do not have to pay taxes in retirement.

- The Roth TSP protects you against future tax increases (you’ve locked in your taxes).

Disadvantages of the Roth TSP vs. Traditional TSP

- With the Roth TSP you are contributing after tax dollars.

- You miss out on any opportunities to reduce your taxable income and get into a lower tax bracket during your wage earning years.

Traditional TSP vs. Roth TSP: Is one *always* better?

The reason why it’s so hard to answer the question, “Which is better, Roth TSP or Traditional TSP” is that the answer is “it depends”. Let me say that again- for some people, the Roth TSP will be better, for others the Traditional TSP will be better. And in many cases, they will get will get you to exactly the same place. So don’t believe people when they make extreme, unequivocal statements in all caps that ROTH IS THE BEST. It’s simply not true.

So don’t believe people when they make extreme, unequivocal statements in all caps that ROTH IS THE BEST.

What is true is that both versions of the TSP are great. They both have some of the lowest fees of any employer sponsored retirement plan. And they both come with a great employer match. I don’t want you to not contribute to the TSP because you’re confused about which option to choose. If you read this post and still aren’t sure, just pick one. You can always change your mind later. The most important thing is to just start.

Example 1: Where they are exactly the same.

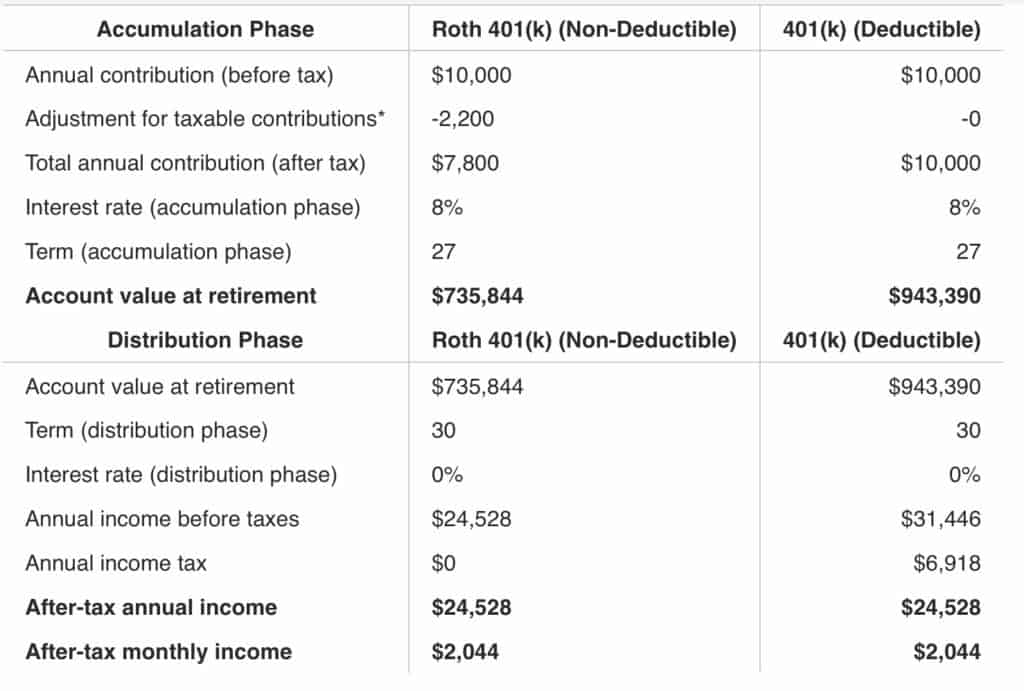

In many cases it doesn’t matter whether you contribute to the Roth TSP or the Traditional TSP because you end up with the same amount of money at the end. Let’s say you can contribute $10,000 (pre-tax) dollars per year.

- If you choose the Roth TSP, you’re paying taxes today. You invest less money today. Your balance grows and compounds more slowly. You have less money when you get to retirement but you don’t have to pay taxes.

- If you choose to put that $10,000 in your TSP, you end up with a bigger balance at retirement but you have to pay taxes on what’s left.

If you’re in the same tax bracket when you work and when you retire, it doesn’t matter which account you put your money in. Here is an example calculation for illustration I did for someone in the 22% tax bracket using this calculator.

I simplified the withdrawal schedule so that the person takes 1/30th of their TSP balance upon retirement date each year for 30 years. You can see that you end up with the exact same amount of money at the end no matter which TSP option you chose. In actuality the balance and withdrawals are unlikely to result in exactly the same value in the reality due to market fluctuations and withdrawal strategies. However, you can see that if you plan on retiring into the same tax bracket you are in now, the two accounts will work equally well for you.

When the Traditional TSP is better

I’ve already shown that the Traditional and Roth TSPs are roughly equivalent if you retire in the same tax bracket you are in right now. If you had a time machine and could travel to the future and knew with certainty your tax bracket would be lower in retirement, then you will be better off investing in the Traditional TSP.

However, it is difficult to know what your future tax rate will be. Congress has the power to change the tax law at any time. Given the size of our national debt, it is likely that at some point, our taxes will rise.

It is also hard to predict what your future income will be. If you’re in the FERS retirement system, your retirement income will include a FERS annuity, social security, and TSP withdrawals. Those three sources of income could easily replace 80% or more of your working income. If that’s the case, and if our tax rates stay the same, you’re likely to retire at your current tax rate and the difference between traditional and Roth will be a wash.

One advantage of the traditional TSP is that you can choose when to pay the tax. By modulating the size of your withdrawals across years, you may be able to reduce the amount of tax you pay.

When the Roth TSP is better

In the Roth TSP option, you are “locking in” your current tax rate. If you are in the 12% or lower tax bracket, it probably makes sense to use the Roth TSP option.

Another time when the Roth TSP is better than the Traditional TSP is if you have unlimited money to invest. All of the comparisons I presented assumed that you had a fixed number of pre-tax dollars to invest. To switch to a Roth contribution, you’d have to contribute less dollars towards retirement. However, if you were such a voracious saver that you could max out your Roth TSP contribution with post-tax dollars then maybe you should consider that.

Update: YouTube case study

After writing my original post, I found this case study on YouTube from some retirement experts. Luckily, they agreed with my analysis. If your tax bracket stays the same in retirement, it doesn’t matter. It’s definitely worth checking out if this topic interests you.

Summary

The most important thing I can say is that the TSP is great and you should be investing in your TSP. Hopefully the post helped you frame your financial planning and retirement planning goals. Here are some other important conclusions:

- If your tax bracket stays the same in retirement, both are equally good. Given how FERS retirement is structured, I think it’s highly likely I’ll end up in the same tax bracket.

- Traditional TSP allows you to choose when you pay the tax. That could be good, but if you get to retirement and the tax rates are much higher, then you’re screwed.

- The Roth TSP allows you to lock in your current tax rate. This is great if you’re not in a high tax bracket right now.

- Overall, for many people, their retirement outcome will be similar no matter which style they choose.